WTI Price Analysis: Bulls press against daily trendline resistance, bears are lurking

- WTI M-formation is in play in thin choppy trade on Monday.

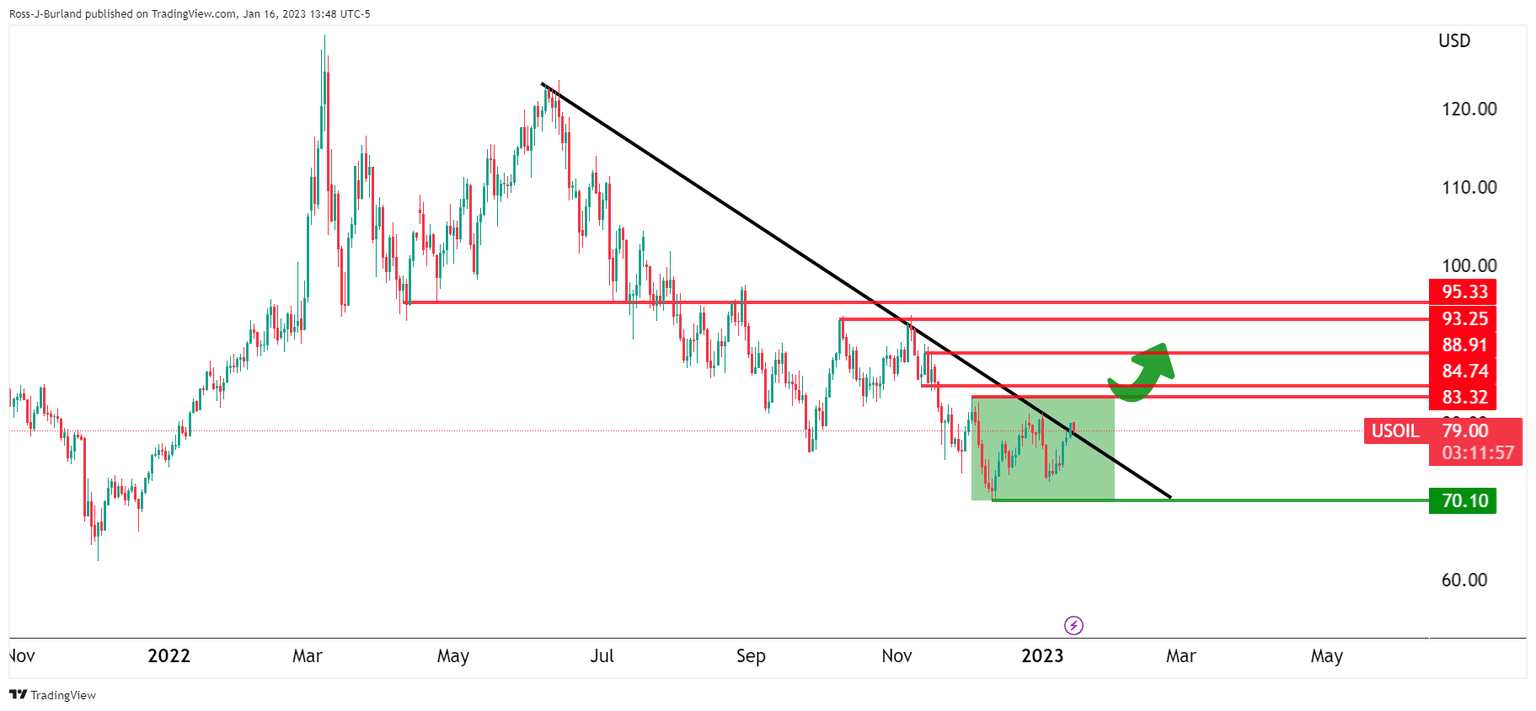

- Daily chart parameters keep the price stuck in a range, testing daily trendline resistance.

Oil has fallen in thin trade at the start of the week with US exchanges closed for the Martin Luther King, Jr, holiday. West Texas Intermediate spot is currently trading around $79.00 and is down by 1.25%.

Technically, the M-formation on the hourtly chart is a reversion pattern that would be expected to draw in the price into the Fibonacci scale drawn on the prior bearish impulse's range. The 38.2% Fibo aligns with a structure near 79.15 that could act as a resistance on a restest.

If the price were to break there, then a 50% mean reversion will be a likely scenario ahead of the 61.8% Fibonacci that meets the neckline of the M-pattern near 79.38. Above there, the double top of the M-formation comes in at around 79.75. Stops above there will be located around 80.00. However, given that the market is on the backside of the bullish trend, the downside will remain favourable until the bulls can break above 83.32 daily highs and structure:

On the other hand, a break of structure opens risk to a run towards 93.25 / 95.33 and higher in a correction of the 2022 summer commencing bearish cycle:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.