AUD/USD Price Forecast: Recovery is expected to gather further steam near term

- AUD/USD added to Monday’s uptick and rose to multi-day highs past 0.6600.

- The US Dollar retreated further and reached two-week lows.

- The RBA left its OCR unchanged at 4.35%, as widely anticipated.

The selling pressure remained well and sound around to the US Dollar (USD) on Tuesday, prompting AUD/USD to extend its weekly recovery and climb above 0.6600 the figure, reaching fresh two-week highs.

Indeed, the pair briefly managed to trespass the key 200-day Simple Moving Average near 0.6630, just to recede a tad afterwards. It is worth recalling that a clear breakout of this region could shift its outlook to a more positive one, most likely paving the way for further gains.

Although doubts remain over the impact of China’s recent stimulus measures, rising copper prices vs. a small pullback in iron ore prices seem to have limited the Aussie Dollar’s upside potential on Tuesday.

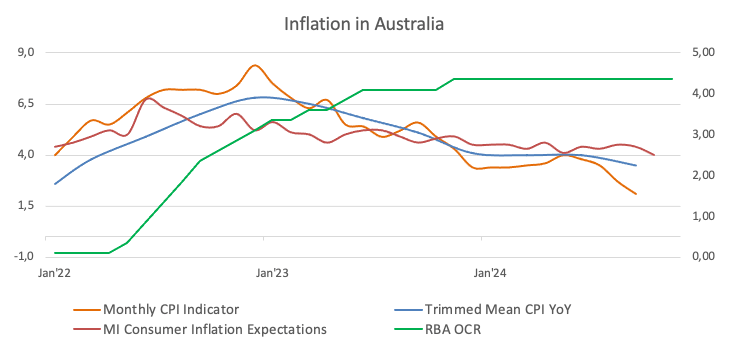

Back to monetary policy, the Reserve Bank of Australia (RBA) held interest rates steady at 4.35%, as widely expected, and maintained a neutral stance on policy. The bank reiterated that it’s keeping its options open, stating, "The Board is not ruling anything in or out," and emphasised the need to stay alert to the risk of rising inflation.

While acknowledging that underlying inflation remains high, the RBA noted that inflation is moving closer to its target range’s midpoint, though it will "take some time before it is sustainably within the target range."

The bank’s updated forecasts, to be detailed in the upcoming Statement on Monetary Policy, still predict that trimmed-mean inflation will reach the middle of its 2-3% target band by December 2026, despite downgraded growth projections across the board.

At her press conference, Governor Michelle Bullock struck a balanced tone. She mentioned that the Board hadn’t explicitly discussed scenarios for raising or cutting rates and emphasised that she believed the current settings were appropriate.

Meanwhile, the market is not fully pricing in the first 25 basis point rate cut until May 2025, suggesting the RBA may be one of the last G10 central banks to ease.

Meanwhile, in Oz, latest data showed Australia’s Monthly CPI easing by 2.1% in September (from 2.7%), with annual inflation for Q3 up by 2.8% and the Trimmed Mean CPI at 3.5% YoY.

Meanwhile, potential rate cuts by the Federal Reserve could support AUD/USD, though uncertainty over China’s economy might limit its medium-term upward momentum. The National People’s Congress Standing Committee, which began its meeting on Monday, is expected to announce further fiscal stimulus details by Friday.

The latest CFTC Positioning Report indicates speculators were net buyers of AUD as of October 29, although overall open interest has declined for the third week in a row.

AUD/USD daily chart

AUD/USD short-term technical outlook

Extra losses might push the AUD/USD to its October low of 0.6536 (October 30), ahead of the 2024 bottom of 0.6347 (August 5).

On the upside, the initial hurdle comes at the so far November top of 0.6641 (November 5), prior to the interim 100-day and 55-day SMAs of 0.6691 and 0.6731, respectively, before the 2024 peak of 0.6942 (September 30).

The four-hour chart indicates that an upswing seems to be developing. That being stated, the initial resistance level is 0.6641, followed by 0.6661, and lastly 0.6723. Meanwhile, initial support is at 0.6536, ahead of 0.6347. The RSI rose above the 63 level.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.