USD/JPY roils as markets look for signs of rate moves

- FOMC Minutes due in the midweek as markets weigh Fed rate cut chances.

- BoJ set to begin raising rates, but investors remain unclear about when.

- US NFP jobs data dump looms ahead later in the week.

USD/JPY churned near familiar levels on Monday, easing into the new trading week mostly flat. The pair is cycling near recent highs as investors await moves from either the Federal Reserve (Fed) or Bank of Japan (BoJ). Both central banks are expected to make more moves on interest rates in 2025, with the Fed aimed downward and the BoJ expected to to begin raising rates.

BoJ Governor Kazuo Ueda recently reaffirmed the BoJ’s commitment to reaching a neutral rate. What makes the BoJ unique among the rest of the major developed central banks around the planet is the BoJ’s long-running battle to get inflated started rather than trying to stop it. With BoJ reference rates far below the global median, the Japanese Yen took a hard turn in 2024 as rate differentials widened. With the natural rate of interest likely riding much higher than the current BoJ reference rates, BoJ Governor Ueda and company will have to begin adjusting policy rates up at some point or risk sending the Japanese economy back into a tailspin.

The Fed’s latest Meeting Minutes will be dropping on traders on Wednesday, but the key data print this week will be Friday’s upcoming US Nonfarm Payrolls (NFP) report. With one-half of the Fed’s mandate including full employment, markets will be watching this week’s labor figures from the US with renewed interest.

