WTI Price Analysis: Bears lurking for weekly swing trade opportunity

- WTI is on the verge of petering out following a strong upside rally.

- Bears will be keen to see resistance do the work and open downside opportunities.

WTI has not been kind to bulls seeking to buy in at a discount as the black gold marches on without giving back any ground.

At the time of writing, WTI is trading some 11.6% higher than where it was at the start of the month.

From a 4HR perspective, a time frame favoured by swing traders, the price has rallied 7.88% in the last 13 bars.

A close miss

WTI is into its sixth consecutive bullish bar and there just has not been any get-in in which to take advantage of the rally, a rally and trade setup which had been forecasted on 11th Sep as follows:

In the above analysis, the market was forecasted correctly, but due to the risk management rules of the swing trading strategy, there was little opportunity to catch the high-speed train bar the break and restest of 38.10 on the 15th Sep.

Current situation

WTI prints $40bls and completes a 50% mean reversion of daily sell-off

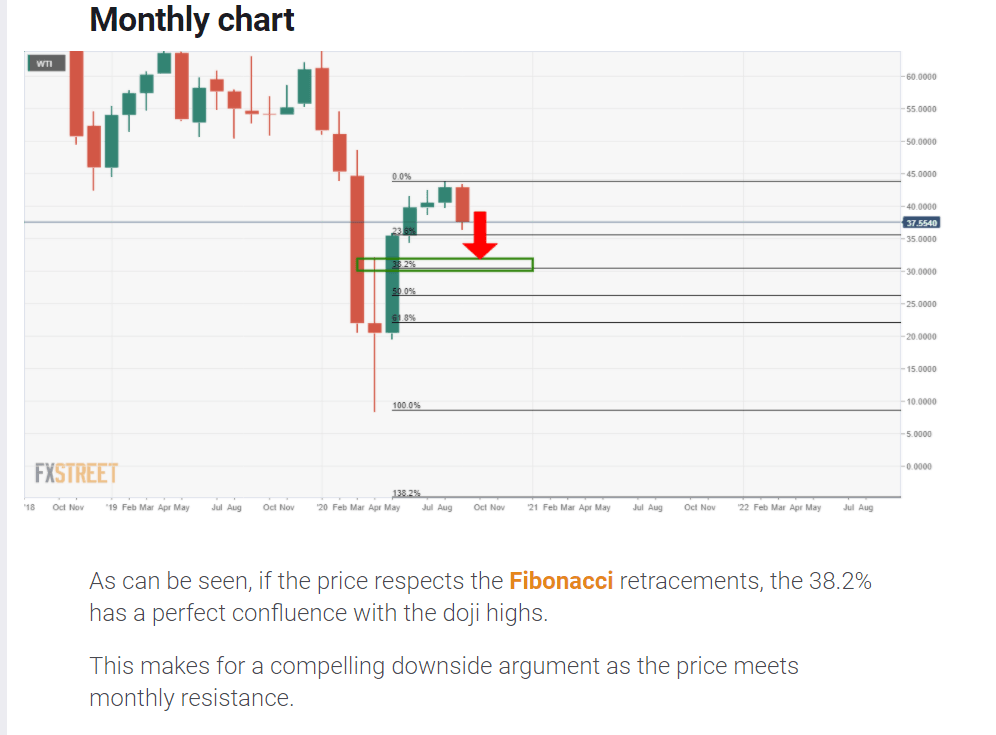

As the above article explains and as the four-hour chart illustrates, the price has reached the anticipated resistance levels.

On the flip side, If one wishes to read the original analysis, this was always expected to hold and to then offer a major phase of distribution to be apart of:

The bulls will now need to overcome structure at the 3rd Sep lows overhead at $40.20/80 which meets a 61.8% Fib of the same daily bearish impulse.

Failures between here and there will give rise to the downside prospects.

The start of a new wave to the downside towards weekly and monthly demand zones in the $34 area will offer an opportunity to short.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637353866951670399.png&w=1536&q=95)

-637357881152616288.png&w=1536&q=95)

-637358977914030161.png&w=1536&q=95)

-637358983054499571.png&w=1536&q=95)