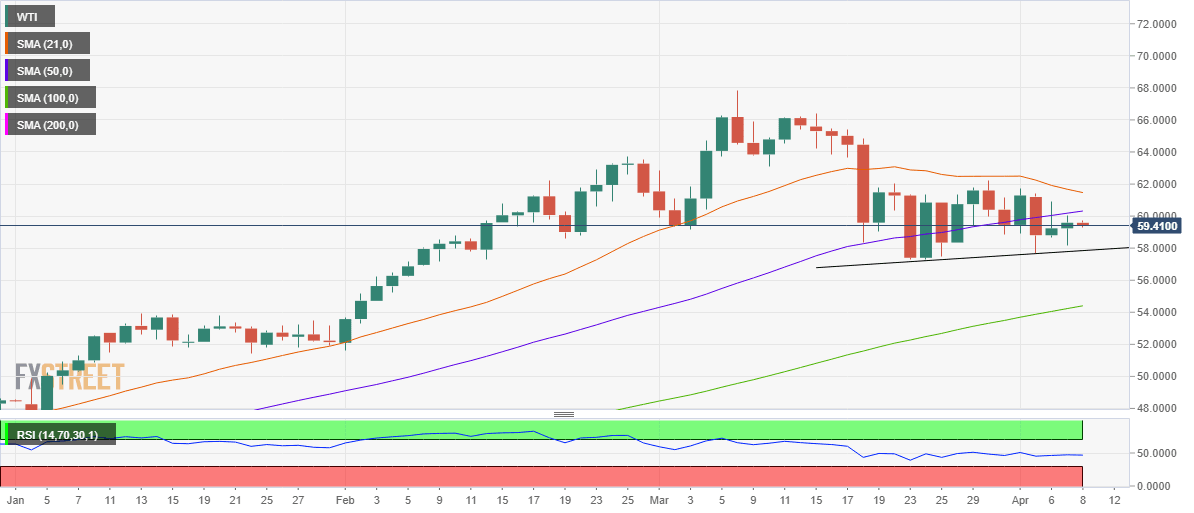

WTI Price Analysis: Risks further falls towards $58 mark whilst below 50-DMA

- WTI sellers return following rejection at 50-DMA resistance at $60.32.

- The US oil could risk a drop towards the ascending trendline support at $57.85.

- RSI trades flat while within the bearish zone, pointing to more losses.

WTI (futures on NYMEX) is snapping two-day bullish momentum on Thursday, as it returns to the red zone despite the upbeat market mood and broad-based US dollar decline.

The sentiment around the black gold remains undermined by an unexpected build in the American gasoline inventories, which overshadowed the drawdown in the crude stockpiles recorded last week.

From a near-term technical perspective, the WTI barrel remains exposed to the downside after it failed to find acceptance above the 50-daily moving average (DMA) at $60.32 for the third day in a row.

Adding credence to a potential move lower, the 14-day Relative Strength Index (RSI) keeps its bearish streak intact, as the indicator remains below the 50.00 level.

The ascending trendline support at $57.85 is expected to guard the downside, below which the March 23 low of $57.27 could be tested.

WTI one-day chart

On the flip side, WTI faces immediate resistance at the upward-sloping 50-DMA.

Further up the bearish 21-DMA at $61.46 could limit the recovery attempts.

WTI additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.