There is a 30% probability this could be the stocks market bottom

Up we go?

Quick Take: There is a 30% probability this could be the absolute bottom for stocks and currencies. That is high, coming from this fundamental bear.

There are only two scenarios. The above. And then the possibility we are only one third of the way into this major correction phase.

Everything is the biggest ever. Why not the corrections too?

There was a lot of interesting data just released. The run of which continues to point to a still slowing China, a retrenchment of the consumer and definitely moderating manufacturing in China.

It is not out of the question that China and the USA could be the two big disappointments of the year. Economically speaking.

Some of this has already been priced in to equities. Hence the immediate and very significant correction we had to have. Also, a small portion of the risk of Ukraine conflict has been priced in. Fundamentally, I believe further downside correction is appropriate.

The market may have other ideas. We were quite clear in our expectation for a rally in Monday trading in New York. It looked to be tiring late in the day, but post close the futures have kicked on.

It is not quite clear yet, as to whether this is a correction, range trading consolidation before we head much lower, or we have already in fact seen the absolute low point. My feeling is that there is another 12-18 hours of moderate buying. We will then discover if there is any further real institutional selling still to hit the market.

My favoured scenario is this moderate rally beginning to tire, for an extended period, perhaps a couple of weeks around current levels consolidation, before again resuming a major down-trend of quite significant quantum.

Australian factory activity flatlines

The Australian Industry Group Survey.

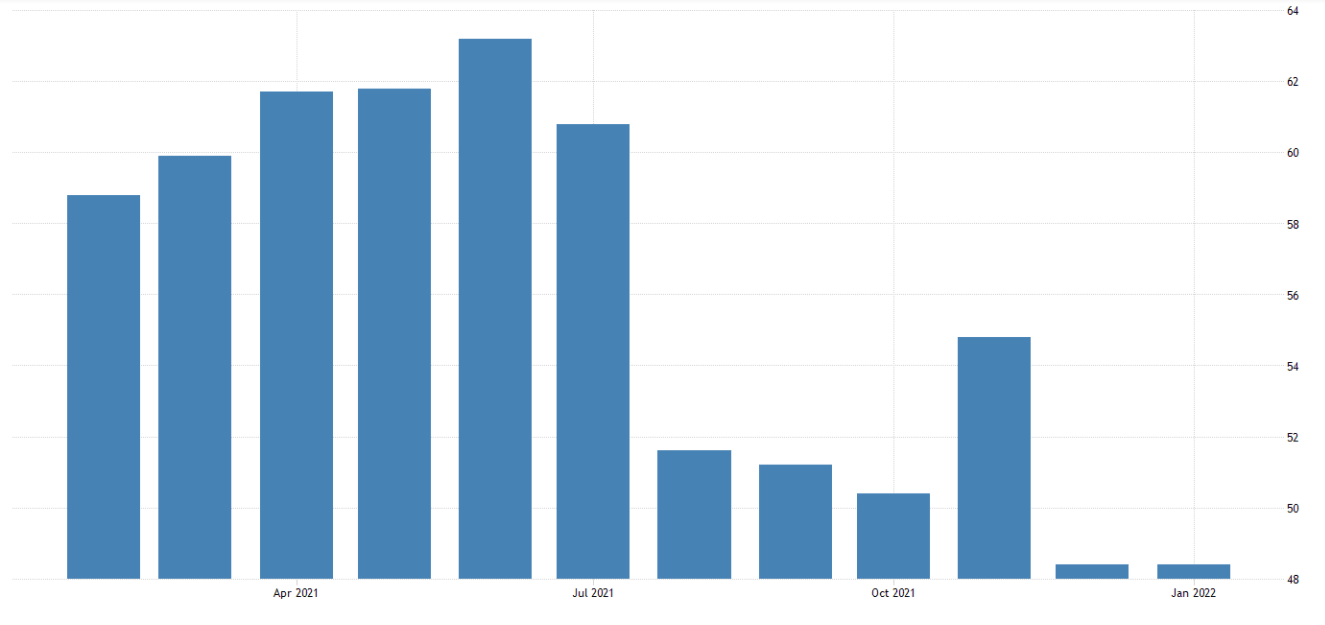

US Chicago PMI falling back

US Texas manufacturing activity index

German GDP languishing

Taking a look at the run of data, makes you wonder what the excitement in financial markets has all been about.

Author

Clifford Bennett

Independent Analyst

With over 35 years of economic and market trading experience, Clifford Bennett (aka Big Call Bennett) is an internationally renowned predictor of the global financial markets, earning titles such as the “World’s most a