USD/JPY holds below 113.00, multi-week low performance, US CPI eyed

- The risk-off sentiment undervalued JPY's safe-haven appeal.

- USD/JPY weighed heavily on the back of Japan's real wages decline, report.

- The pair look for impetus from US CPI amid a light economic calendar.

USD/JPY is trading under the 113.00 mark during early Asian session hours on Wednesday. The pair pushed lower alongside commodity currencies as risk appetite reversed overnight. As of now, a tight currency range is expected in the near term as markets look ahead to US CPI.

After falling from the 114.00 level, Japan's Current Account balance shrank below the ¥1060B forecast to ¥1033.7B in September, which weighed on the USD/JPY prices.

Also, in the news, Japan being the world's third-largest economy hit hard by the coronavirus pandemic, Prime Minister Fumio Kishida is set to map out and secure funding for a stimulus package worth more than 30 trillion yen ($265 billion) within the year.

It is to be noted that Reuters reported that "Japan's real wages declined in September for the first time in three months as inflation picked up faster than growth in nominal pay, the government said''. The news agency said that this is a sign of global cost-push inflation starting to affect Japanese households. This information has weighed heavy on the quote's price action.

Meanwhile, the US dollar index is moving below 94.00, down by 0.09% on the day. Treasury yields fell across the curve as markets digested news that dovish Fed Governor Lael Brainard has been interviewed for the Fed's chair position. This should see local rates markets open to a bid tone.

Amid a light economic docket in Japan, the pair will find impetus from the critical US inflation figures.

Technical levels

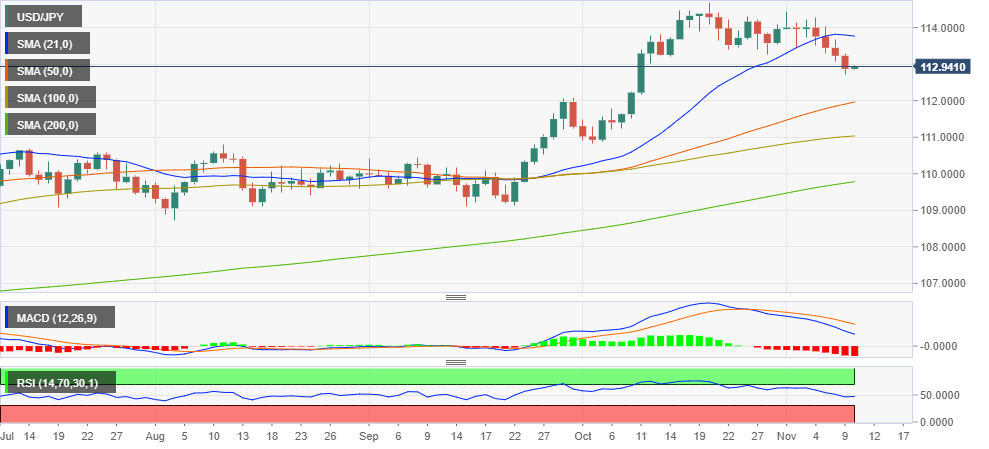

The USD/JPY daily chart indicates 113.76, 21-day Simple Moving Average (SMA), as immediate resistance to the upside. If it's breached, the pair's one-week high of 114.44 will be the next topside barrier. The next resistance would be one month's high at 114.70.

The price may reverse and continue the downtrend towards the support levels of 111.96, 110.03 and 109.78, which are the pair's 50, 100 and 200-day SMAs respectively. Following the Moving Average Convergence Divergence (MACD), the movement shows a cautious dive. The Relative Strength Index (RSI) looks cheerful but manages to stay below the 50-line horizon.

Author

Sounava Ray Sarkar

Independent Analyst

Sounava has been working as a Journalist since 2012. He has worked with several reputed media organizations in various capacities before settling as a writer and news editor for business and technology segments.