USD/MXN Price Analysis: Mexican peso breaks 20.00, tests levels under 19.90

- USD/MXN breaks key short-term supports, looks for 19.80

- Despite the rally versus USD, the Mexican peso is far from being a top EM performer.

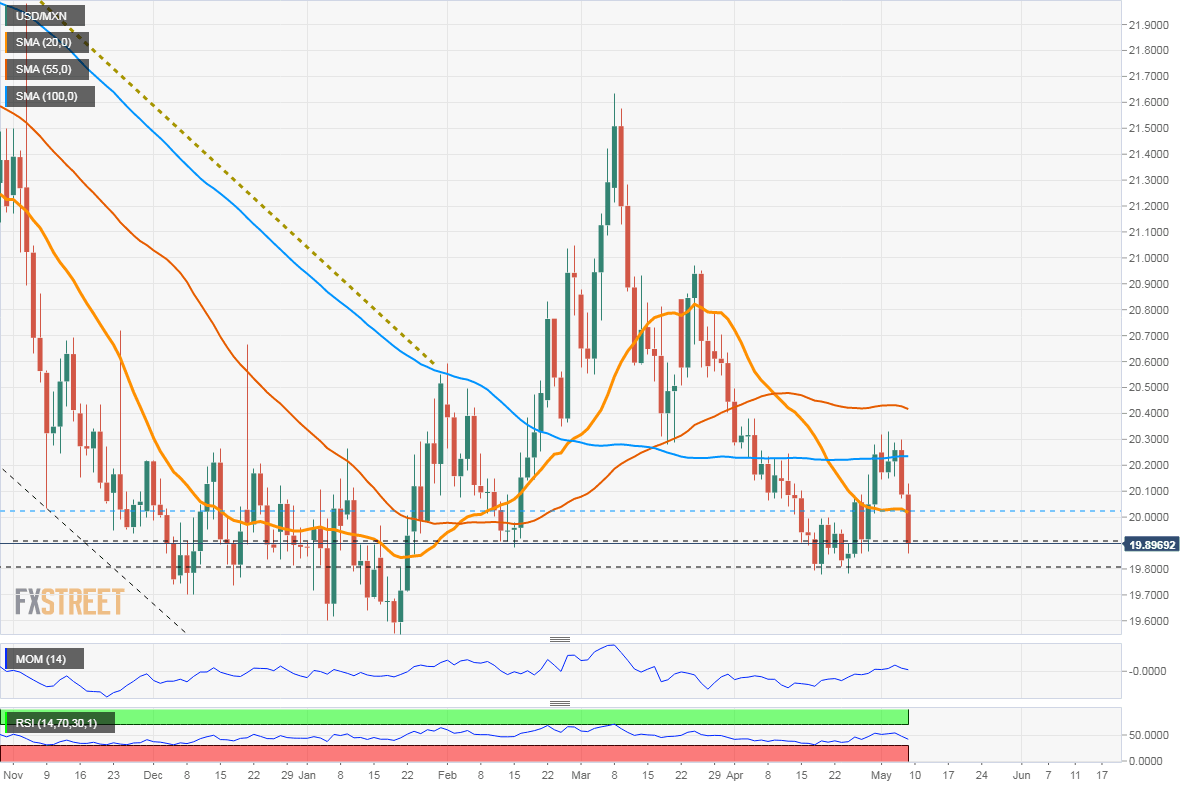

A sharp decline of the US dollar across the board pushed the USD/MXN under 20.00. After breaking the 20.05/00 barrier, the price dropped to 19.85, hitting the lowest level since April 29.

The USD/MXN is testing levels under 19.90, and if it holds below, a decline targeting 19.80 seems likely. Technical indicators favor further losses at the moment. The April floor at 19.75/80 should offer support. A break lower should expose the 19.50 area.

A recovery back above 20.00/05 is needed for the greenback to alleviate the bearish pressure. Above the next resistance stands at 20.15, followed by the critical 20.30.

The USD/MXN is ending Friday on a weak note, driven by a decline of the dollar. Just one day ago, it was testing the 20.30 resistance; now it is back under the 20-day moving average.

USD/MXN daily chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.