Apple's earnings set new records, the stock will follow?

Apple has always been a fairly divisive stock. Ever since the death of Steve Jobs, Analysts have constantly argued about whether the stock will move up or down. Despite all this, Apple has been on an upward trajectory since the beginning of 2017 (with a few hiccups along the way).

However, COVID-19 pandemic presents an unprecedented challenge for Apple. As such, we take a look at how the crisis may affect Apple in the long run, and whether Apple has the resources as well as the innovation to cope with the challenges of the future.

How the Pandemic May Affect Apple

The pandemic has had a hugely adverse effect on Apple (just like most other companies). Let’s take a look at why Apple is especially vulnerable to the aftereffects of COVID-19, and why the worst may be behind us.

Demand Potentially Reduced

The most obvious effect of COVID-19 on Apple is the fact that people will now have less money to spend on premium products.

The Asian Development Bank estimates total damage from the pandemic could be as high as $8.8 Trillion. With less money to spend, chances are that the demand for products priced as high as Apple’s are will be lower than before in the next couple of years.

General Market Outlook is Not Optimistic

As we stated at the beginning, Apple is not alone. The entire market crashed on 20th February when the ramifications of COVID-19 became apparent.

After falling for a few weeks, the S&P 500 began a gradual recovery that is still underway. However, that does not mean that that the overall outlook on the market is optimistic. In fact, the recovery seems to be based on speculation rather than prudent investing.

The current bullish run of the S&P 500 seems to be based on a hope that things will return to normal soon, rather than sound financial analysis.

The Fed Lends its Support

Efforts to recover from the crisis are well underway. The Fed pledged $2.3 Trillion for virus relief at the beginning of April. While this will not affect Apple in a huge way, it will help the economy recover faster by supplying liquidity, combat against short sellers and increase stock market prices.

While Apple is a global powerhouse, a lot of their customers are still based in the US, and a quick recovery would be extremely beneficial (although it is unlikely).

Manufacturing Has Reopened

The pandemic originated in China, and China was the first country that had to engage in a widespread lockdown that shut down businesses and factories across the country. Apple, having most of its production in China like many other companies, was unable to produce components at its usual pace for a while.

Thankfully, things seem to be returning to normal. Foxconn, the largest iPhone manufacturer in China, reopened in early April and seems to be operating at full capacity. It has stated that it plans to still keep up with the scheduled fall launch of the currently unannounced next-gen iPhone.

Apple as a Company

It is clear that Apple has been affected adversely from the pandemic but is on the path to recovery. Apart from a sharp dip beginning in the middle of February that ended on March 23rd, Apple’s stock has continued its meteoric rise. If this trend continues, Apple will soon cross $1.5 Trillion in market capitalization.

We all know how wrong market sentiment can be. As such, let’s take a look at some of Apple’s fundamentals to determine whether or not the stock is worth it at its current price ($331.5).

Dire Short-Term Prospects

Apple stock has been on a rise mainly due to the announcements of normalization, such as the reopening of stores in China. However, Apple had already announced as far back as February that it will not be able to meet its Q2 earnings estimate. The actual revenue was $58.3 Billion, almost $5 Billion less than the lower range of their estimated.

We are still not clear on whether the new iPhone will be released in time. As a company whose entire business model is predicated on a flagship line updated every year, this could have long-lasting consequences (especially if competitors manage to get their flagships out in time).

Despite the shutdown of its retail stores, Apple still managed to increase its results from last year, when its Q2 revenue was $58 Billion. We expect the Q3 revenue to be much closer to the estimates. However, we do not think that the company’s performance will match its pre-crisis levels until the current situation has completely normalized.

