Are Euro Stoxx 50 Under Bears Control?

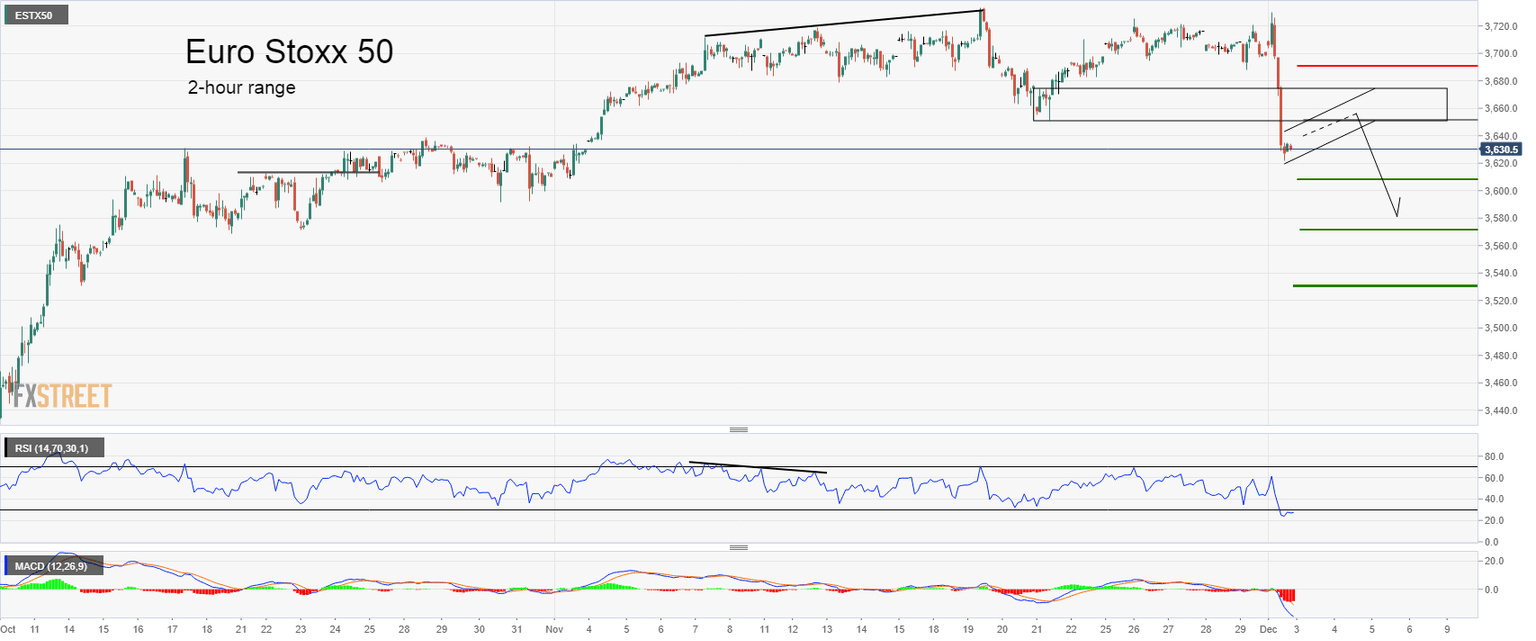

This Monday, December 2, the bears seemed to have taken control of the market, the pan-European index Euro Stoxx 50 lost 1.77%, moving away from the zone of annual highs. In this article, we discuss our arguments for a change in the bias to bearish.

1. The fundamental traders are watching with suspicion at the progress of the negotiations between the United States and China. Besides, the new tariffs imposed by the Trump administration on steel and aluminum imported from Brazil and Argentina are added to the equation. On the other hand, the US government promised to apply tariffs on French products in response to France’s tax for digital services that would injure US technologic companies.

2. Technically, the pan-European index should make a corrective upward movement, which, depending on the depth, could give us clues as to the extent of the next move. We expect the bullish movement to reach the area between 3,650 points and 3,674 points. A close below 3,650 points would trigger a bearish position that could lead the price to drop to at least 3,609 points.

3. If the Euro Stoxx 50 index extends its falls, it could reach 3,571 points and even 3,531 points.

4. The bearish scenario will be invalid if the price climbs and closes above 3,691 points.

5. The risk posed by this downside scenario could occur if the drop recorded this Monday is a false move to trap sellers and lead to the Euro Stoxx 50 index reaching new record highs.

Trading Plan Summary

-

Entry Level: 3,650 pts.

-

Protective Stop: 3,691 pts.

-

1st Profit Target: 3,609 pts.

-

2nd Profit Target: 3,571 pts.

-

3rd Profit Target: 3,531 pts.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and