Here is what you need to know on Wednesday, May 11:

Oh well, there goes the hopes for a rally then. We were all geared up for a benign CPI report. Economists had promised us that used car prices were slowing, and this among other factors would lessen the impact of price rises. Investors are on the sidelines with cash to invest, and sentiment was terrible. Things looked ripe then for a short, sharp bear market rally.

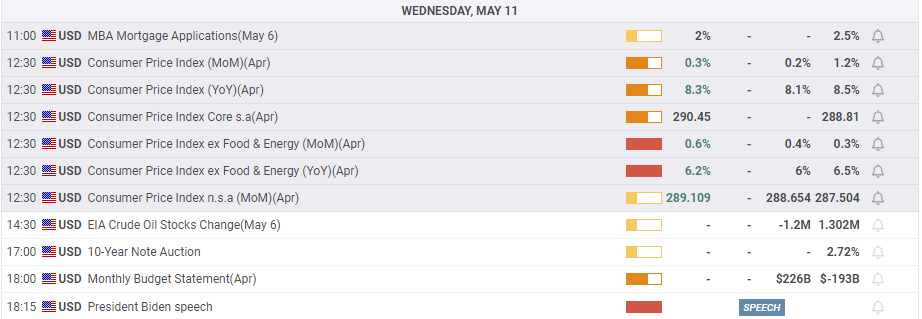

Instead, we got a number surprisingly high, and things began to look overly bearish. This, however, would be the perfect time to smoke out all those longs and then let the rally begin. The next few hours are all noise before the real money decides our fate. Bond yields will actually be what decides our fate, and the initial reaction was not good. Check out the 2-year bond yield chart below. Yikes, a spike up to 2.84%, but already it is coming straight back down. Markets will drift for a few hours before the big money piles in. This is crucial to give us our direction for the month ahead. So far bonds are all higher across the curve, but watch this space. Bonds have been nervous themselves as evidenced by their VIX – the MOVE index – also spiking.

US 2 year yield, 5-minute chart

The dollar went on a charge of its own after the CPI print but has retraced slightly. It is still higher for the day at 104.04. Oil is also gaining and is back above $102. Bitcoin is back below $30,000, and gold is at $1,839.

European markets are higher: Eurostoxx +0.3%, FTSE +0.1% and Dax +0.9%.

US futures are now lower: S&P -0.6%, Dow -0.4% and Nasdaq -1.2%.

Wall Street (SPY) (QQQ) News

US CPI 8.3 % versus 8.1% expected.

US Core CPI 6.2% versus 6% expected.

German Finance Minister says country may already be in stagflation.

EU and UK argue over Gibraltar and Northern Ireland.

Wendy's (WEN) missed on top and bottom lines. Down 3%.

Krispy Kreme (DNUT) beats on top and bottom lines. So we are eating burgers instead of donuts. That's healthy!

Perrigo (PRGO) revenue ahead, but profits behind estimates.

Tesla (TSLA) begins shipping from Giga Shanghai again.

Chicken Soup for the Soul Entertainment (CSSE) to acquire Redbox (RDBX).

Roblox (RBLX) fell 12% after earnings but back to nearly flat now.

Unity Software (U): poor revenue guidance, shares fall 22%.

Coinbase (COIN) is not coining it in anymore, shares fall 14% on earnings.

Occidental (OXY) repaid Warren's faith as it beat on earnings.

Toyota (TM) said profits could slump 20% on surging supply costs. Read across for all auto manufacturers, legacy and electric.

Playboy (PLBY) up on strong earnings.

ICL Group (ICL) up on strong earnings.

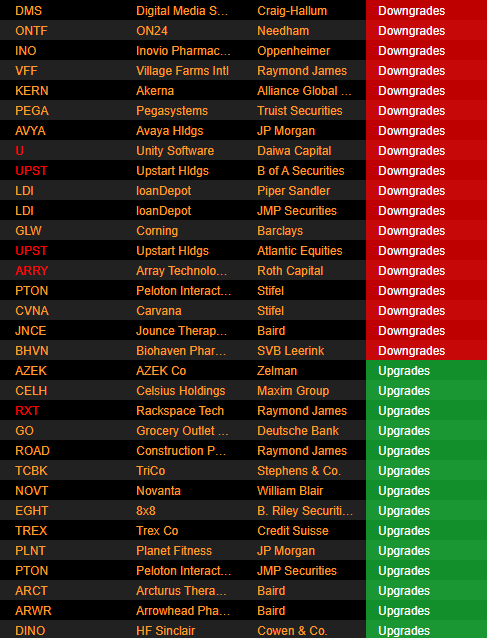

Upgrades and Downgrades

Source: Benzinga Pro

Economic Releases

The author is short Tesla and Twitter

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.