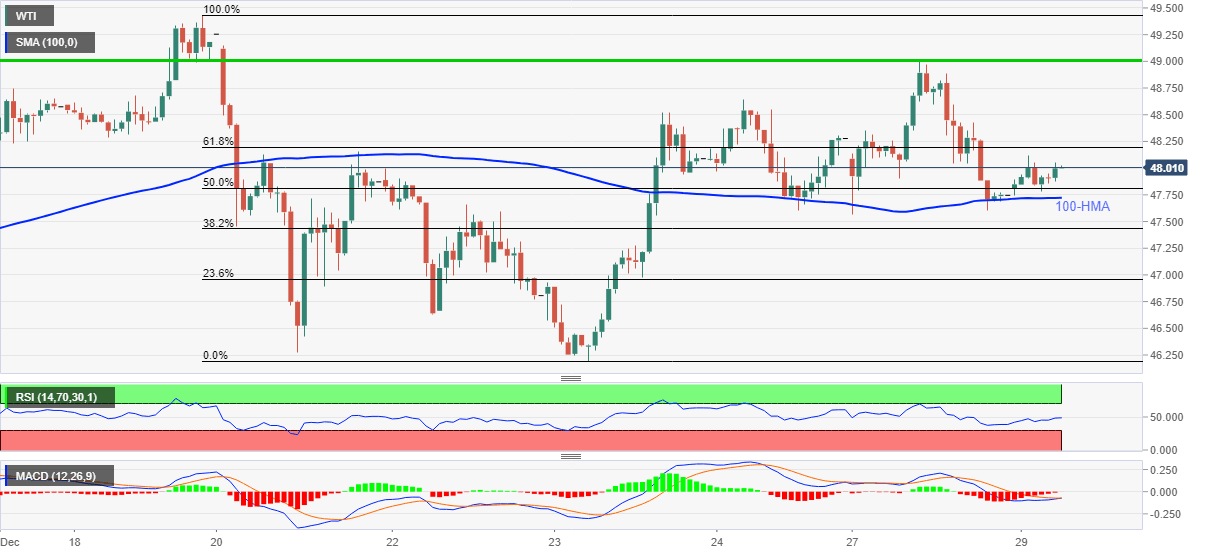

WTI Price Analysis: Bulls flirt with $48.00 as 100-HMA restricts immediate downside

- WTI holds wavers around intraday high while flashing mild gains.

- Strong RSI, likely shift in MACD signals also favor energy buyers above short-term key moving average.

- $49.00 holds the key to monthly high during the further run-up.

WTI prints 0.55% gains while taking rounds to $48.00 ahead of Tuesday’s European session. In doing so, the energy benchmark keeps 100-HMA as the key support while respecting signals from RSI and the MACD.

That said, the black gold currently aims 61.8% Fibonacci retracement of its December 18-23 downturn, around $48.20, a break of which will propel the quote towards the weekly high, as well as multiple lows marked on December 18, near $49.00.

If at all the commodity bulls manage to cross the $49.00 threshold, the monthly peak and early February lows near $49.40/45 hold the keys to the further upside towards the $50.00 round-figure.

Meanwhile, a downside break of 100-HMA, currently near $47.70, can have $47.50/55 as an intermediate before eyeing the $47.00 support.

In a case where the oil sellers keep reins past-$47.00, $46.60 and the December 23 bottom surrounding $46.20 can return to the chart ahead of highlighting the monthly low near $44.00.

WTI hourly chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.