WTI Price Analysis: 100-hour SMA is capping upside

West Texas Intermediate (WTI) crude is currently trading near $65 per barrel.

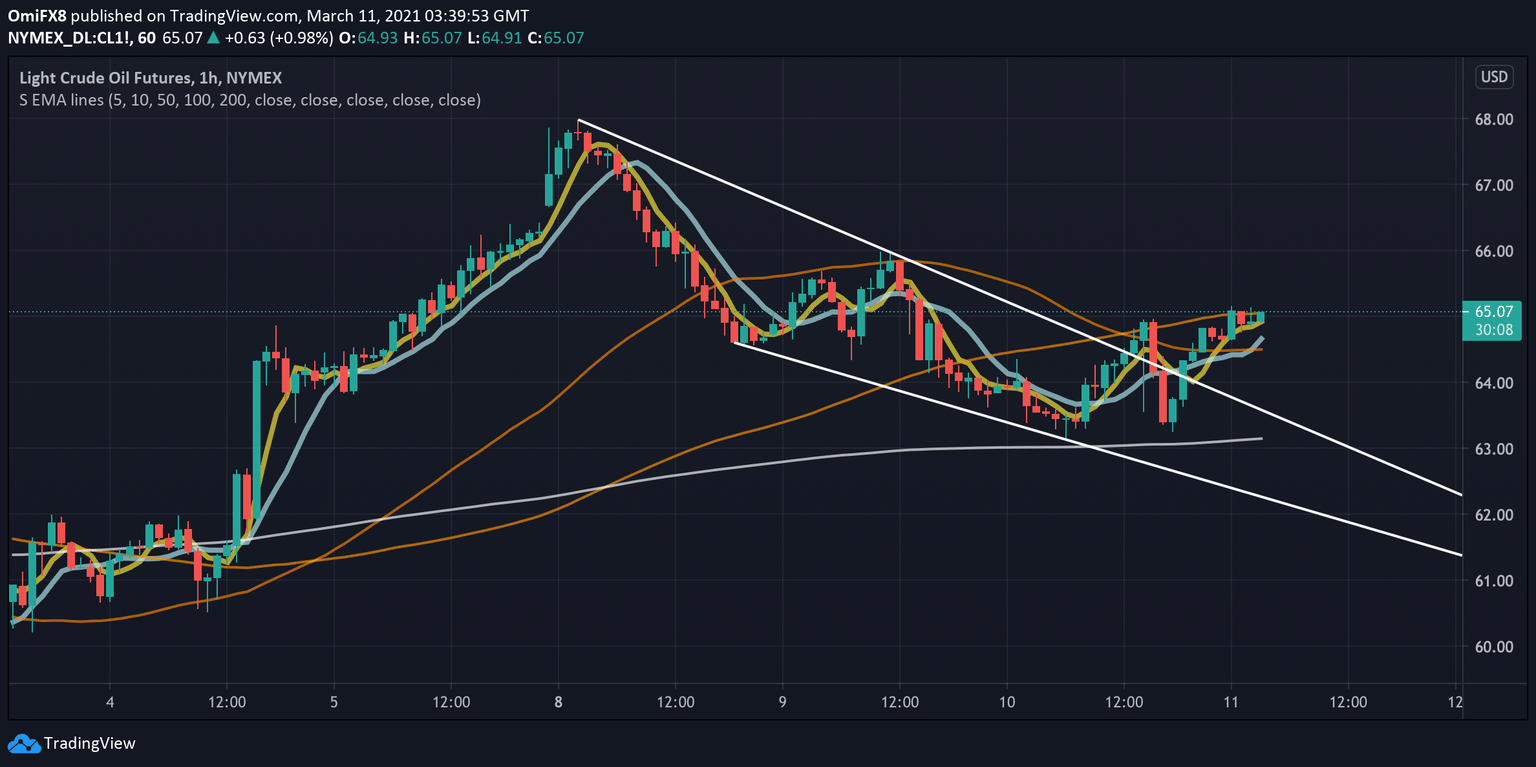

Oil broke higher from the hourly chart bearish channel during Wednesday's US trading hours. So far, however, the breakout has failed to invite stronger buying pressure, leaving the 100-hour Simple Moving Average (SMA) hurdle intact.

The SMA is currently lined up at $65.06. The average proved a tough nut to crack on Wednesday.

A convincing move above the SMA would revive the immediate bullish view, opening the doors for a retest of the March 8 high of $67.98.

Meanwhile, acceptance under the 200-hour SMA located at $63.15 would shift risk in favor of a deeper correction.

Hourly chart

Trend: Bullish above 100-hour SMA

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.