AUD/USD Price Forecast: China is expected to prop up the uptrend

- AUD/USD came under pressure and slipped back below 0.6900.

- The strong rebound in the Greenback sparked a knee-jerk in AUD.

- The final Manufacturing PMI in Australia eased to 46.7 in September.

AUD/USD met renewed selling pressure and abandoned a three-day positive streak on the back of the strong resumption of the buying interest around the US Dollar (USD) on Tuesday.

In fact, inflows into the Greenback accelerated on Tuesday as investors assessed Monday’s hawkish message from Chair Powell, who favoured a 25-basis point rate reduction as kind of the standard move from now on.

Against that, the pair eased from recent peaks north of 0.6900 the figure and receded to as low as the 0.6870 region, despite further upside in copper prices and iron ore prices.

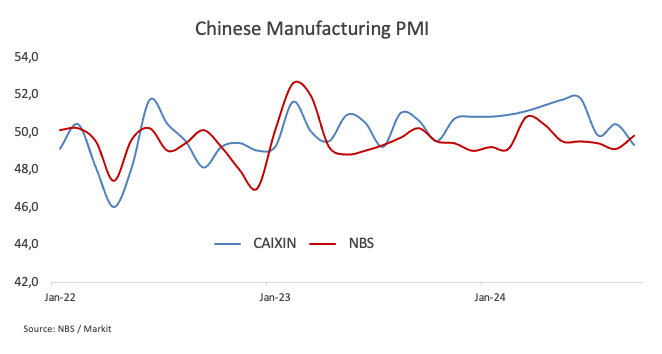

Moving forward, it is expected that the recently announced stimulus packages in China could help the economy finally gather steam. However, the latest data from Chinese business activity appear to point in the opposite direction.

On the monetary policy front, the Reserve Bank of Australia (RBA) kept rates steady at 4.35% at its September 24 meeting, as expected. The RBA reiterated that it would continue to monitor inflation risks, although Governor Michele Bullock downplayed immediate rate hikes, stating that a rate increase was not seriously considered.

Markets are currently pricing with a 55% probability of a 25-basis-point rate cut by year-end. The RBA is anticipated to be among the last of the G10 central banks to reduce rates, with a rate cut expected later this year due to weak economic activity that is likely to ease inflation.

As the Federal Reserve’s rate cuts are already priced in, AUD/USD may see additional gains this year, though uncertainties around China’s economy and its stimulus implementation remain.

The CFTC Positioning report showed a reduction in speculative net shorts in AUD to three-week lows, aligning with positive expectations for the currency despite a weaker U.S. dollar and cautious guidance from the RBA.

Data-wise, in Oz, the final Judo Bank Manufacturing PMI came in at 46.7 in September.

AUD/USD daily chart

AUD/USD short-term technical outlook

If bulls regain the upper hand, AUD/USD should retarget its 2024 high of 0.6942 (September 30) before approaching the key 0.7000 barrier.

On the other hand, there is an initial contention at the September low of 0.6622 (September 11), which is supported by the important 200-day SMA (0.6626), before reaching the 2024 bottom of 0.6347 (August 5).

The four-hour chart shows some loss of upward momentum. Having stated that, the initial resistance is 0.6942, which comes before 0.7024. On the downside, the initial support level is at 0.6870, seconded by the 55-SMA at 0.6858 and then 0.6817. The RSI collapsed below 45.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.