USD/MXN falls below 21.00 amid a mixed market mood

- The USD/MXN extends weekly fall, down for the third consecutive day.

- A mixed-market sentiment favors risk-sensitive currencies like the Mexican Peso to the detriment of the US dollar.

- USD/MXN Price Forecast Has an upward bias unless MXN bulls hold the exchange rate under 21.00.

The USD/MXN is falling during the New York session, down some 0.47%, trading at 20.95 at the time of writing. The market sentiment is mixed, as European equity indices ended the day in the red, while US equities are rising across the pond, except for the Dow Jones, which is down 0.15%.

In the overnight session, upbeat news regarding vaccine effectiveness against the omicron variant improved market sentiment. Early lab studies made by two of the most successful COVID-19 vaccines showed that a third shot neutralizes the omicron variant. That enhanced risk appetite toward riskier assets, favoring risk-sensitive currencies like the Mexican Peso, rising almost half-percent against the greenback.

That said, the Mexican Peso remained subdued in the overnight session, seesawing around 21.00, though, at the overlap of the European and the American session, the Mexican Peso strengthened, dipping to a fresh weekly low at 20.8840. In the meantime, the US Dollar Index, which tracks the greenback’s performance against a basket of its rivals, slides almost 0.50%, sitting at 95.88, a headwind for the USD/MXN pair.

An absent Mexican and US economic docket would leave USD/MXN traders leaning to market sentiment dynamics and the US Consumer Price Index for November, to be released on Friday.

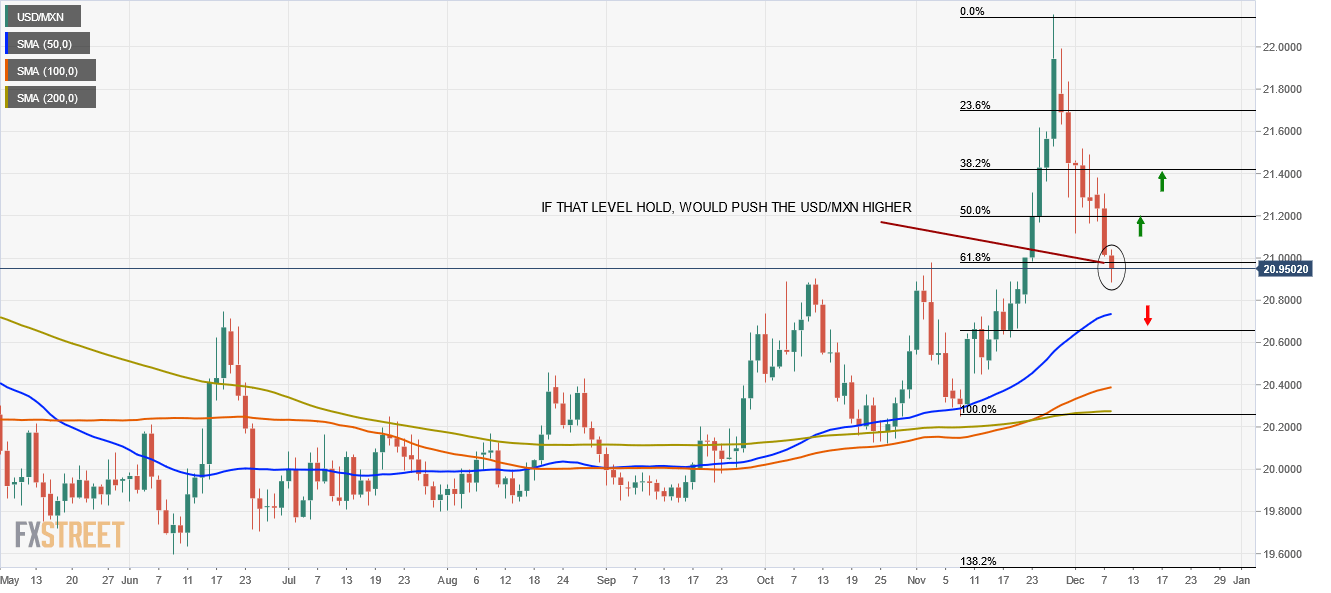

USD/MXN Price Forecast: Technical outlook

The USD/MXN daily chart shows that the pair has an upward bias, as demonstrated by the daily moving averages (DMA’s), which reside well above the spot price with a slight horizontal slope. The pair bounced at the October 12 high previous resistance-turned-support level at 20.9002, some 400 pips away from the 61.8% Fibo retracement. However, USD bulls would need a daily close above 21.00 to resume the uptrend.

In that outcome, the first resistance would be the 50% Fibo retracement at 21.2006. A clear break of the latter would expose the 38.2% Fibo retracement at 21.4252, followed by a weekly high at 21,6338.

On the other hand, if the USD/MXN posts a daily close below the 61.8% Fibo retracement, that would open the door for further losses. The first support would be the 50-DMA at 20.7256, followed by the 78.6% Fibo retracement at 20.6564.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.