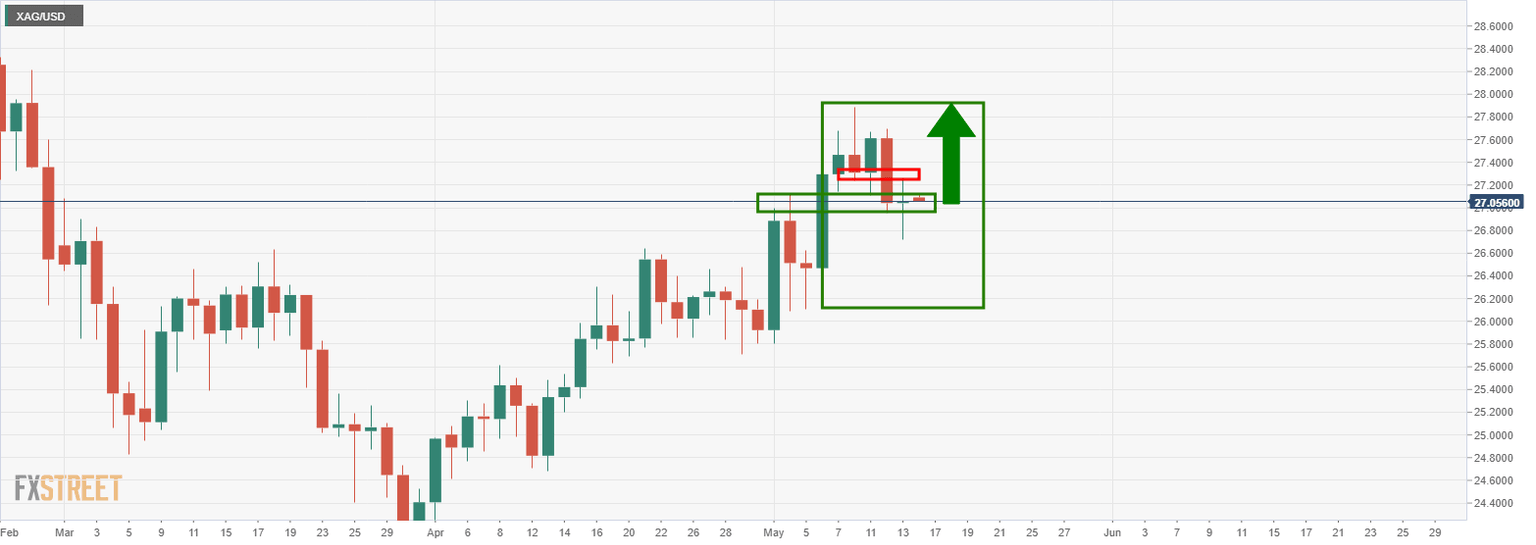

XAG/USD bulls seeking upside probe of M-formation's neckline

- XAG/USD is attempting the upside despite a solid greenback.

- The M-formation is compelling for an upside test of the neckline.

Precious metals were higher on Thursday and silver, as measured by XAU/USD spot, ended higher by over 0.25% after rallying from a low of $26.72 to score a high of $27.24.

Its sister metal, gold, was strong, however. The gold to silver ratio was higher by 0.34% though as gold remains the bull’s preferred hedge to inflationary concerns.

The market is fixated on inflationary pressures and the velocity of the US dollar which has benefitted from both good data and nerves that the Fed will be forced to act sooner than telegraph due to higher inflation.

With new applications for unemployment insurance continuing to fall, according to jobless claims data from the Labor Department that hit a 14-month low, the greenback is taking the lead in the G10 space.

Coupled with the positive data, the last two days of economic data has prompted inflation fears as a scarcity of materials and workers threatens to send prices surging.

Silver technical analysis

Silver broke the 10 and 20 EMAs on the hourly time frame to take on the 4-hour 10 EMA.

Daily chart, M-formation

The daily picture sees the price attempting to complete the M-formation at the neckline of the pattern in the day’s highs.

However, there is still room to move higher in the resistance structure for a fuller test of the neckline around 27.30.

A break there will make way for a continuation to the upside for a higher high and fresh daily bullish impulse.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.