AUD/USD Forecast: Further losses not ruled out

- AUD/USD retreated for the third consecutive session on Wednesday.

- Further weakness in the commodity complex weighed on AUD.

- The Westpac Leading Index came in flat in June.

AUD/USD extended its losses from earlier in the week, flirting with two-week lows in the low-0.6700s on Wednesday.

This third daily decline came despite further losses in the US Dollar (USD), even as US yields traded in a mixed fashion and market speculation suggested that a rate cut by the Federal Reserve (Fed) in September is nearly fully anticipated. Consequently, investors are increasingly betting on two Fed rate cuts, with the second expected at the December 18 meeting.

Market expectations accelerated after Fed Chair Jerome Powell remarked on Monday that the three US inflation readings for the second quarter "slightly increase confidence" that inflation is moving towards the Fed's target in a stable manner. Powell's comments appear to have heightened anticipation of rate cuts sooner than previously expected.

Still around the Fed, New York Fed President John Williams indicated that the Fed is "getting closer" to the point where it can begin cutting interest rates. However, he noted that there wouldn't be sufficient data before the July meeting to confirm that inflation is on a sustainable path back to 2%.

On another front, falling copper prices and a modest decline in iron ore prices contributed to Wednesday’s negative sentiment towards the Aussie dollar.

Regarding monetary policy, it appears the Reserve Bank of Australia (RBA) will be the last G10 central bank to start lowering interest rates. In its latest meeting, the RBA maintained a hawkish stance, keeping the official cash rate at 4.35% and signalling flexibility for future decisions. The meeting minutes revealed that officials considered another rate hike to curb inflation but decided against it, partly due to concerns about a potential sharp slowdown in the labour market.

The RBA is in no rush to ease policy, expecting that it will take time for inflation to consistently fall within the 2-3% target range. There is about a 25% chance of a rate cut in August, increasing to around 50% in the following months.

Potential Fed easing in the medium term, in contrast to the RBA’s likely prolonged restrictive stance, could support AUD/USD in the coming months. However, concerns about slow momentum in the Chinese economy might impede a sustained recovery of the Australian currency as China continues to face post-pandemic challenges. The persistent lack of traction in Chinese inflation could prompt some stimulus from the People’s Bank of China (PBoC), which might eventually support the AUD, although disappointing Q2 GDP figures are likely to temper any optimism.

Data-wise, in Oz, the Leading Index came in flat in June vs. the previous month, according to Westpac. Next on tap will be the release of the always-important domestic labour market report.

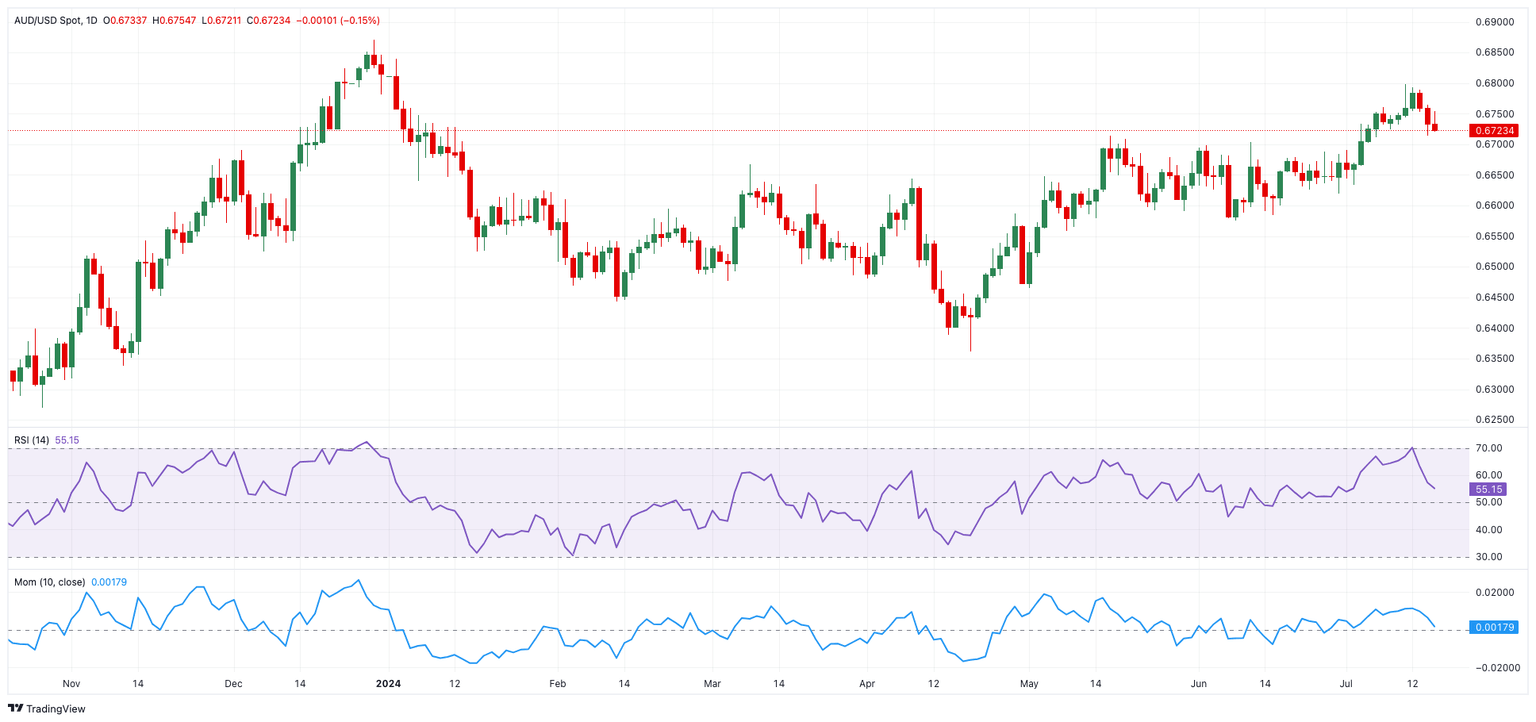

AUD/USD daily chart

AUD/USD short-term technical outlook

Further losses in AUD/USD should encounter the next temporary support at the 55-day SMA of 0.6658. If the pair clears this level, it might challenge the June low of 0.6574 (June 10), which seems to be supported by the important 200-day SMA (0.6576). From here, the May low of 0.6465 is followed by the 2024 bottom of 0.6362 (April 19).

In case buyers regain some initiative, the immediate target emerges at the July high of 0.6798 (July 8), seconded by the December 2023 top of 0.6871, the July 2023 peak of 0.6894 (July 14), and the crucial 0.7000 barrier.

Overall, the uptrend should continue as long as the AUD/USD remains above the 200-day SMA.

The 4-hour chart shows an acceleration in the negative trend. Against that, the immediate goal is 0.6714, which is propped up by the 100-SMA of 0.6711 and the 200-SMA of 0.6675. On the upside, the initial barrier is the 55-SMA of 0.6746, followed by 0.6798 and 0.6871. The RSI decreased to around 40.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.