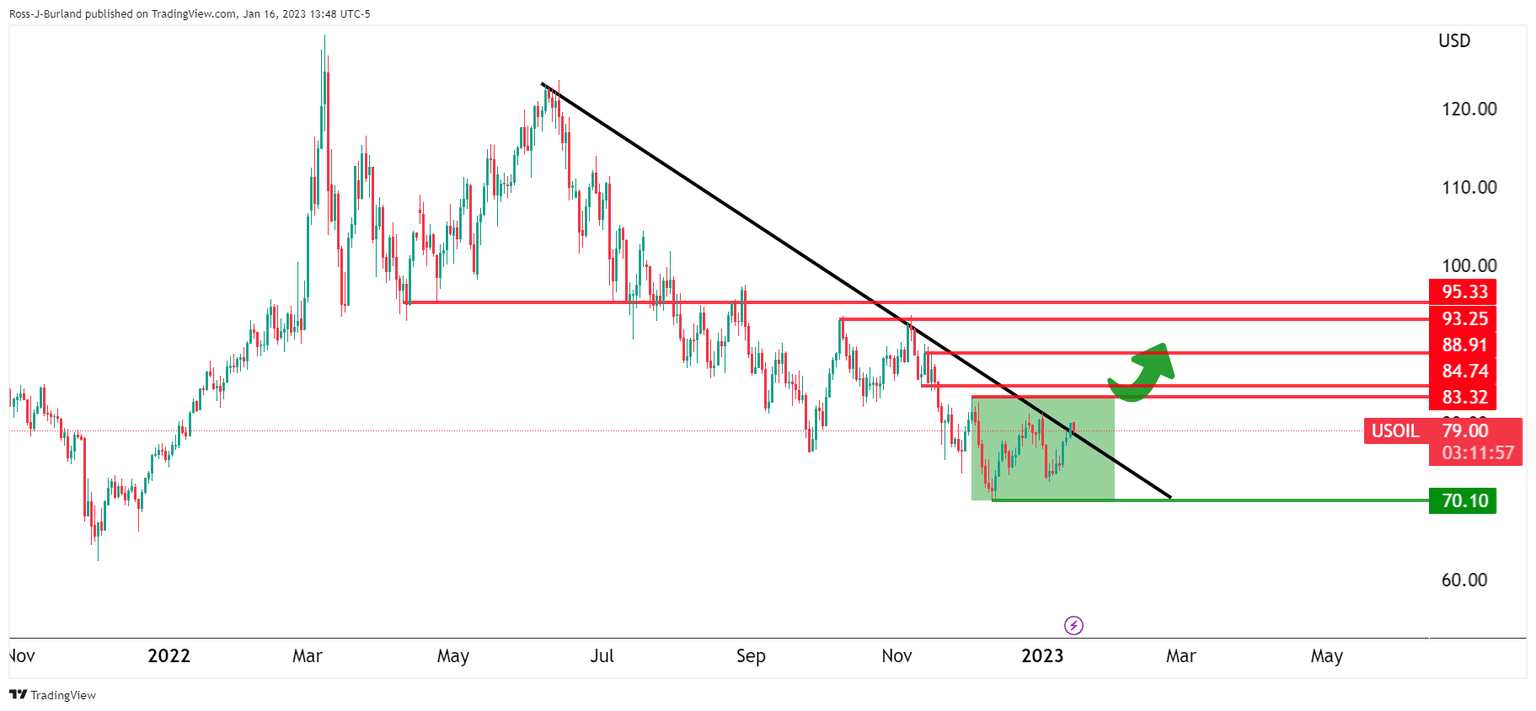

WTI Price Analysis: Bulls need to get over the line, $83.30 eyed

- WTI bears are holding the fort at $81.00 which guards the key structure of $83.30.

- While below resistance, there are prospects of a move lower into the coil that is in progress between $81.00 and $70.10 bear cycle lows.

As per the prior analysis, WTI Price Analysis: Bulls press against daily trendline resistance, bears are lurking, the resistance in the $80s is of key importance for the foreseeable future. The following illustrates recent developments that resulted in a break of the bear cycle's daily trendline and prospects of a phase of accumulation that could result in a significant bullish correction going forward.

WTI prior analysis

it was stated that A break of structure opens risk to a run towards 93.25 / 95.33 and higher in a correction of the 2022 summer commencing bearish cycle:

However, were are not there yet. The bulls have only managed to pierce the trendline resistance and the breakout structure remains intact:

While the proposed price action from here is typical of such a break in structure and accumulation schematics, it is yet to be seen how the bears will react to the recent developments in price action. The certainty is that 81.00 is holding as resistance for the time being guarding the key structure of 83.20. While below this area of resistance, there are prospects of a move lower into the coil that is in progress between there and 70.10 bear cycle lows.

WTI H1 chart

The above illustrates the possibility of a breakdown in hourly structure for the sessions ahead.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.