Vinco Ventures Stock News and Forecast: BBIG soars on Cryptyde spin-off date

- BBIG stock soars 30% in the aftermarket on Thursday.

- Vinco Ventures finally announces the date for the proposed Cryptyde spin-off.

- The company shareholders to get bonus dividend in Cryptyde.

BBIG stock is back up and running after quite some time in the doldrums. Thursday was not exactly a day full of good news for stock traders, so the news coming out after the close from BBIG was well received, and the stock has rallied in afterhours trading.

Vinco Ventures (BBIG) stock news: Not the time for high debt

BBIG stock is currently up 32% in Friday's premarket after the company announced on Thursday after the close the dates for record and distribution of a dividend in relation to the Cryptyde spinoff. Cryptyde will trade under the ticker TYDE. For every 10 shares of BBIG, shareholders will receive 1 share in TYDE. The record date is May 18 and the expected date for distribution is May 27. Any fractional shareholding (ie less than multiples of 10 shares) will be given cash instead of shares in TYDE. Cryptyde is a blockchain spin-off from Vinco Ventures.

While this news looks positive, we take a very cautious view of this investment. Both Cryptyde and Vinco are high risk. Cryptyde has already entered into agreements to raise up to $42 million in debt. This is not a time to be holding high levels of debt when you are a start-up venture with little income. The latest earnings for Vinco Ventures (BBIG) show these risks clearly stated and I am taking directly from the SEC return here:

- "We may require additional financing to sustain or grow our operations and implement our business plans and such additional capital may not be available to us, or only available to us on unfavorable terms". Becoming more and more likely now as credit spreads widen.

- "As of December 31, 2021, Lomotif had not generated any significant revenues and is likely to continue to experience significant net losses for the foreseeable future". Wow no comment necessary, this has been hailed as the saviour by many retail traders. Have you seen what has happened to hare prices of other social media platforms recently!!

- "A substantial number of shares of our common stock may be issued upon conversion of our outstanding convertible notes or exercise of our outstanding warrants, and such issuances and any other equity financing we may conduct may significantly dilute our stockholders and cause the price of our common stock to decline".

- For the year ended December 31, 2020, our operations lost $7,563,625 of which $4,623,130 was non-cash and $1,131,975 related to restructuring, severance, transaction costs and non-recurring items. At December 31, 2020, we had total current assets of $5,342,183 and current liabilities of $11,285,663 resulting in negative working capital of $5,943,480. At December 31, 2020, we had total assets of $28,028,207 and total liabilities of $14,505,506 resulting in stockholders’ equity of $13,522,701. We expect that we will have sufficient cash to meet our working capital needs and capital requirements for the next 12 months from the date of this filing.

- "Our obligations under the senior secured convertible notes that we issued in July 2021 and the transaction documents relating to those notes are secured by a security interest in substantially all of our and our subsidiaries’ assets. In addition, we are required to maintain a minimum cash balance of not less than $80,000,000 in a designated account subject to a deposit account control agreement in favor of the collateral agent. We may not use the cash in this account for operational purposes. As of April 14, 2022, these notes had a total principal of $113,000,000 outstanding, of which $33,000,000 will be due in July 2022, and the remaining $80,000,000 will be due in July 2023". Debt restructuring in July 2022 and 2023 if it makes it that far. July 2022 will be make or break, refinance then and it will likely be ok but that is a big if. Credit conditions are tightening by the day.

- "The warrants we issued in November and December 2021 contain certain provisions which provide that we shall seek to obtain a stockholder approval to increase our authorized shares of common stock to at least 400,000,000". Currently, Vinco Ventures (BBIG) has 188 million shares outstanding. So that's more than doubling, so 50% dilution, nice!

- "The number of new shares of our common stock issued in connection with raising capital, satisfying our outstanding debt obligations, or as consideration for acquisitions, could constitute a material portion of the then-outstanding shares of our common stock. As of April 14, 2022, there were 28,274,454 shares issuable upon conversion of a total outstanding principal of $112,990,000 under our senior secured convertible notes, 160,701,887 shares subject to outstanding warrants, up to 10,000,000 shares to be issued pursuant our unit purchase agreement to acquire AdRizer, 80,000 shares subject to outstanding options under the Company’s equity incentive plans, 4,000,000 issuable under contingent purchase agreement, and an additional 3,267,040 shares reserved for future issuance under the Company’s equity incentive plans".

Now, it is true every company has to outline potential risks to its shareholders and BBIG has been quite open here, so kudos to that, but the potential dilution and the debt is the big issue for us. Not in the current environment but last year this would have been okay, but now financial conditions have tightened and will continue to do for at least the remainder of 2022. The company does say it has enough cash for the remainder of the year but raising fresh cash will be an issue.

