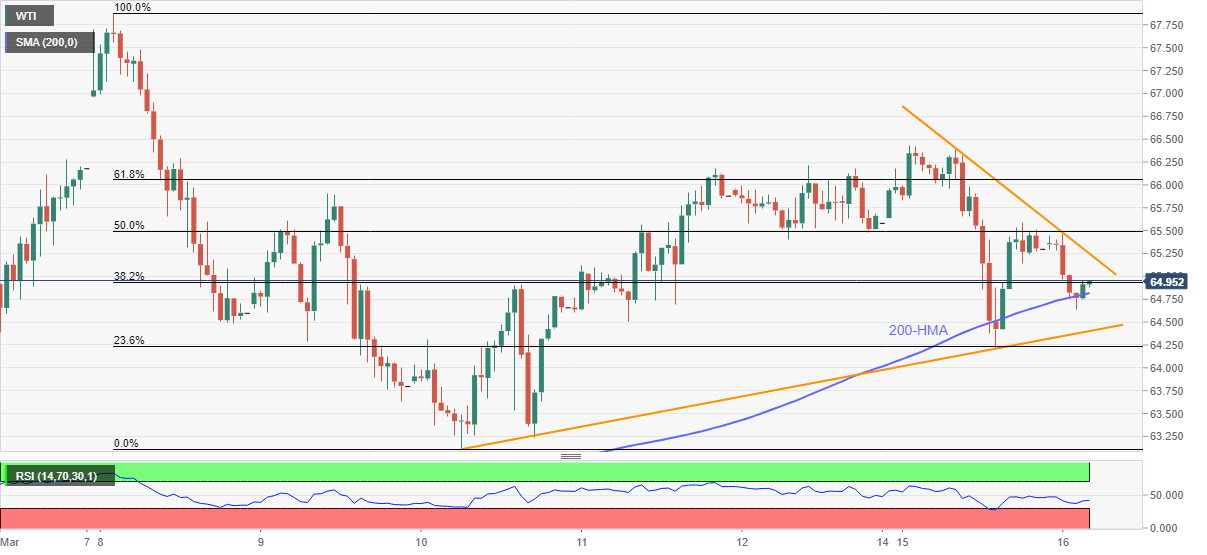

WTI Price Analysis: Bounces off 200-HMA, weekly support towards regaining $65.00

- WTI trims early Asian losses during a corrective pullback from key moving average.

- Immediate falling trend line probes oil buyers before key Fibonacci retracement levels.

- Bears need fresh monthly low for conviction, RSI favors sustained trading above 200-HMA.

WTI eyes recovery pushing back the oil bears during the three-day downtrend on early Tuesday. In doing so, the black gold jumps off 200-HMA to print $64.90, down 0.60% intraday, by the press time.

Given the quote’s U-turn from the key HMA, as well as upbeat RSI conditions, the energy benchmark is up for further trimming of losses towards a downward sloping trend line from Monday, currently around $65.25.

However, any further upside beyond the stated resistance line will be tested by 50% and 61.8% Fibonacci retracements of the quote’s March 08-10 fall, respectively near $65.50 and $66.05.

Even if the oil bulls manage to cross $66.05, a clear break of the weekly top close to $66.40 will be needed to confirm the commodity’s further upside.

Alternatively, a sustained break of 200-HMA, at $64.80 now, will have to break the one-week-old support line figure of $64.40, to back the WTI sellers.

Overall, WTI consolidates recent gains but the trend stays bullish till the quote stays above the monthly low of $63.11.

WTI hourly chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.