AUD/USD Analysis: Bulls seem non-committed, remain at the mercy of USD price dynamics

- AUD/USD struggles to capitalize on its recent recovery from the YTD low touched last week.

- Hawkish Fed expectations continue to act as a tailwind for the USD and cap gains for the pair.

- The Australian PMI prints offer some support to the major amid easing Middle East tensions.

The AUD/USD pair attracts some follow-through buying on Tuesday, albeit struggles to capitalize on the early strength to the 0.6465 area, or over a one-week high. The Australian Dollar (AUD) gets a minor boost following the release of upbeat domestic data, which showed that business activity expanded at the fastest rate in two years. In fact, Australia's composite Purchasing Managers Index (PMI) rose from 53.3 to 53.6 in April as the manufacturing sector approached the break-even level and jumped from 47.3 in March to 49.9. Adding to this, the gauge for the services sector remained in the expansionary territory for the third consecutive month. This supports the view that the Reserve Bank of Australia (RBA) could keep rates higher for longer to counter inflationary pressures, which, along with a positive risk tone, benefits the Aussie.

Despite the overnight attack on US forces in the Middle East, hopes that the Iran-Israel conflict will not escalate further continue to boost investors' appetite for riskier assets. This, in turn, is seen acting as a headwind for the safe-haven US Dollar (USD) and lending additional support to the AUD/USD pair. The downside for the USD, however, remains cushioned in the wake of growing acceptance that the Federal Reserve (Fed) will delay cutting interest rates in the wake of sticky inflation and a resilient economy. The hawkish outlook, meanwhile, remains supportive of elevated US Treasury bond yields and should help limit any meaningful USD corrective decline from its highest level since early November touched last week. Traders might also prefer to wait for this week's important US macro releases before placing fresh directional bets.

Hence, the focus will remain glued to the Advance, or the first estimate of the US Q1 GDP growth figures, due on Thursday. This will be followed by the Personal Consumption Expenditures (PCE) Price Index on Friday, which should play a key role in influencing the Fed's future policy decisions and driving the USD demand. In the meantime, traders on Tuesday will take cues from the release of the flash US PMIs later during the early North American session. Apart from this, the US bond yields, along with the broader risk sentiment, should provide some impetus to the AUD/USD pair. Nevertheless, the aforementioned mixed fundamental backdrop makes it prudent to wait for strong follow-through buying before confirming that spot prices have formed a near-term bottom and positioning for any meaningful appreciating move.

Technical Outlook

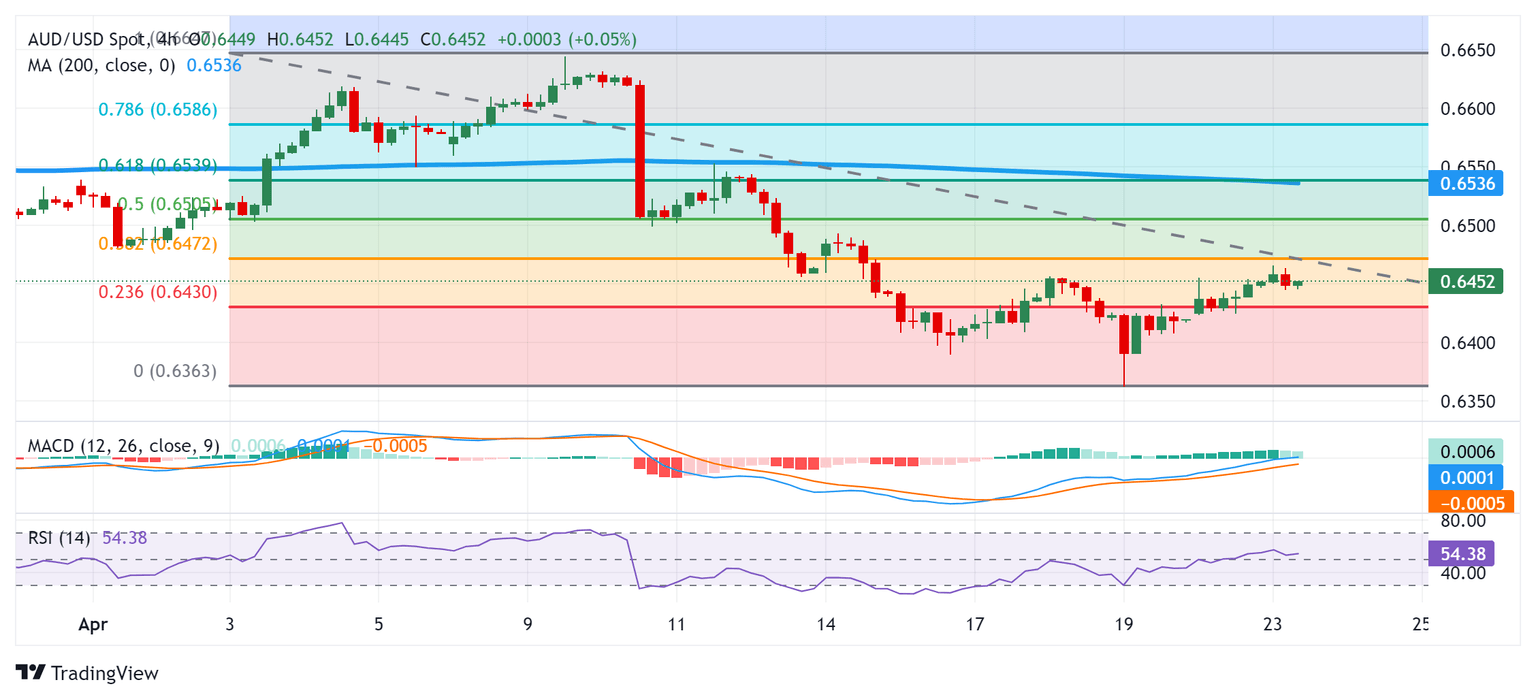

From a technical perspective, the intraday uptick falters near a resistance marked by the 38.2% Fibonacci retracement level of the downfall from the April swing low witnessed over the past two weeks or so. The said barrier is pegged near the 0.6465-0.6470 region and is followed by the 0.6500 psychological mark or the 50% Fibo. level. A sustained strength beyond the latter has the potential to lift the AUD/USD pair further towards the 0.6535 confluence, comprising the 200-period Simple Moving Average (SMA) and the 61.8% Fibo. level. Some follow-through buying might then shift the near-term bias in favor of bullish traders and prompt a short-covering rally towards the 0.6600 round figure.

Meanwhile, oscillators on the daily chart – though have been recovering from lower levels – are still holding in the negative territory and support prospects for the emergence of some sellers at higher levels. Weakness back below the 0.6430-0.6425 area, or the 23.6% Fibo. level, will reaffirm the bearish outlook and expose the YTD low, around the 0.6365-0.6360 region, with some intermediate hurdle near the 0.6400 round figure. Some follow-through selling will be seen as a fresh trigger for bearish traders and set the stage for the resumption of a two-week-old downtrend.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.