Vinco Ventures (BBIG) stock forecast: Too much risk for not-that-big reward

Based on the above, our forecast is that BBIG stock is non-investible. We realize many of you like the volatility and go ahead, so just please manage your risk, use stops, or whatever mechanism you choose. Based on the above, we see too much risk in holding this for the long term.

The macro-environment is dominating and it will punish high-debt companies. BBIG may work and it may get profitable. This is not intended to be a hatchet job on the stock. Our job is to inform as to the risk-reward profile in investing and trading. The risk is too high in relation to the potential rewards.

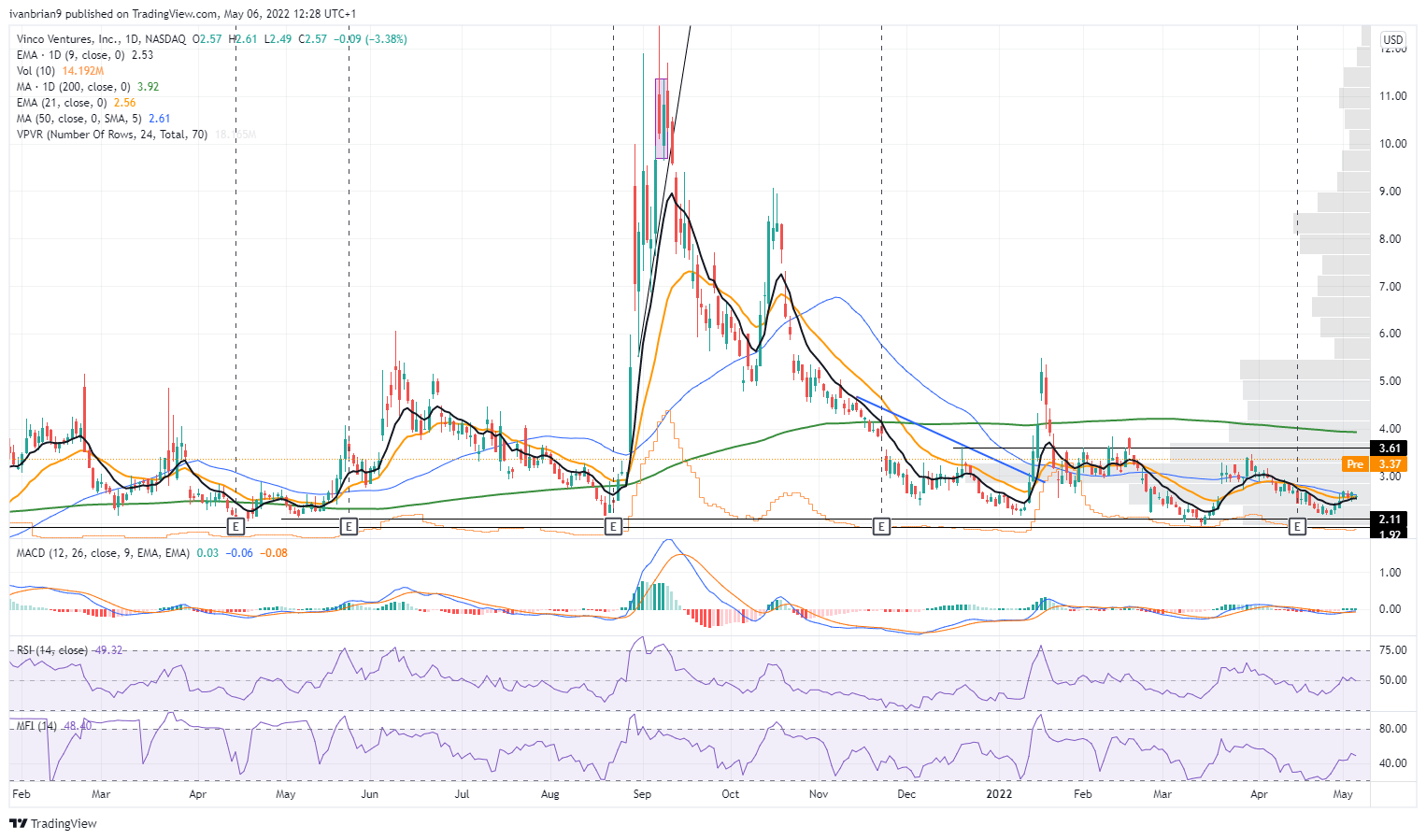

BBIG stock chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.