WTI Price Analysis: Sticks to modest gains around mid-$82.00s, upside potential seems limited

- WTI gains some positive traction on Tuesday and recovers a part of the precious day’s slide.

- The technical setup favours bearish traders and supports prospects for a further downfall.

- Any positive move back above the $83.00 mark is likely to get sold into and remain capped.

West Texas Intermediate (WTI) Crude Oil prices attract some buying on Tuesday and move away from a near three-week low, around the $81.55 region touched the previous day. The commodity sticks to its modest intraday gains through the first half of the European session and currently trades around mid-$82.00s, up 0.25% for the day.

Worries that a further escalation in the Israel-Hamas conflict could disrupt oil supplies from the Middle East turn out to be a key factor lending some support to the black liquid. The upside, however, remains capped in the wake of the worsening economic conditions in China – the world's top oil importer – and headwinds stemming from rapidly rising borrowing costs, which could dent fuel demand.

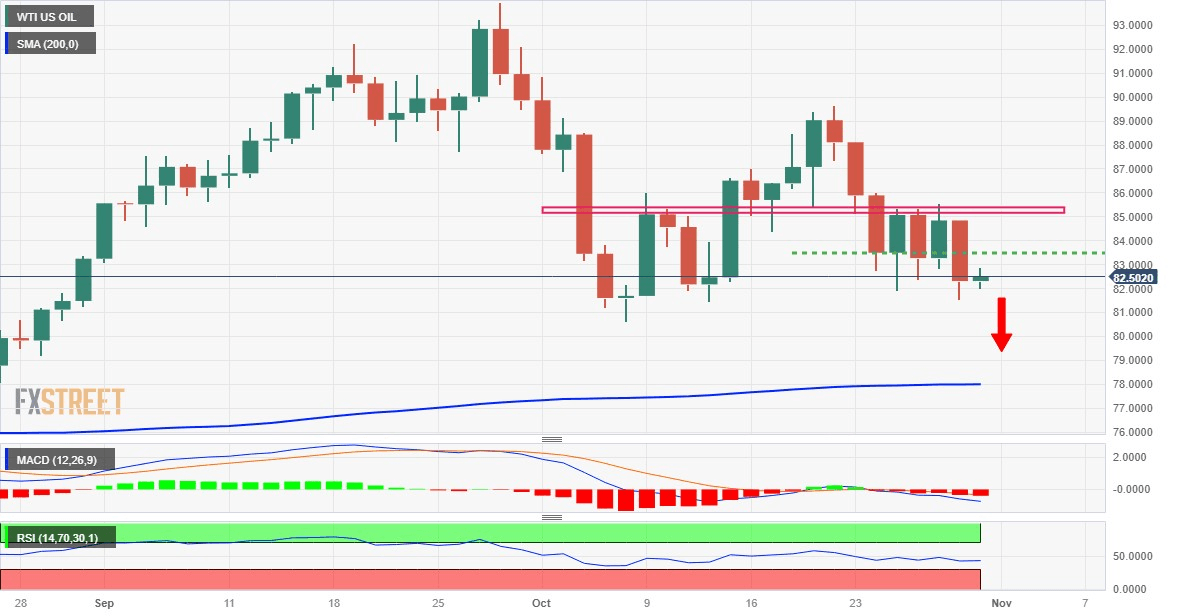

From a technical perspective, the overnight sharp decline and a close below the $83.50-$83.30 horizontal support could be seen as a fresh trigger for bearish traders. Moreover, oscillators on the daily chart have just started drifting into the negative territory and suggest that the path of least resistance for Oil prices is to the downside. Hence, any subsequent move up is more likely to get sold into.

The $83.00 round figure, followed by the $83.30-$83.50 support breakpoint now seems to act as an immediate strong barrier. A sustained strength beyond, however, could lift Oil prices beyond the $84.00 mark, towards the $84.70 intermediate hurdle en route to the $85.00 psychological mark. The next relevant resistance is pegged near the mid-$85.00s, which if cleared will negate the bearish outlook.

On the flip side, the $82.00 round figure is likely to protect the immediate downside ahead of the overnight swing low, around the $81.55 region. Some follow-through selling will be seen as a fresh trigger for bearish traders and make Oil prices vulnerable to weaken further below the $81.00 mark. The downward trajectory could eventually drag the commodity towards the monthly low, around the $80.65 region.

WTI daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.