- Private payrolls from ADP triple expectations in January.

- Service Employment PMI reached the best level since February 2020..

- Manufacturing Employment PMI is the highest since June 2019.

- Nonfarm Payrolls for January forecast at 50,000 after -140,000 in December.

If it is up to the managers in charge of the hiring rather than the analysts, US job creation could return with a bang in January.

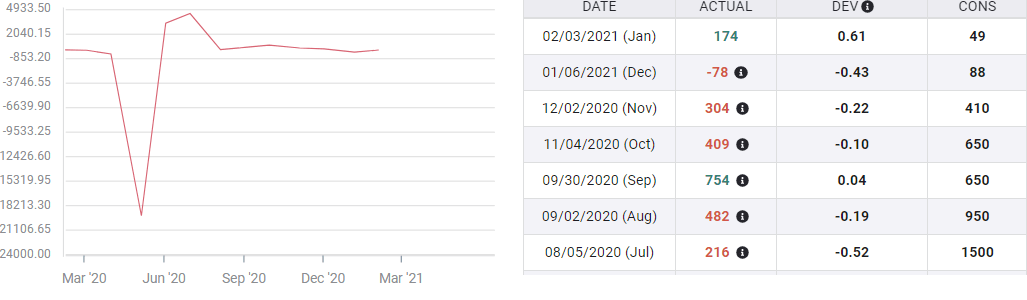

Private payrolls for the clients of Automatic Data Processing (ADP) added 174,000 employees in January far more than the 49,000 projection and December's 123,000 loss was reduced by more than a third to -78,000.

ADP Payrolls

Purchasing Managers' Indexes

Some of the managers whose companies use ADP's services were no doubt among those surveyed by the Institute for Supply Management for their monthly Purchasing Managers' Indexes (PMI).

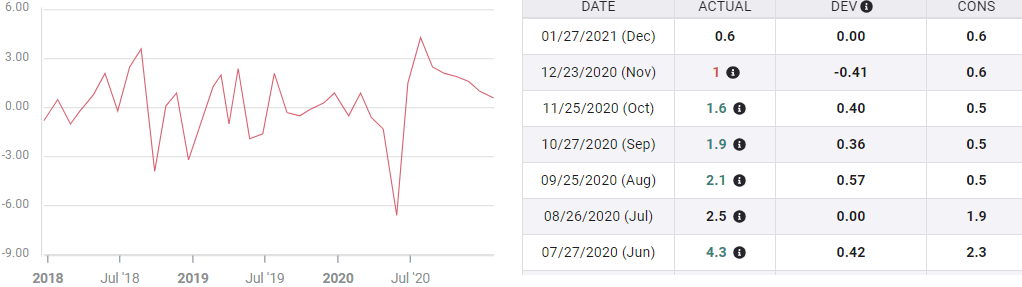

Employment surveys in the service and manufacturing sectors, which ask about hiring plans, rose sharply in January and the December results were revised higher.

Manufacturing Employment PMI, released on Monday, registered 52.6 in January, up from the revised 51.7 (originally 51.2) in December and the best reading since June 2019.

The Services Employment Index came in at 55.2, its highest level since February 2020 and a leap from its 49.7 forecast and December's revised 48.7 (initially 48.2).

Overall the reports were highly expansionary. Manufacturing completed its eighth positive month, though it dropped to 58.7 from 60.5, and is having its best run since June 2019. New Orders dropped to 61.1 from 67.5 but here too, the 63.2 average of the eight months to January was the best in over a decade.

The Services Index climbed to 58.7 in January its highest score since November 2018. New Orders rose to 61.8 from 58.6, also its eighth month of robust expansion.

Business investment

Executives have been anticipating the end of the pandemic, at least as a source of business restrictions, and a surging recovery for more than for six months.

Not only have attitudes remained positive through the fall and winter even as COVID-19 counts rose across the country but businesses have spent to be ready for the pending economic expansion.

Nondefense Capital Goods ex-aircraft, the business investment proxy category of Durable Goods, averaged 1.62% from July through December. The months of the fourth quarter dropped to 1.07%, but considering the spiraling viral counts at that time and California's lockdown in December, the spending was a solid vote for recovery.

Nondefense Capital Goods

Initial Jobless claims

Claims are a caveat to the optimistic PMI view of the economy.

Skyrocketing requests for unemployment benefits presaged the collapse in payrolls in March and April and a modest rise in December prefigured that month's decline.

From November to December unemployment filings jumped from 740,500 to 837,500. Nonfarm Payrolls shed 140,000 positions in December, the first loss since April.

Initial filings have continued to rise in January. The average of the first four weeks is 867,750. If the 830,000 forecast for the final statistic is correct the average drops to just 860,200.

Conclusion

The claims and PMI data compared above look in two directions.

Initial Jobless Claims, though recent, reflects management hiring and firing decisions made in December and early January. Attitudes in the PMI survey, though polled in the first two-weeks of January, anticipate conditions into the next quarter.

The optimism expressed in the managers' indexes mirrors the hiring in the ADP payrolls. The odds for a positive surprise in the January Nonfarm Payrolls have shortened considerably.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD remains firmer ahead of RBA interest rate decision

The Australian Dollar continued its winning streak for the fifth consecutive session on Tuesday, driven by a hawkish sentiment surrounding the Reserve Bank of Australia. This positive outlook reinforces the strength of the Aussie Dollar, offering support to the AUD/USD pair.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold price extends its upside as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.