USD/MXN Price Analysis: Fades bounce off 50-SMA above 18.00

- USD/MXN takes offers to reverse the previous day’s corrective bounce off one-week low.

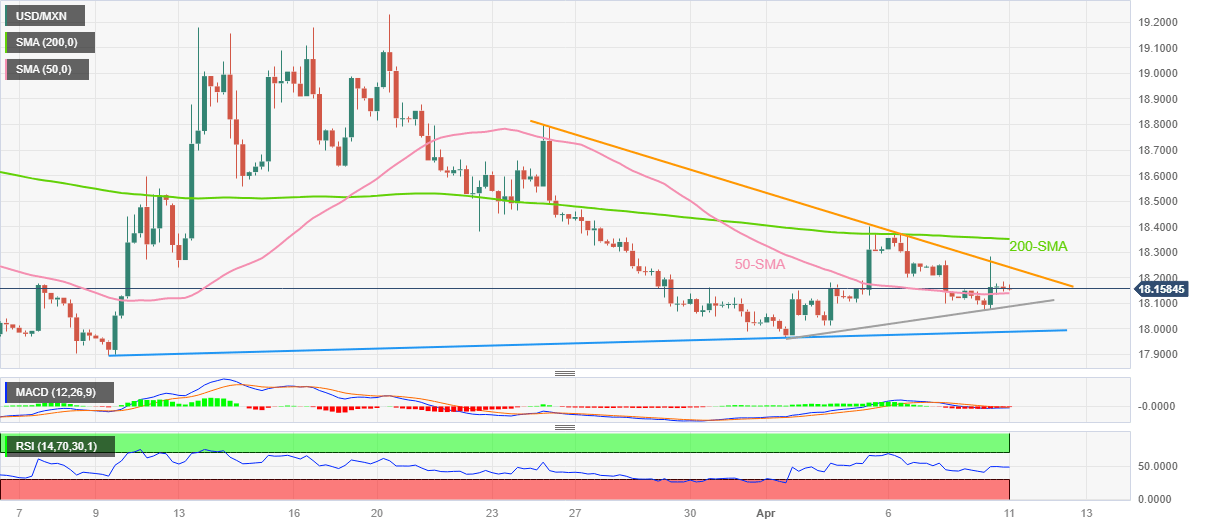

- Bearish MACD signals, steady RSI joins sustained trading below 200-SMA to keep Mexican Peso buyers hopeful.

- One-week-old ascending trend line, monthly support challenge bears; Buyers should remain cautious below 200-SMA.

USD/MXN renews intraday low near 18.14 as it fails to extend the week-start recovery from the 50-SMA amid early Tuesday.

In doing so, the Mexican Peso (MXN) pair stays below a two-week-old resistance line and the 200-SMA, keeping its 12-day-old bearish fashion intact. Adding strength to the downside bias are the bearish MACD signals and a steady RSI (14).

With this, the USD/MXN price is well-set to break the 50-SMA immediate support of around 18.13, which in turn can direct the sellers toward a one-week-long ascending trend line support, near 18.10.

Following that, an upward-sloping support line from early March, around the 18.00 round figure by the press time, can act as the last defense of the USD/MXN buyers, a break of which could drag prices towards refreshing the yearly low, currently near 17.89.

Alternatively, a fortnight-old descending resistance line, close to 18.25 at the latest, guards the immediate upside of the USD/MXN pair ahead of the 200-SMA hurdle of 18.35.

In a case where the Mexican Peso pair stays firmer past 18.35, the late March swing high of around 18.80 and the 19.00 psychological magnet may check the bulls before giving them control.

Overall, USD/MXN is likely to remain sidelined but the bears seem to have an upper hand of late.

USD/MXN: Four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.