AUD/USD Forecast: Neutral above 0.7100, RBA caps the upside

AUD/USD Current Price: 0.7125

- The Australian Trade Balance posted a surplus of 5114M in September.

- RBA Meeting’s minutes hinting an upcoming rate cat put a cap to the AUD.

- AUD/USD neutral in the near-term, better chances of advancing if above 0.7210.

The AUD/USD pair is ending the first day of the week as it started it around 0.7130, reverting an early slide to 0.7102. The Aussie was underpinned by an upbeat September Trade Balance, as the trade surplus surged to 5114 M according to preliminary estimates. Imports decreased 1% in the month, amid supply disruptions due to the coronavirus, while exports were up 3%. The pair recovered, despite the sour tone of US equities, in part helped by steady gold prices, as the bright metal held above $1,900.00 a troy ounce. Australia won’t release macroeconomic data this Tuesday, although a couple of policymakers will offer speeches in separate events.

AUD/USD short-term technical outlook

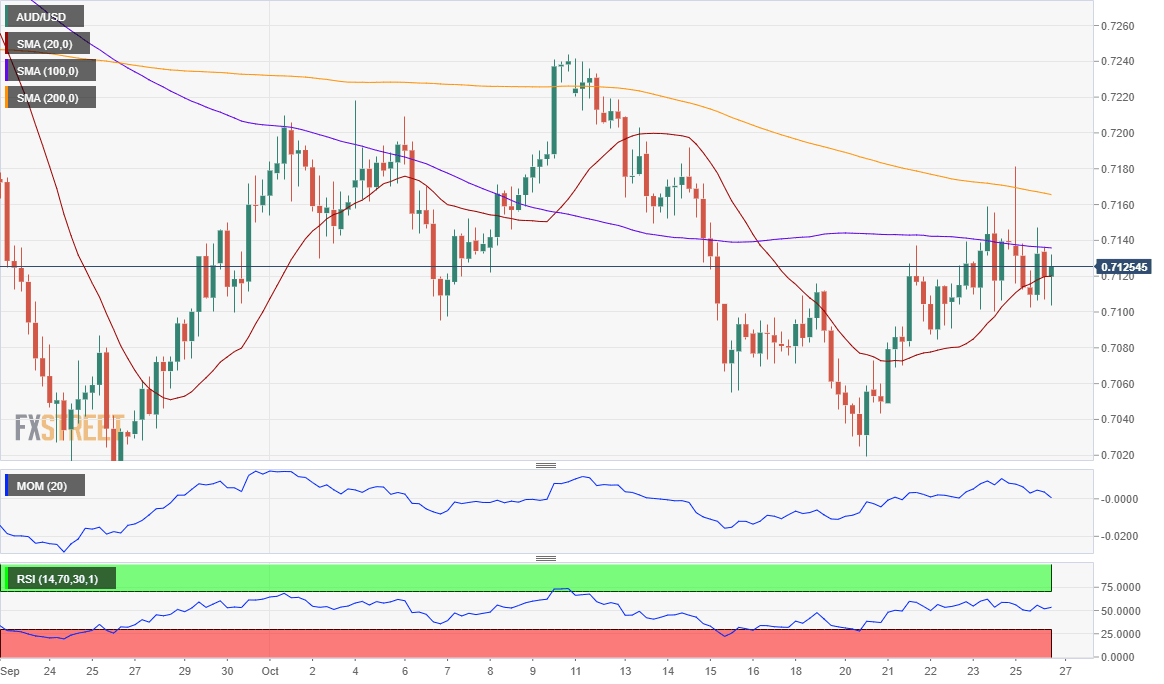

The AUD/USD pair is neutral in the near term, as the 4-hour chart shows that technical indicators hold within positive levels with modest bullish slopes. At the same time, however, the pair battles with its 20 SMA but stands below the 100 and 200 SMA. Chances of additional gains are not only conditioned to dollar’s weakness, but also to the latest RBA Meeting’s Minutes, which hinted at an upcoming rate cut, spooking bulls.

Support levels: 0.7110 0.7065 0.7020

Resistance levels: 0.7170 0.7210 0.7260

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.