Wake Up Wall Street (SPY) (QQQ): Worst first half ever? Not quite, but not far off

Here is what you need to know on Friday, July 1:

Phew, thankfully that mess is over with. One of the worst starts to the year in living memory for both stock and bond markets is now behind us and surely it cannot get much worse, can it?

Worst US 60/40 portfolio returns through June... pic.twitter.com/79h1dAgMtS

— Charlie Bilello (@charliebilello) July 1, 2022

Well, the good news first. July is historically a positive month, in fact, the best of the quarter. Bad H1 performances for stocks historically are followed by a positive H2 performance. There is always a but however. We have some tough times ahead with expectations for an incoming recession, tightening financial conditions, surging inflation, a strong dollar, strong oil and souring consumer sentiment. Ok, I managed to quickly deflate that fleeting good news! July is earnings season again, and we feel downgrades are likely and forecasts will overall be negative. CEO confidence is falling.

"A staggering 68% of #CEOs surveyed by @Conferenceboard expect the #Fed's war on #inflation will eventually trigger a #recession." @CNNBusiness's @MattEganCNN examines our gloomy Q2 #CEOConfidence survey featuring Chief Economist Dana Peterson. https://t.co/5b0dBYRnxD

— The Conference Board (@Conferenceboard) May 18, 2022

We know consumer confidence is falling from the last two surveys, and consumers are the backbone of the economy and the stock market. Household investments in US stocks are at record levels, so plenty of challenges lie ahead.

Back to the here and now, and the latest news on another county lockdown in the Chinese province of Anhui is going to bring back some painful memories for investors. Not another round of lockdown, but let us wait and see how this plays out. So far so small, it is not Shanghai. Oil is up as the US and Iran are still miles away it seems from getting anything close to a deal. Yields are falling sharply as investors price in a recession. The latest Atlanta Fed GDPNOW tracker shows we may already be in one.

On June 30, the #GDPNow model nowcast of real GDP growth in Q22022 is -1.0%. https://t.co/T7FoDdgYos #ATLFedResearch

— Atlanta Fed (@AtlantaFed) June 30, 2022

Download our EconomyNow app or go to our website for the latest GDPNow nowcast. https://t.co/NOSwMl7Jms pic.twitter.com/t87bBJGRsv

The dollar is stronger despite falling yields at 105.17 as sterling yields also fall, and let us face it, Europe is a basket case. Gold is at $1,787, and Bitcoin is lower again at $19,100. Weekends see Bitcoin volatility, so keep an eye out. Oil is higher at $108.60.

European markets are lower: Eurostoxx -0.65 FTSE -0.6% and Dax -0.1%.

US futures are also lower: S&P and Dow are both -0.5% and the Nasdaq is -0.7%.

Wall Street top news (SPY) (QQQ)

Lingbi County in China enters covid lockdown.

ECB Panetta says inflation expectations are 2%. Wow, really? Expectations versus reality!

EU CPI higher than expected, record high at 8.6%.

Meta Platforms (META) says serious times ahead in an internal memo. Reuters says CEO Mark Zuckerberg said it might be “one of the worst downturns we’ve seen in recent history.”

Kohls (KSS) ends sale talks with Franchise Group-CNBC.

Micron (MU) down on outlook despite earnings beat. Trend starting!

LiAuto (LI) reports strong deliveries, 69% yearly gain.

XPeng (XPEV) deliveries up 133%.

NIO deliveries in June up 60% YoY.

FedEx (FDX) down on Berenberg downgrade.

Enjoy Technology (ENJY) files for bankruptcy. SPAC deal from last year, here they come!

Apple (AAPL) hikes iPhone 13 prices 20% in Japan-Reuters.

Salesforce (CRM) CEO sells another batch of stock.

Tesla (TSLA) delivery numbers are due possibly today or over the weekend.

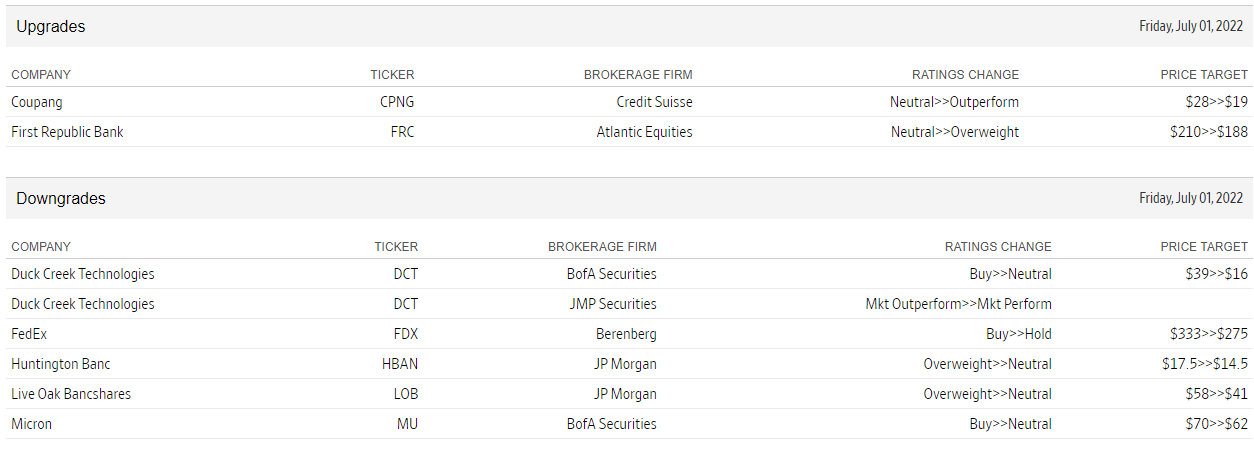

Upgrades and downgrades

Source: WSJ.com

Economic releases

The author is short Tesla stock.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.