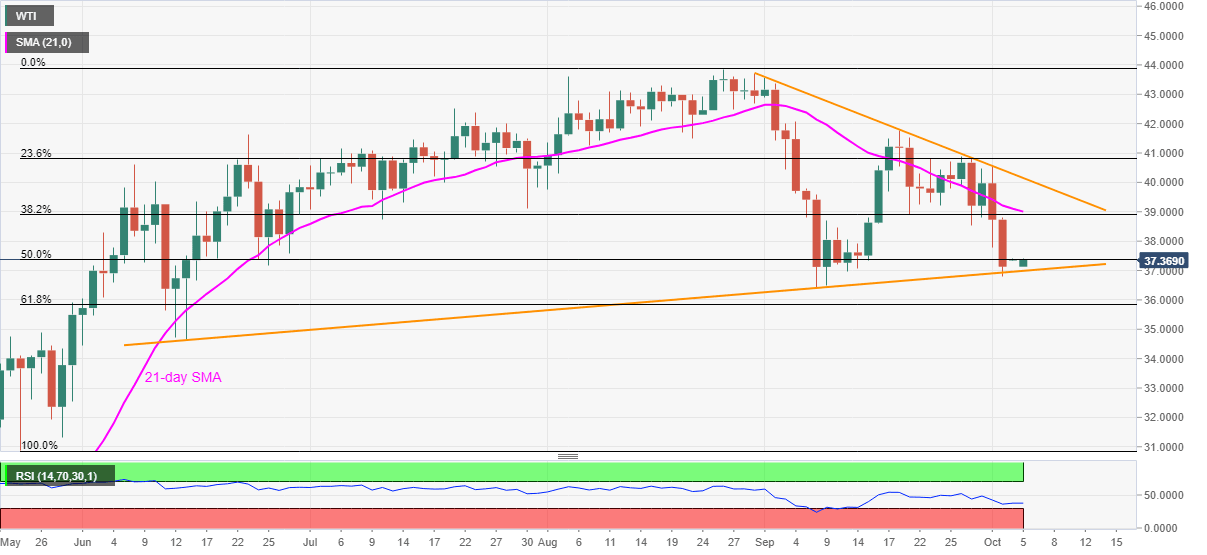

WTI Price Analysis: Rebounds from 16-week-old support line above $37.00

- WTI picks up bids toward $37.50 following its U-turn from the lowest in one month.

- 50% Fibonacci retracement offers immediate resistance ahead of $38.90-$39.00 key upside area.

- Sellers will target 61.8% Fibonacci retracement following the trend line break.

WTI rises to $37.40 during the pre-Tokyo open Asian trading on Monday. The black gold slumped to the lowest since September 09 on Friday but stepped back from closing below an ascending trend line connecting lows marked in mid-June and early September.

The buyers are currently attacking 50% Fibonacci retracement level of May 22 to August 26 run-up, near $37.40, a daily close beyond the same will aim for 38.2% Fibonacci retracement and 21-day SMA, close to $38.90-$39.00, during the further rise.

If at all the oil bulls remain dominant past-$39.00, the $4.00 round-figure and a downward sloping trend line from August 31, at $40.15 now, will be the key to watch.

Alternatively, the energy benchmark’s daily close below the stated support line, currently around $36.85, may take a rest near September month’s low of $36.43 before targeting the 61.8% Fibonacci retracement level of $35.82.

WTI daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.