USD/MXN Price Analysis: Mexican Peso appears well-set to refresh monthly low near 17.42

- USD/MXN remains pressured at the lowest levels in two weeks after snapping two-day uptrend.

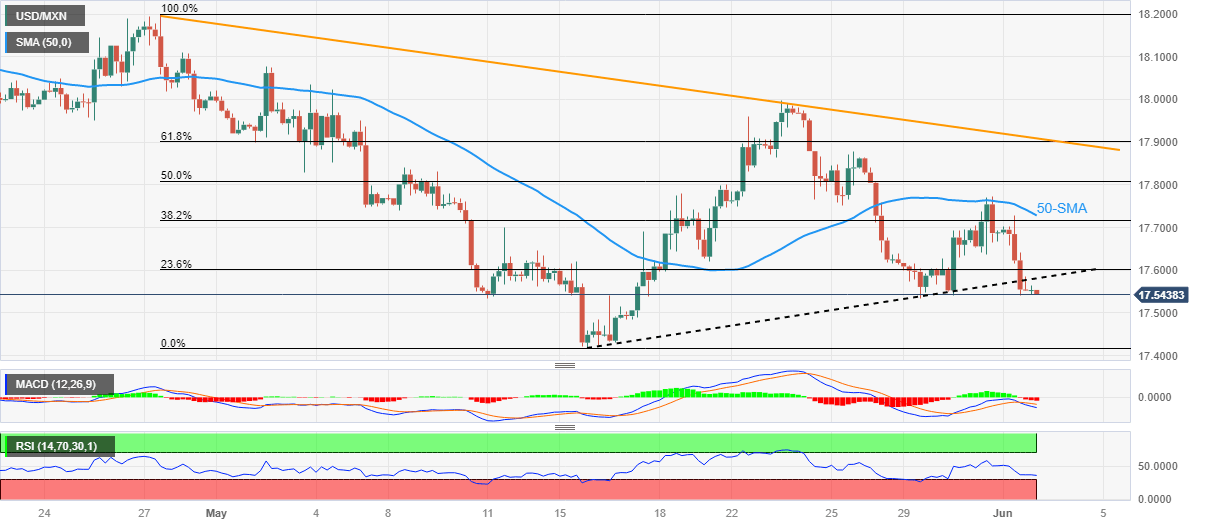

- Clear downside break of short-term support line, bearish MACD signals favor Mexican Peso buyers.

- 50-SMA, descending resistance line from late April adds to the upside filters.

- Oscillators keep sellers hopeful but the downside appears bumpy.

USD/MXN prods intraday low near 17.54 as it run the previous day’s bearish play despite a limited audience on early Friday. In doing so, the Mexican Peso (MXN) pair extends the mid-week reversal from the 50-SMA, as well as the downside break of a two-week-old rising trend line.

Not only a U-turn from the short-term key moving average and the support line break but the bearish MACD signals also favor the USD/MXN sellers. However, the RSI (14) line remains below 50.0 and hence suggests limited downside room.

As a result, the multi-month low marked in May around 17.42 gains the USD/MXN pair seller’s attention.

In a case where the USD/MXN pair remains bearish past 17.42, it will witness a bumpy road toward the 17.00 psychological magnet. That said, the year 2016 low of 17.05 may act as an intermediate halt.

Alternatively, recovery moves need to cross the immediate support-turned-resistance, around 17.58 by the press time, to recall the USD/MXN buyers.

Even so, the 50-SMA level of around 17.73 may challenge the pair buyers before giving them control.

It’s worth noting that a convergence of the downward-sloping resistance line from late April and 61.8% Fibonacci retracement of April-May fall, around 17.90, quickly followed by the 18.00 round figure, acts as the last defense of the bears.

USD/MXN Price: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.