VERU Inc Stock News and Forecast: VERU soars on Phase 3 covid trial data

- VERU stock closes up 182% on Monday at $12.28.

- Veru Inc. reports positive trial data for covid treatment in hospitalized patients.

- VERU stock spiked to $24.57 last year before collapsing on positive covid trial data.

VERU stock is top of the social media charts this morning after a stellar performance on Monday. Retail traders love something with a decent but of volatility, especially something that has the potential to be a so-called multi-bagger. Well, VERU certainly fit the bill on Monday as the stocks stormed ahead from $5 to nearly $15 before retracing a bit by the close.

Read more stock market research

Veru Inc is a pharma company involved predominately in urology and oncology treatments but the bulk of recent attention has focused on its covid treatment candidate Veru 111.

VERU stock news: Veru 111 phase 3 trial approved

Back in February 2021, we saw a similar spike in the VERU stock price. It went from $10 to $23 in a matter of days after VERU announced positive Phase 2 trial data for Veru 111: "Veru Inc., an oncology biopharmaceutical company, announced positive efficacy and safety results from a double-blind, randomized, placebo-controlled Phase 2 clinical trial evaluating oral, once-a-day dosing of VERU-111 versus placebo in approximately 40 hospitalized patients at high risk for Acute Respiratory Distress Syndrome (ARDS) from SARS-CoV-2".

The stock spiked before falling back on a public issue of new stock. As is often the way with pharma stocks it is dramatic newsflow like this that moves them. A lack of newsflow sees stock fall back and VERU eventually gave up all its gains and then some to trade at $4.52 on Friday. Monday then saw the following news from Veru as Phase 3 trial data had proven successful for Veru 111: "Veru Inc., an oncology biopharmaceutical company, today announced positive efficacy and safety results from a planned interim analysis of the double-blind, randomized, placebo-controlled Phase 3 COVID-19 clinical trial evaluating oral sabizabulin 9 mg versus placebo in 150 hospitalized COVID-19 patients at high risk for Acute Respiratory Distress Syndrome (ARDS). The Independent Data Safety Monitoring Committee unanimously recommended that the Phase 3 study be halted early due to efficacy, and they further remarked that no safety concerns were identified".

So good news indeed, the phase 3 trial has followed promisingly from the Phase 2 trial and the logical next step is to get FDA approval and get the product to market and begin generating meaningful revenue. So far so good. The only caveat to add here is that the demand for covid products may be about to go into terminal decline as the virus becomes endemic. Populations have now large vaccinated cohorts and also many are immune from infection. You can witness this lack of potential in the share prices of Moderna (MRNA), down 50% over the past 6 months, and BioNTech (BNTX) down over 30 % in the past six months.

VERU stock forecast

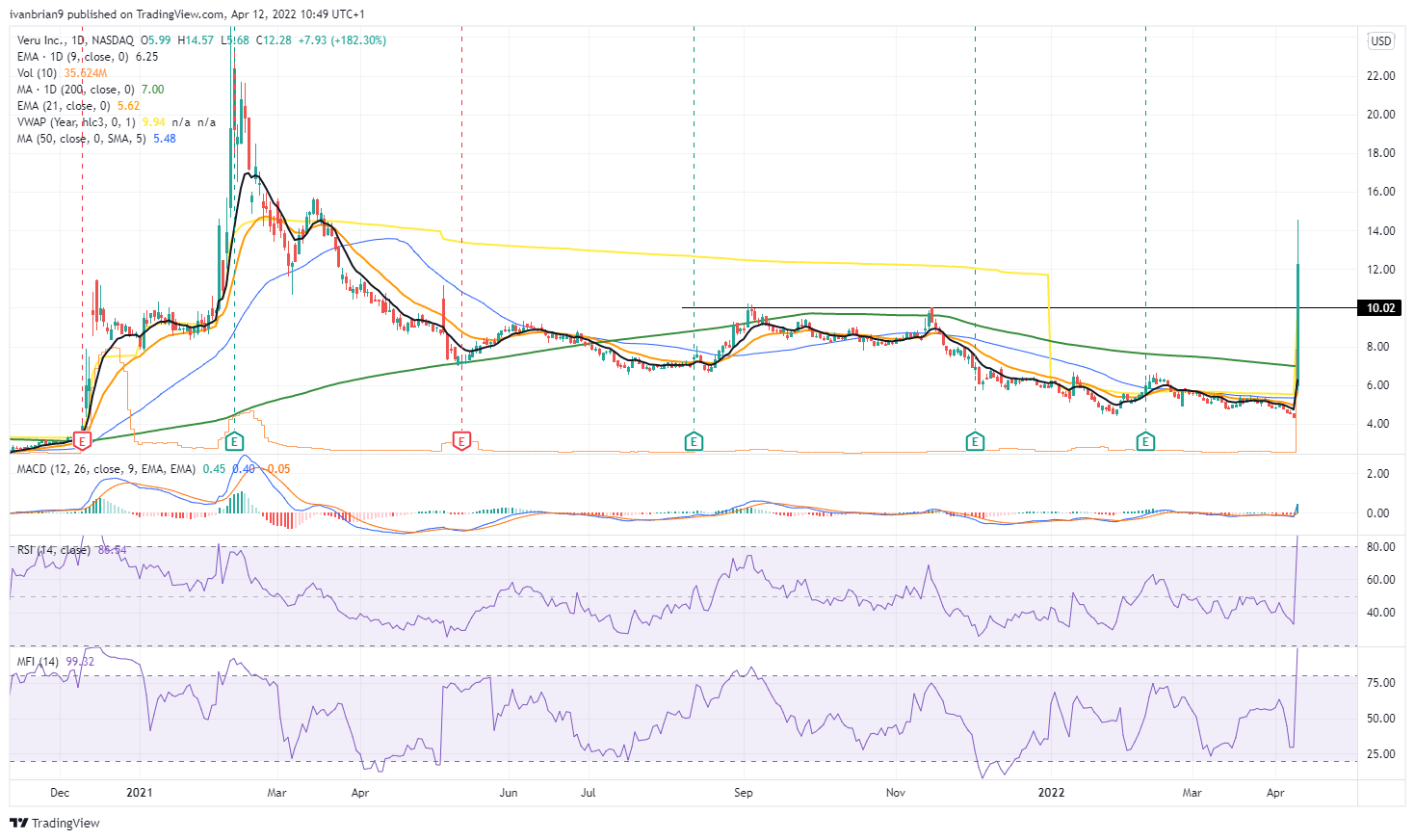

VERU stock does have other products in various stages of development but this is the most eye-catching and newsworthy given the pandemic. Pharma stocks are notoriously volatile and news dependent meaning technical analysis is largely irrelevant. In this case, VERU stock has broken the important double top at $10 but the speed of the move has seen both the MFI and RSI move into overbought territory. This is now momentum so watch for when it fades and exit or use stops.

VERU stock chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.