USD/SEK rises after Riksbank's cut and dovish outlook

- USD/SEK maintains gains exceeding 0.40%, underscoring the Dollar's continued firmness during Wednesday's session.

- The Riksbank sports a dovish view, trimming rates as forecasted, coupled with indications of more rate cuts in the second half of this year.

- Fed hawks are stepping in and challenging the dovish narrative.

The USD/SEK pair is trading higher at 10.55, marking a significant gain from a low of 10.45 last week. This uptick comes on the back of the monetary policy divergences between the Federal Reserve (Fed) and Riksbank. On the one hand, the Fed’s officials are turning hawkish. On the other hand, Riksbank, with a more dovish stance, has started to cut rate cuts and may undertake additional reductions in the second half of the year if the present economic conditions prevail.

After cutting rates to 3.75%, Governor Thedeen expressed a sense of caution, suggesting that a rate cut in June is improbable given the existing circumstances. He emphasized the concern regarding the weakening of the Swedish Krona (SEK), indicating that it needs to be taken into account. As for now, market expectations anticipate a total of 75 basis points of rate cuts over the next 12 months.

On the US side, recent dovish bets have been given up by investors, and the start of the easing cycle of the Fed is being priced in to start in November.

USD/SEK technical analysis

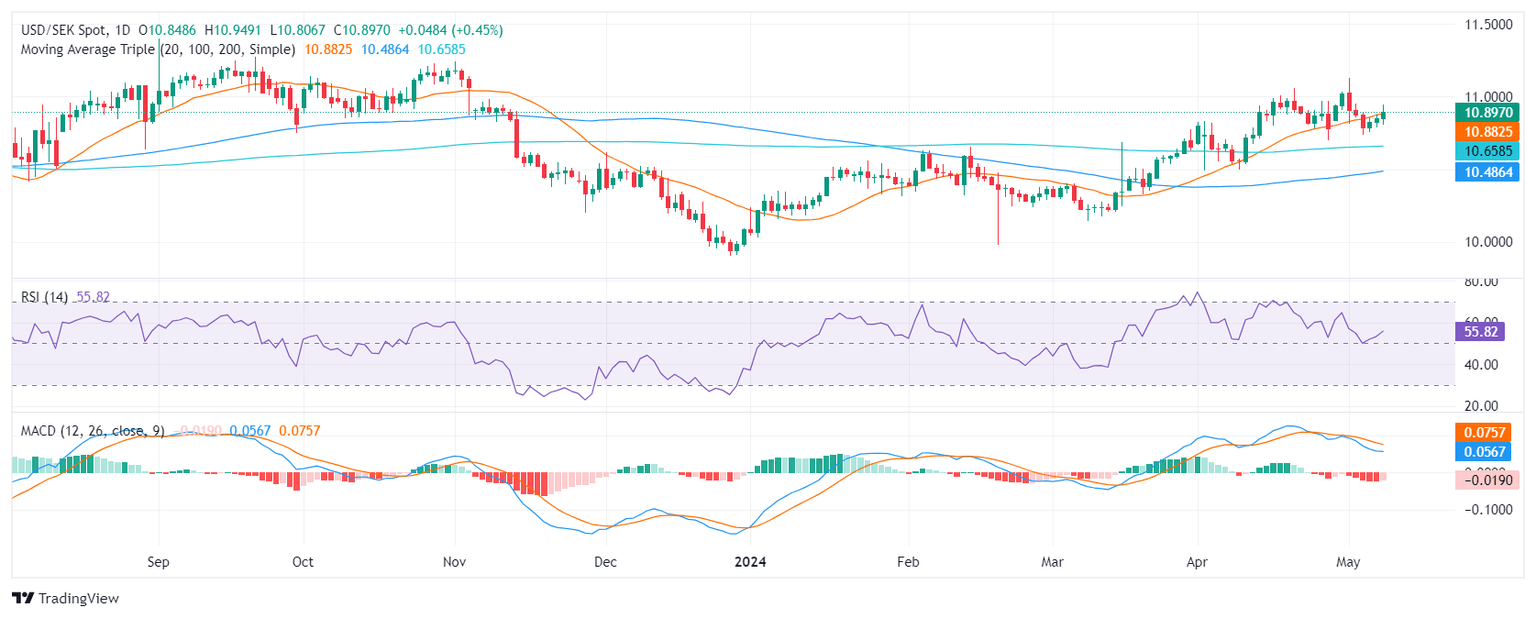

On the daily chart, the Relative Strength Index (RSI) for the USD/SEK pair resides within the positive territory after recovering from a dip into the negative domain. The MACD histogram sheds more light on the scenario, with progressively decreasing red bars showcasing a slowdown in negative momentum.

USD/SEK daily chart

In regard to the Simple Moving Averages (SMAs), the USD/SEK pair has reclaimed territory above the pivotal 20-day SMA. This escape from the bears not only illustrates evidence of buyers stepping in to restore short-term sentiment but also signals a potential shift in momentum. When observing the larger picture, the pair maintains a position above the 100 and 200-day SMAs, illustrating a solid long-term trend in favor of the bulls.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.