WTI clinches fresh 4-month tops beyond $42.00/bbl

- Prices of the WTI climb further north of $42.00 on Tuesday.

- Upbeat sentiment among traders, OPEC+ news bolster the move.

- API’s weekly report on US crude stockpiles coming up next.

Prices of the barrel of West Texas Intermediate are attempting to break above the prevailing consolidation and run above the $42.00 mark on Tuesday.

WTI faces the next hurdle at the 200-day SMA

The barrel of the American reference for the sweet light crude oil is navigating the area of multi-week highs on the back of positive news bolstering further the upbeat mood in the risk complex.

Indeed, auspicious headlines regarding a potential COVID-19 vaccine plus the gradual reopening of the economy in China have fuelled hopes of a pick-up in the demand for oil, thus sparking the current move.

Additionally, the latest decision by the OPEC+ to ease oil output cuts in August plus the recently clinched deal to allow extra stimulus in Europe are also collaborating with the upbeat mood surrounding the commodity.

Later in the session, the API will publish its weekly report on US crude oil inventories ahead of Wednesday’s official report by the DoE.

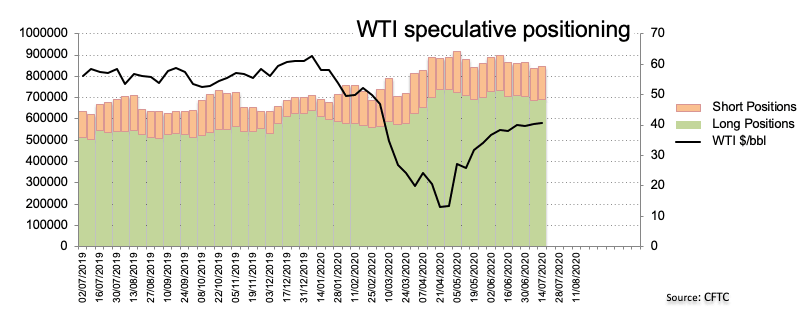

News from the speculative community noted net longs in crude oil climbed to 2-week highs during the week ended on July 14th, according to the latest CFTC positioning report.

WTI significant levels

At the moment the barrel of WTI is gaining 3.00% at $42.00 and faces the next resistance at $43.46 (200-day SMA) seconded by $48.64 (monthly high Mar.3) and then $54.45 (monthly high Feb.20). On the downside, a breach of $38.56 (monthly low Jul.10) would aim for $36.23 (55-day SMA) and finally $34.38 (monthly low Jun.15).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.