Apple’s Long-Term Vision

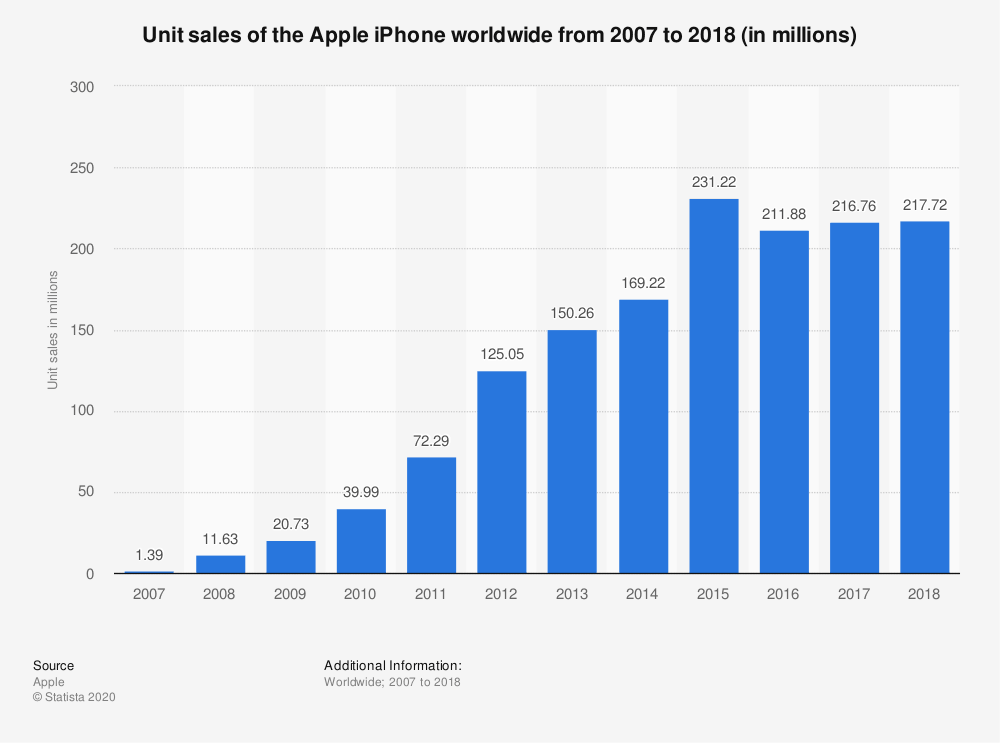

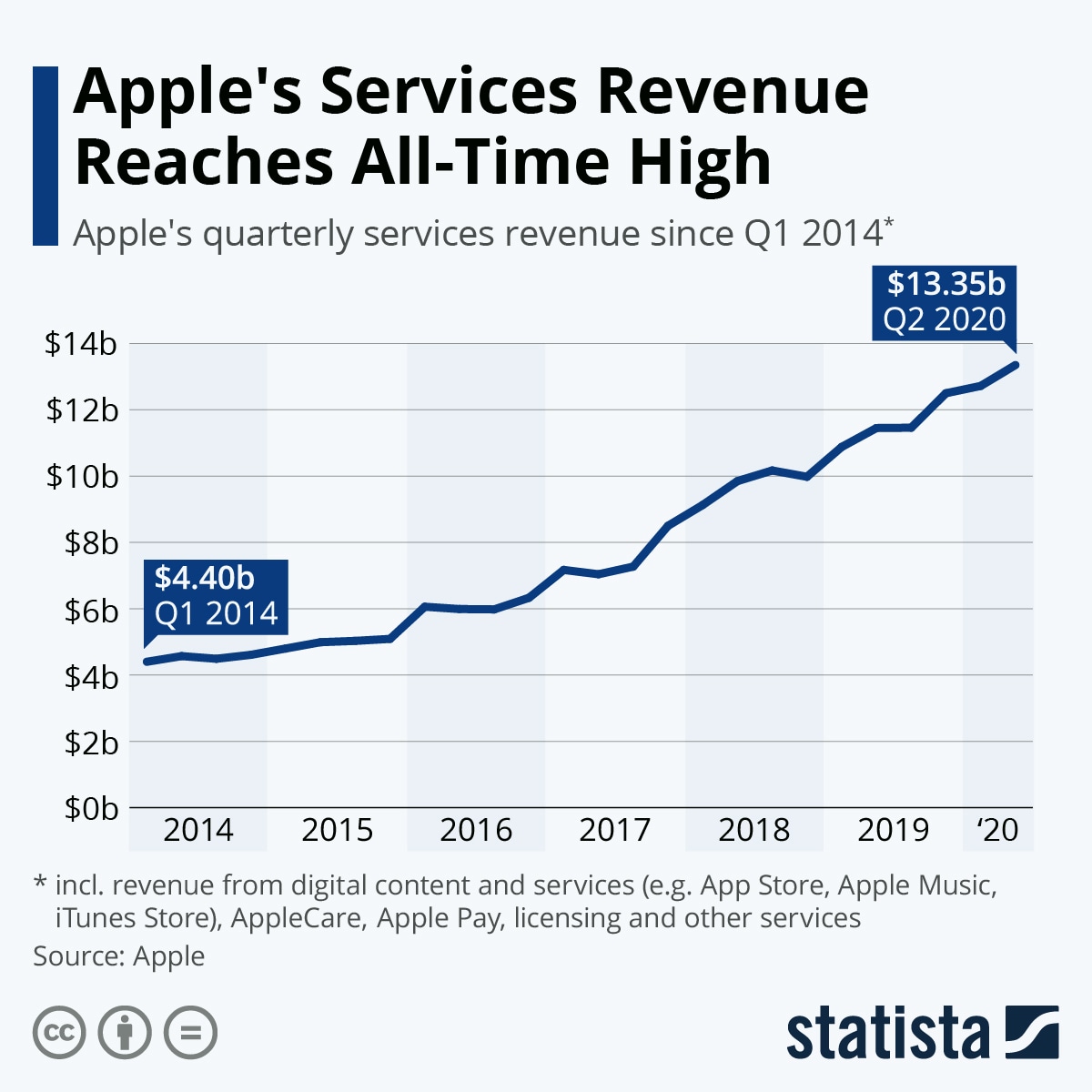

Apple has been placing a huge emphasis on services in the last few years. This is evident from the fact that services contributed $13.3 Billion in Apple’s Q2 revenue, an all-time high. iPhone sales have in a slump since 2015 due to an increase in competition.

