Wake Up Wall Street (SPY) (QQQ): Will the Fed rise to the rescue?

Here is what you need to know on Wednesday, September 22:

Today is Fed watching day, so expect limited volatility and volume. That was certainly the case on Tuesday with some terrible volume profiles and small trading ranges. Risk was very definitely off as witnessed by the lack of a bounce among riskier meme and crypto names. China though has given things a boost this morning in the shape of Evergrande paying some interest on its debt and avoiding a default, so far. We have said that China is unlikely to let it default, but stranger things have happened and investors had been growing nervous. Last time we looked, Evergrande shares in Germany were trading over 40% higher.

The dollar is flat at 1.1730 versus the euro, Oil higher at $71.40, Bitcoin is higher at $42,100, and gold is flat at $1,774. Vix continues lower to 22 now.

European markets are higher: Dax +0.75, FTSE +1.8% and EuroStoxx +1.6%.

US futures are higher: Dow and S&P both +0.6%, while the Nasdaq is +0.4%.

Wall Street (SPY) top news

Evergrande pays some due interest payments, shares in Europe rally.

FDA decision on covid booster shots due this week for Pfizer (PFE).

Also for Pfizer (PFE) and BioNTech (BNTX): US gov't to purchase an additional 500 million vaccine shots to donate to poorer countries.

UK Prime Minister Johnson says the US is not doing trade deals right now.

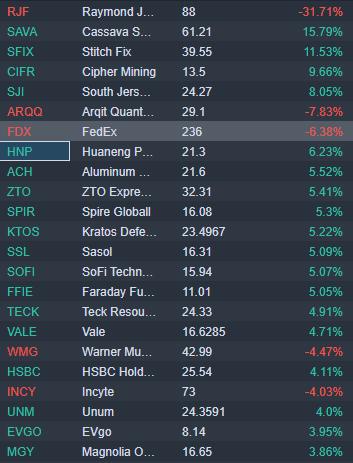

Raymond James Financial (RJF) down 31% premarket. No specific news we can see. Morgan Stanley cut the price target to $66.67.

Cassava Sciences (SAVA) up 20% premarket on positive trial data for Alzheimer's treatment.

Stitch Fix (SFIX) up after good Q4 results, +11% premarket.

FedEx (FDX) down 6% premarket on poor results and guidance.

Adobe (ADBE) down 3%, earnings beat estimates.

General Mills (GIS) up 3% on earnings and sales beat.

Zoom Video (ZM): the deal with Five9 (FIVN) is to be investigated by US Dept of Justice-Benzinga.

Disney (DIS) up as Credit Suisse says recent sell-off overdone-CNBC.

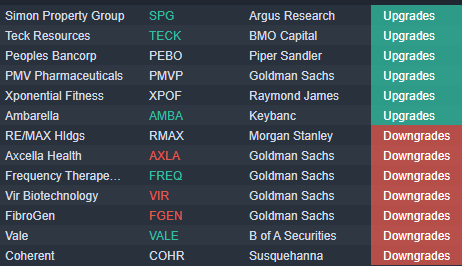

Upgrades, downgrades, premarket movers

Source: Benzinga Pro

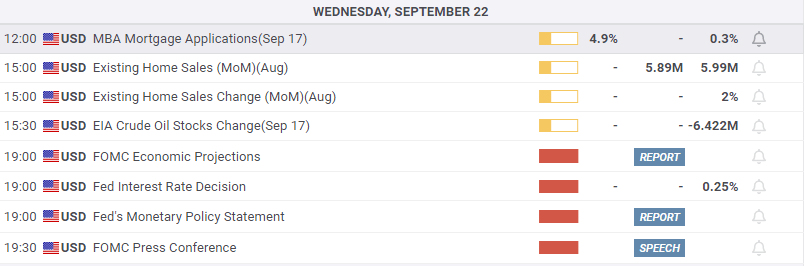

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.