AUD/USD Forecast: Nearing 0.6800 ahead of employment data

AUD/USD Current Price: 0.6832

- Australian economy expected to have added 15,000 new jobs in October.

- Wages’ growth in Australia remained at seven-year lows in Q3.

- AUD/USD technically bearish, break below 0.6800 opening doors for a steeper decline.

The Australian dollar came under selling pressure following the release of Australian Q3 wages’ growth, modestly up but well below trend since 2012. According to the official release, wages were up by 0.5% in the quarter, and by 2.2% YoY, below the previous 2.3%, also missing the market’s forecast. The AUD/USD pair fell to 0.6828, as Asian and European indexes edged lower, bouncing just modestly with Wall Street hitting record highs. Nevertheless, news signalling that US-China trade talks may have hit a snag kept the upside limited.

Australia will release this Thursday its October employment data. The economy is expected to have added 15.0K new jobs in the month, following a 14.7K increase in September. The unemployment rate is expected to tick higher to 5.3%, despite the participation rate is foreseen steady at 66.1%. The report has little chances of changing the dominant bearish trend, even in the case of an upbeat reading. A recovery will most likely be temporal, with sellers ready to add at higher levels.

AUD/USD short-term technical outlook

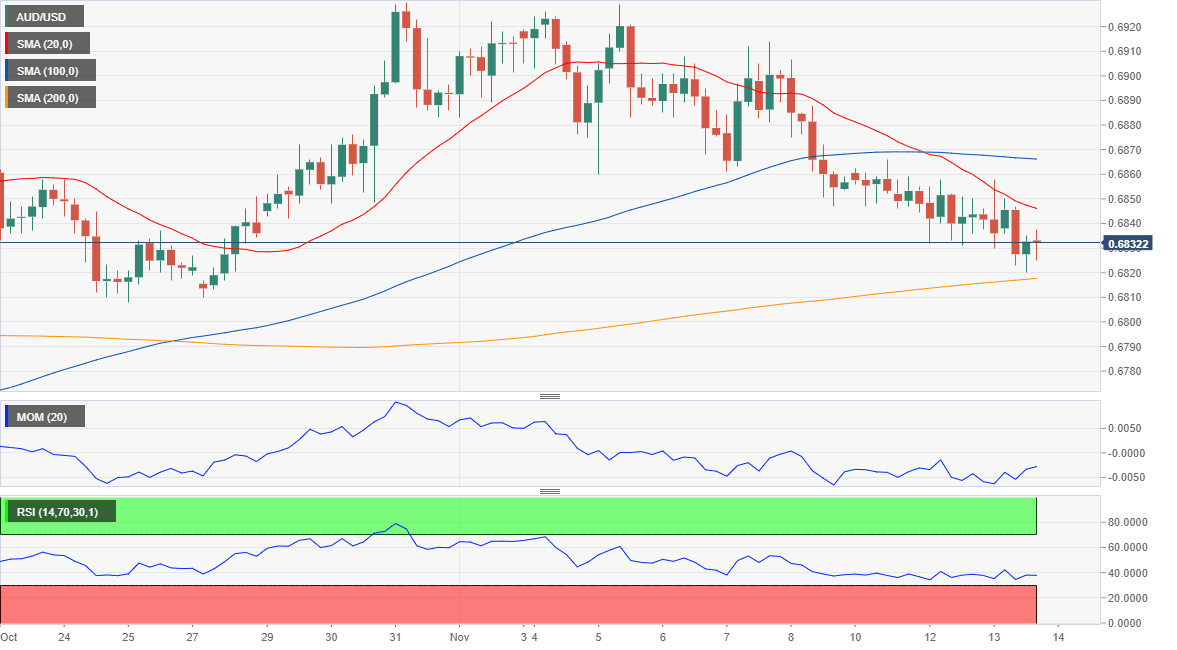

The AUD/USD is trading around the 0.6830 level, neutral-to-bearish in the short-term, as, in the 4-hour chart, a bearish 20 SMA, keeps rejecting attempts to regain the upside. Technical indicators in the mentioned chart lack directional strength but remain within negative levels. The pair is set to test the 0.6800 level and break below it on a dismal employment report.

Support levels: 0.6800 0.6770 0.6730

Resistance levels: 0.6860 0.6895 0.6930

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.