WTI crude oil nears $91 on OPEC+ cuts and demand uncertainty fueling price surge

- WTI trades at $90.48 per barrel, up 0.09%, amid Saudi Arabia and Russia’s 1.3 million barrel production cuts aimed at market stabilization.

- Citi Bank and Chevron’s CEO predict Brent crude could surpass the $100 per barrel mark, signaling bullish sentiment in the oil market.

- Upcoming central bank decisions, particularly from the Fed, could impact WTI prices; a hawkish hold may strengthen the USD and pressure oil lower.

Western Texas Intermediate (WTI), the US crude oil benchmark, rises courtesy of supply tightness. At the same time, uncertainty about global demand sparked a jump in WTI, which trades above the $90 per barrel at $90.48, printing modest gains of 0.09%.

Western Texas Intermediate (WTI) hovers near year-to-date highs, bolstered by OPEC+ production cuts and market speculations on future demand

Saudi Arabia’s Energy Minister, Prince Abdulaziz bin Salman, defended the Organization of Petroleum Export Countries and its allies (OPEC+) crude oil cuts needed to stabilize the markets amid uncertainty on China’s demand.

A few months ago, Saudi Arabia and Russia established cuts of 1.3 million barrels of crude production to stabilize oil prices as demand remains fragile. Since then, the Brent and WTI crude oil have climbed for three consecutive weeks.

In the meantime, analysts begin to upwardly revise oil prices for the end of 2023 and 2024. Citi was the last bank that predicts Brent would surpass $100 a barrel this year, echoing comments made by Chevron’s CEO Mike Wirth, who said oil would cross that threshold.

Aside from this, WTI could witness a dip as the global economic agenda would feature central bank decisions, mainly focused on the Fed. If the US Federal Reserve delivers a hawkish hold, that could underpin the Greenback (USD) to the detriment of US dollar-denominated assets.

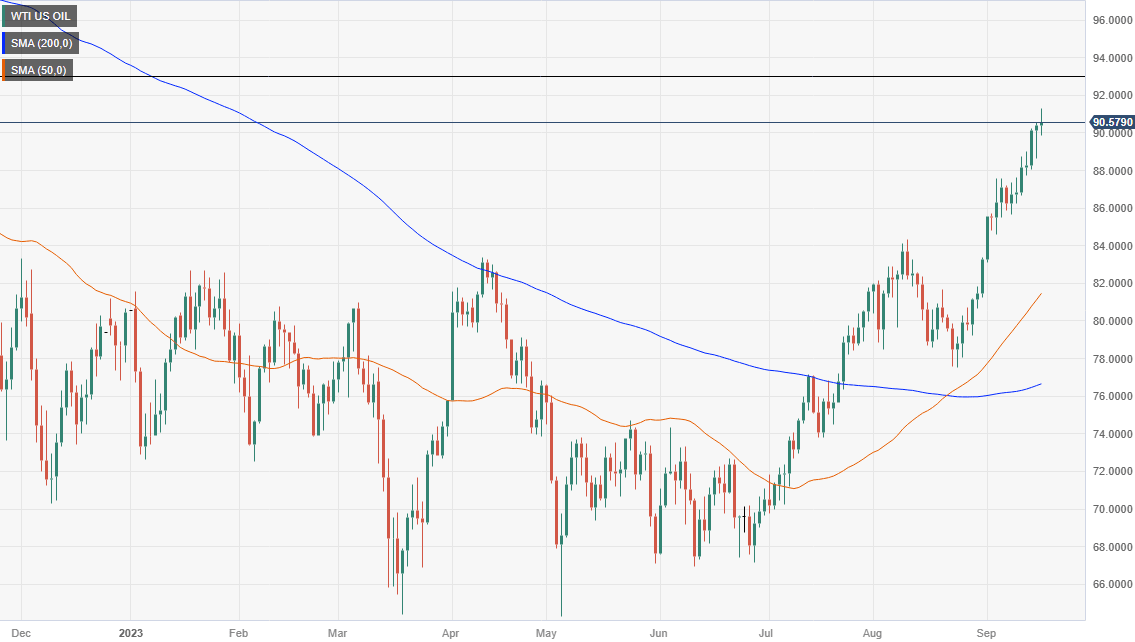

WTI Price Analysis: Technical outlook

Since August 24, WTI has gained close to 18% and has reached a new year-to-date (YTD) high of $91.29. Oil price is set to extend its gains towards the November 2022 high at $92.92, but price action appears to have peaked, as WTI is forming a doji, meaning that neither buyers nor sellers are in charge. Further upside is seen at $92.00 before the November 2022 high is tested. Conversely, a drop below today’s low of $89.85 could open the door toward a deeper correction, with sellers eyeing $88.00.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.