AUD/USD Forecast: China keeping Aussie underpinned

AUD/USD Current Price: 0.7022

- China announced a 50 basis point RRR cut, likely to trigger risk appetite at the opening.

- Australian Commonwealth Bank Manufacturing PMI, foreseen steady at 49.4 in December.

- AUD/USD holding above 0.7000 and poised to extend its advance.

The AUD/USD pair closed the day at 0.7016, its highest settlement since mid-July, although ending the year with losses. The Aussie has been among the most benefited from the announcement of a trade agreement between the US and China, ignoring other factors that usually play against the commodity-linked currency. The pair advanced on Tuesday despite mixed Chinese data, as the official NBS Manufacturing PMI beat expectations in December by printing at 50.2. The Non-Manufacturing PMI, however, missed the market’s expected slide to 53.6 and came in at 53.5.

This Monday, China announced a 50 basis point RRR cut, effective January 5. The decision is aimed to inject liquidity and lower costs for business. The announcement will likely boost the market’s sentiment at the opening. Also, the Asian macroeconomic calendar will include the December AUS Commonwealth Bank Manufacturing PMI, foreseen steady at 49.4, and the Chinese Caixin Manufacturing PMI for the same month, expected at 51.7 from 51.8 previously.

AUD/USD short-term technical outlook

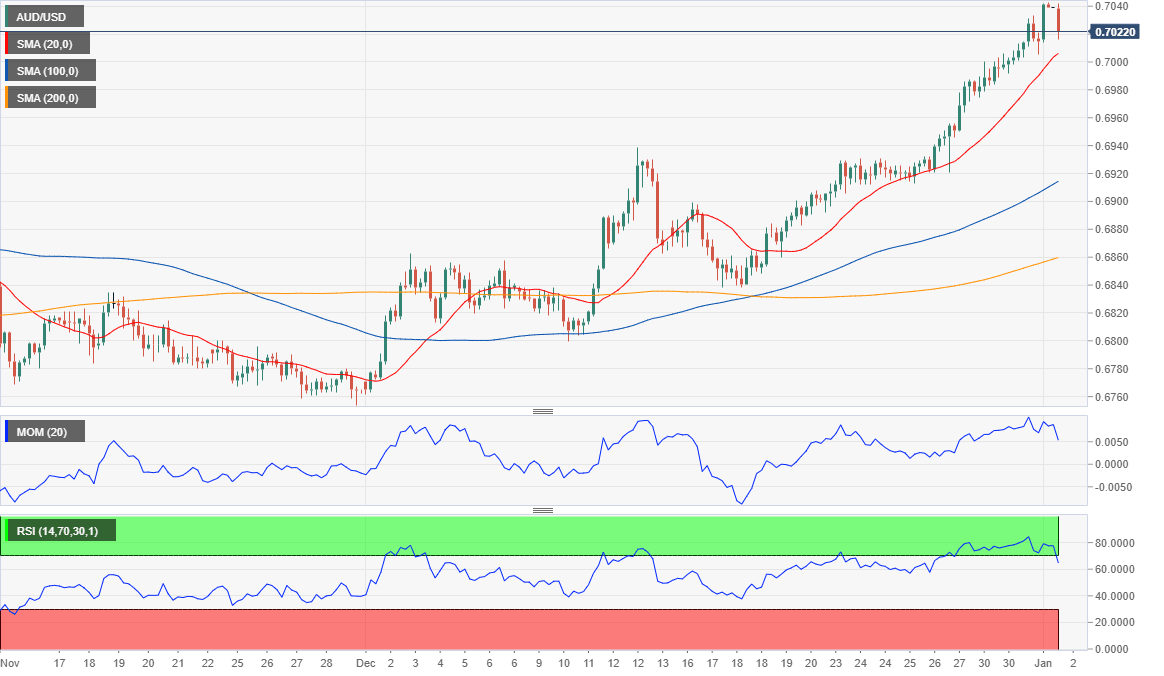

The AUD/USD pair is close to its monthly high at 0.7031 and poised to continue advancing. Nevertheless, and after closing in the green for nine consecutive days, the risk of a downward correcting is high. In the 4-hour chart, technical indicators are retreating from extreme overbought levels, yet far from suggesting a downward extension ahead. Also, the price is holding well above bullish moving averages, with the 20 SMA providing dynamic support at around 0.6960.

Support levels: 0.6960 0.6915 0.6880

Resistance levels: 0.7035 0.7080 0.7110

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.