Long gone are the days when the iPhone was by far the most beautiful device on the market. Not only has Samsung caught up, but competition from Chinese companies such as Huawei and Xiaomi has only compounded the problems for Apple in the hardware department.

Apple has been struggling to sell the iPhone in recent years.

Apple has redefined its attitude towards the iPhone as a result. Not only do they offer users more models to purchase than ever before (it is still possible to purchase an iPhone 8), but they have especially focused on cheaper variants.

The brand-new iPhone SE is a perfect example of that. At only $399 in the US, it offers an extremely cheap (by Apple standards) entry into the Apple universe while retaining many of the core features that make modern iPhones great (such as the A13 processor).

The way we see it, Apple wants to get as many people to use Apple products as possible. This way, they will have access to their services such as the Apple TV and Apple Music. Services will allow the company to generate consistent revenue and grow at a faster pace than they would be if they continue to try to innovate in the hardware department.

Services seem to be the new focal point for Apple!

Will Apple’s Efforts Pay Off?

COVID-19 has helped Apple in one regard, its App Store. The App Store’s year on year growth for Q2 2020 is quite high at around 30%. This is mainly due to people staying indoors and having more time on their hands to explore what their phone has to offer. This, coupled with Apple’s $117 Billion cash on hand, should help Apple survive until they turn things around.

Apple is also looking to shift their focus from China to India once the pandemic is over. The Daily Mail reports that Apple will move over $40 Billion of their production to India. The supply chains that have been disrupted due to the advent of COVID-19 will make the process easier. However, this will also lead to Apple having better access to the Indian market, a place where they have struggled historically.

China is a place where Apple has never been popular. Due to numerous reasons, Apple has never been able to penetrate the Chinese market. Apple’s exposure to China (% of total products sold in the country) was almost 20% at the end of 2018. This poses a large problem as Apple is a US-based company and the US and China have not been on the best of terms recently. If the trade war escalates once again, the ramifications for Apple could be immense.

With China and America’s relations at an all-time low, Apple will be looking towards reducing its exposure to the Red Dragon.

Sadly, the Indian market is not that different from China regarding their preference for cheaper alternatives. It will be a ginormous task for Apple to sway the Indian market in their favor, as the same Chinese brands that are popular in China have also gained a strong foothold in India.

Analysts predict negative growth for 2020, but they also expect the company to grow by over 10% in 2021. Looking at the averages, it is predicted that Apple will continue to have negative growth in Q3 but will turn things around by the last quarter. Of course, this is predicated on the normalization of the global economy by the end of the year.

It seems that the launch of the next iPhone will be a pivotal moment in Apple history. Despite Apple focusing on services more than ever, the iPhone is still their flagship product. Its sales will probably be the most important factor upon which the stock will move up or down.

Conclusion

Currently, Apple does not seem overpriced if you take a look at some of the other major tech companies. Apple’s PE ratio of 26.04 is less than Google (28.05), Microsoft (31.19), and Amazon (118.60). However, all of the other 3 companies have a much more stable business model and a future that is a lot easier to predict.

Apple seems to be stuck at a crossroads. With its hardware business slowing down, Apple has pushed towards the services sector in full force. However, due to the nature of the Apple ecosystem, you need an Apple device in order to be able to access all the things that Apple has to offer.

As such, manufacturing new products is still of paramount importance to Apple. COVID-19 has had a significant impact on Apple’s performance and will continue to do so for at least another quarter by most estimates. If we had to define Apple in one word, it would be “uncertainty”.

Don’t get me wrong, Apple is still a great company that will almost certainly persevere through the pandemic and once again pursue growth and innovation at a staggering pace. However, what’s worrying is the fact that the stock price is continuously rising despite the slowdown in its operations. Either the market believes that Apple has immense potential for further growth, or the rise is based on speculation.

In 2019, Apple’s price roughly doubled in 2019, but there was no increase in its Earnings Per Share. While it is fair to suggest that Apple was undervalued at the beginning of 2019, it is also fair to suggest that it is slightly overvalued today!

We do not believe that Apple is a company that should be bought right now. It is a great business to own with huge cash reserves to not only weather the storm but also invest in future growth. However, you should probably wait for a dip in its price before you invest.

Author

Baruch Silvermann

The Smart Investor

Baruch Silvermann is a personal finance expert, investor for more than 15 years, digital marketer and founder of The Smart Investor.