Wake Up Wall Street (SPY) (QQQ): Retailers remain strong as equities rally again

Here is what you need to know on Friday, November 18:

Equity markets retreated on Thursday, but the moves were actually better than what Fed member James Bullard looked to be attempting with his rate projections of between 5% and 7%. That did send yields higher, and they have largely remained elevated since, but the US Dollar and equity markets did not really react as one would have expected. The Nasdaq barely closed in the red at all, and that is supposed to be the rate-sensitive play.

Friday sees futures all positive, while bond yields continue to push higher. Some may be taking the inversion of the yield curve deeper and deeper into negative territory as an inverse pivot sign. A yield curve inversion is a precursor to recession and lower yields. This is a slightly counterintuitive argument when yields themselves are going higher.

This latest equity rally is now at a critical juncture. The recent consolidation can be seen as a staging point for another push higher or buyer exhaustion. I would normally lean to the fundamental side and argue for lower, but something is not yet feeling quite right about that argument. The pain trade is higher, and the market is designed to inflict pain.

The US Dollar too has failed in its attempts so far to rally. The Dollar Index is flat at 106.61, while Gold is also flat at $1,760. Oil is lower on China's covid worries at $80.56 now, while Bitcoin is steady at $16,700.

European markets are higher. Eurostoxx +0.5%, FTSE +0.45 and Dax +1%.

US futures also higher. Dow +0.5%, Nasdaq +0.9% and S&P +0.8%.

Wall Street top news

ECB President Lagarde sees higher rates spike hawkishly.

Reuters headlines

Meta Platforms (META): Chief Executive Mark Zuckerberg told employees on Thursday that WhatsApp and Messenger would drive the company's next wave of sales growth

Applied Materials (AMAT): The chip tools maker on Thursday forecast first-quarter revenue above market estimates

Gap (GPS): The company beat Wall Street estimates for quarterly sales and profit

JD.com (JD): The e-commerce firm posted an 11.4% rise in third-quarter revenue, beating analyst estimates

Visa (V): The company on Thursday named its president, Ryan McInerney, as its new chief executive officer

Activision Blizzard (ATVI) & Alphabet (GOOGL): Google has struck at least 24 deals with big app developers to stop them from competing with its Play Store

Amazon.com (AMZN): The online retailer said on Thursday there would be more role reductions as its annual planning process extends into next year

BioNTech SE (BNTX) & Pfizer (PFE): The drugmakers said their Omicron-tailored shot produced higher virus-neutralizing antibodies in older adults

Other news

Foot Locker (FL) soars 14% on strong earnings.

Williams Sonoma (WSM) up 8% on strong earnings.

Palo Alto Networks (PANW) up on strong earnings.

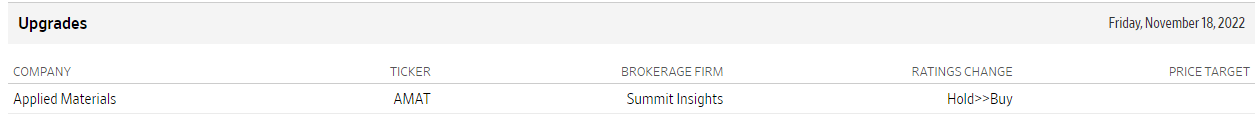

Upgrades and downgrades

Source: WSJ.com

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.