AUDUSD

The Australian dollar fell back towards last Friday’s new 4 ½ month low on Tuesday, following dovish stance from RBA.

Central bank’s Governor Lowe pointed to rate cut on next month’s meeting that would boost hiring to lower unemployment rate, in attempts to push inflation towards its target levels.

The RBA already lowered its GDP growth forecast, warning of weakening Australian economy.

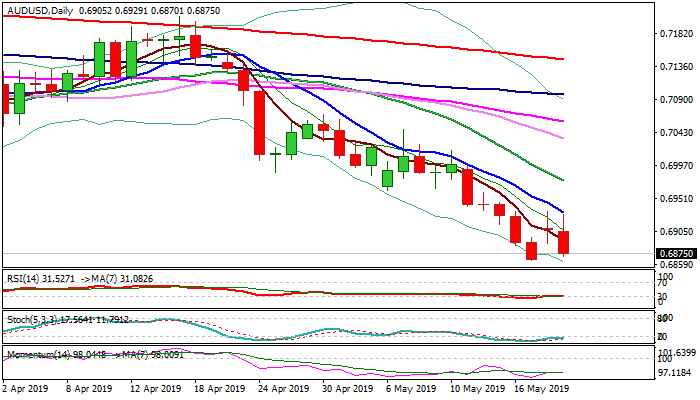

Fresh easing filled Monday’s gap, after short-lived rally on surprise election results stalled under key barriers at 0.6940 zone (Fibo 38.2% of 0.7068/0.6864 / falling 10SMA), shifting near-term focus back to the downside after Monday’s action ended in long-legged Doji.

Dovish RBA adds to existing negative sentiment as overall picture is bearish.

Bears look for retest of 0.6864 low, violation of which would signal continuation of larger downtrend towards initial support at 0.6845 (Fibo 76.4%) and possible further bearish acceleration as below 0.6845 there are no obstacles on the way towards 0.6706 support 3 Jan spike low).

Caution on oversold daily stochastic which may slow bears.

Res: 0.6893; 0.6913; 0.6932; 0.6942

Sup: 0.6864; 0.6845; 0.6750; 0.6706

Interested in AUDUSD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.