USD/MXN recovers from weekly lows amid risk-on mood, awaits Fed decision

- USD/MXN bounces back from weekly lows, gaining 0.56% ahead of the anticipated Fed rate decision.

- Despite a surge in US Consumer Confidence, looming recession concerns and worsening Richmond Fed Manufacturing Index adds uncertainty.

- Mexico’s stalled Economic Activity in May overshadows the IMF’s recently improved growth forecast for 2023.

USD/MXN sustains losses after bouncing from weekly lows of 16.7992 due to a risk-on impulse. Simultaneously, traders brace for the US Federal Reserve (Fed) decision on Wednesday, which is expected to deliver another rate hike amid speculations its job is almost done. The USD/MXN is trading at 16.9188, gaining 0.56%.

Strong US Dollar due to the Fed monetary policy decision looming underpins the USD/MXN

US equities continued to trade in the green before the Fed’s decision. A measure of Consumer Confidence rose to a two-year high in July, as revealed by the Conference Board (CB), with the index coming at 117 from 110.1 in June, exceeding estimates of 111.8. Although it’s a positive sign, consumers’ perceptions of a recession increased over the following 12 months. Concurrently, other data showed that House Prices in the US climbed 2.8% YoY, its lowest since April 2012.

Meanwhile, the Richmond Fed revealed its Manufacturing Index, plunging to -9 from June’s -8, portraying a dismal outlook as shipments and new orders plummeted.

Despite mixed US data, market participants expect the Fed to hike 25 bps the Federal Funds Rate (FFR), but uncertainty arises about another increase, as said by some Fed policymakers ahead of their blackout period. Even so, the FOMC’s statement would provide the base for policy, and USD/MXN traders’ focus would remain on Fed Chair Powell’s press conference, which could give some clues regarding the future of monetary policy.

Another reason that acted as a tailwind for the USD/MXN is a strong US Dollar (USD), as depicted by the US Dollar Index (DXY). The DXY, which measures the USD performance against a basket of currencies, is almost flat at 101.375.

Across the south border, the Mexican economic docket revealed that Economic Activity stalled in May at 0% MoM, below 0.4% estimates, trailing April’s 0.9% expansion. Still annually based, the economy grew 4.3% in May in unadjusted terms, above April’s 2.7%.

The International Monetary Fund (IMF) recently updated Mexico’s 2023 growth forecasts from 1.8% in April to 2.6% in July.

USD/MXN Price Analysis: Technical outlook

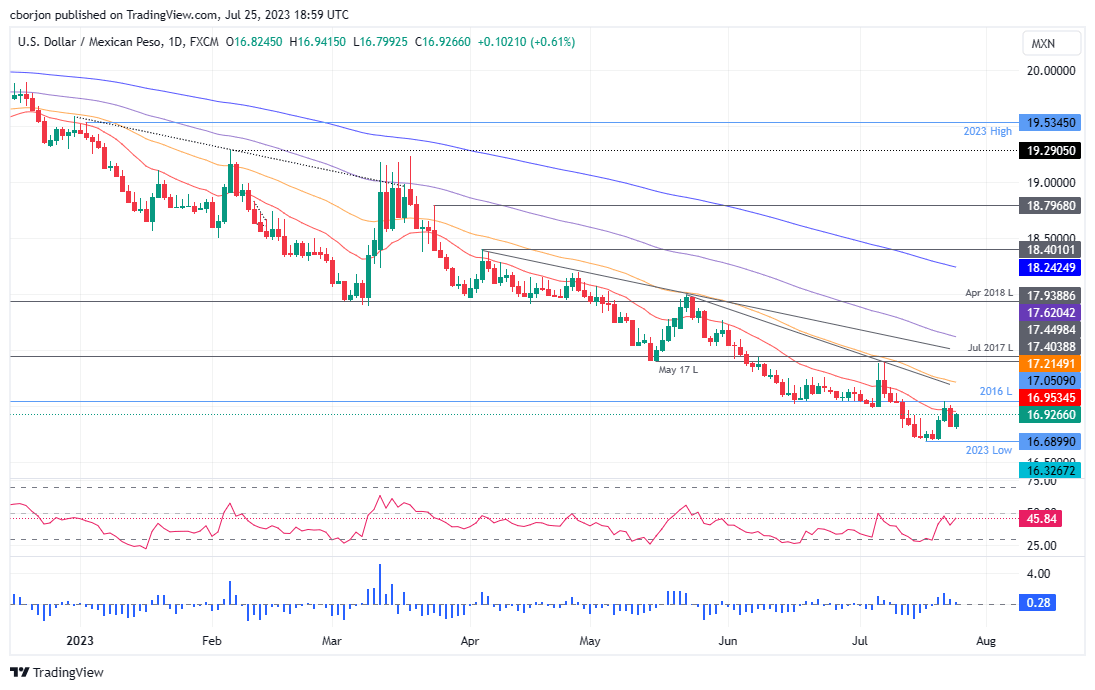

The USD/MXN trend remains down, as shown by the daily chart. Although the USD/MXN bounced from yearly lows, the 20-day Exponential Moving Average (EMA) at 16.9530 is capping any upside attempts to lift the spot above the 17.00 figure, as the 20-day EMA is tracking price action closely, acting as a dynamic resistance. However, if USD/MXN buyers step in once they clear the 20-day EMA, that would expose the weekly high of 17.0500. A breach of the latter will expose the 50-day EMA at 17.2145, followed by May 17 low-turned resistance at 17.4038, ahead of the 100-day EMA at 17.6202. Failure to break initial resistance at the 20-day EMA, the USD/MXN could challenge the YTD low of 16.6899, ahead of dropping to 16.50.

USD/MXN Daily chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.