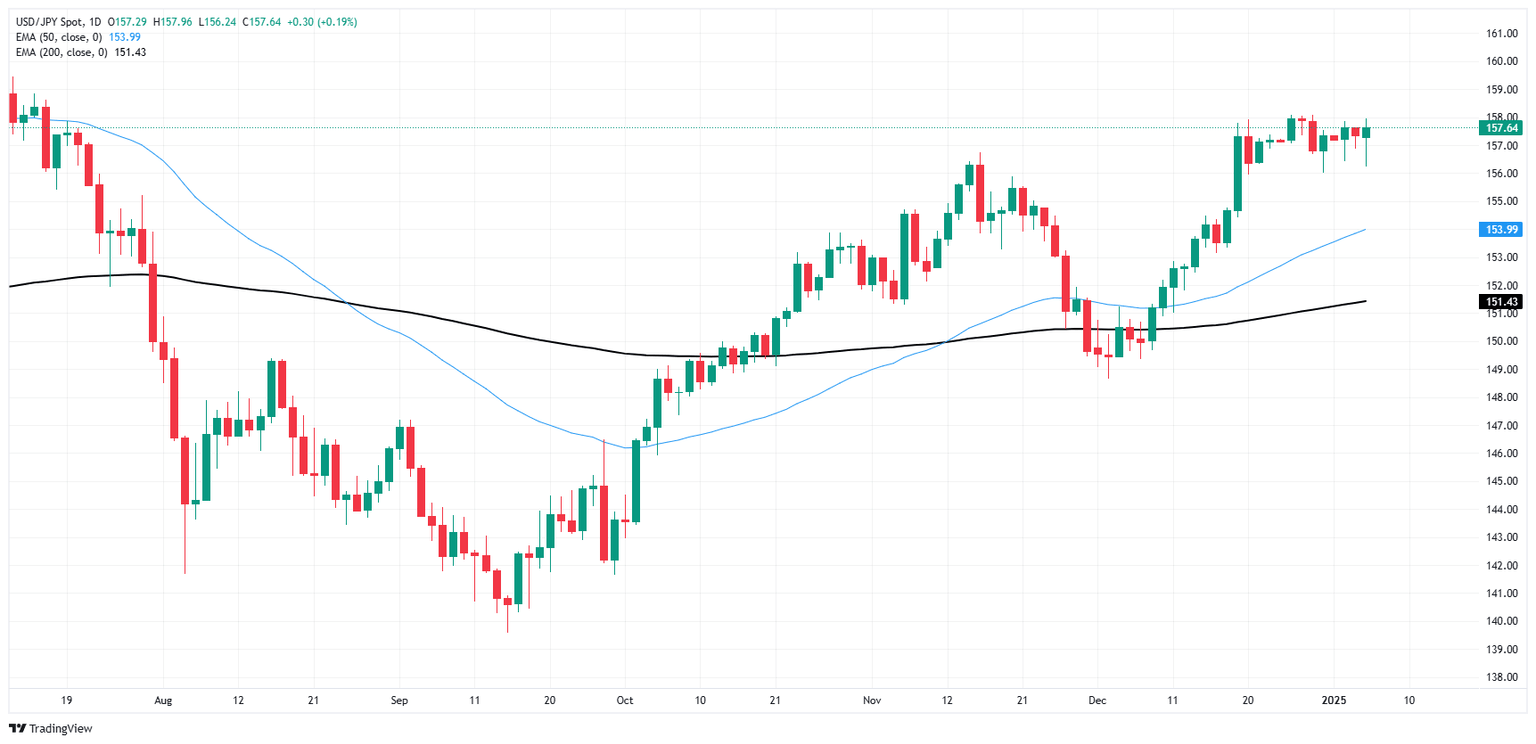

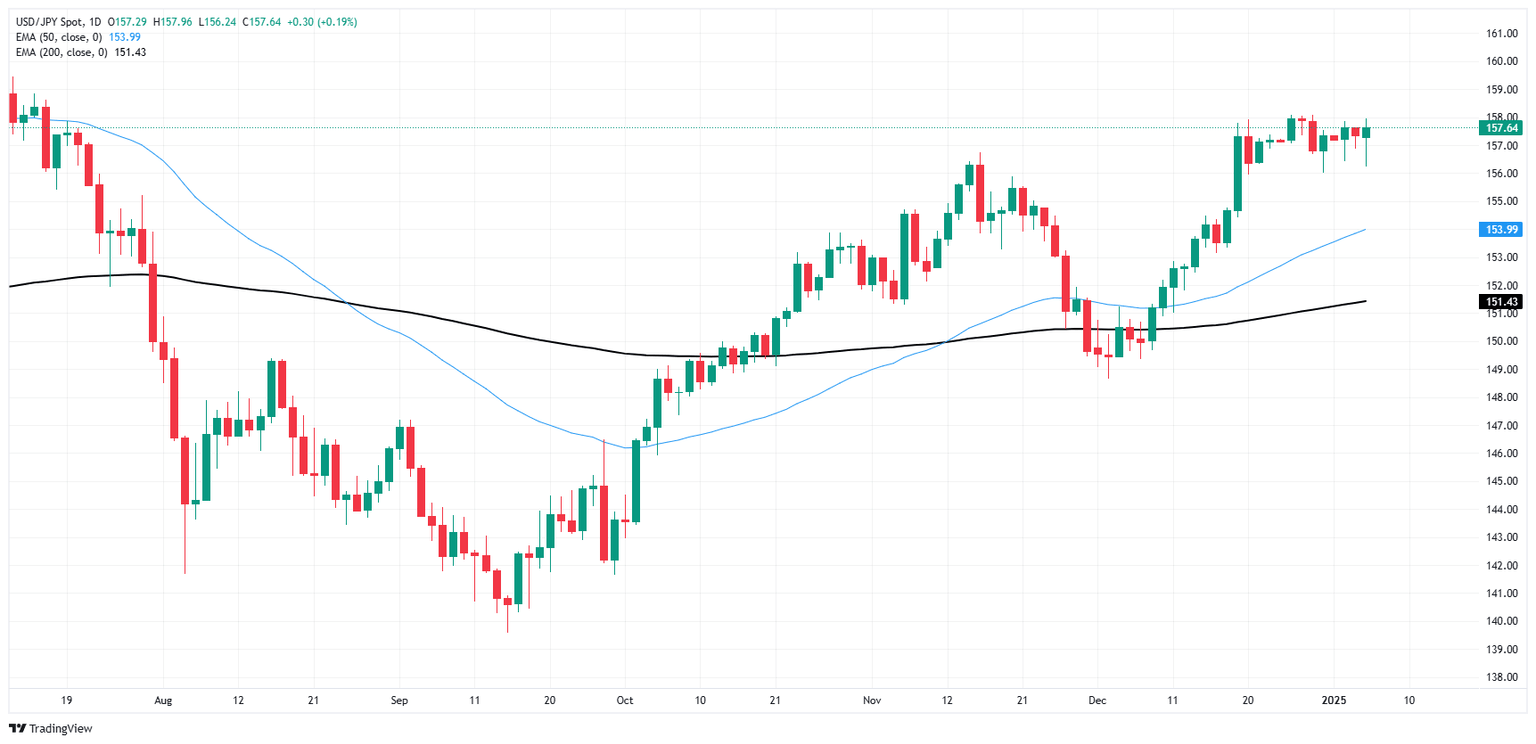

USD/JPY price forecast

USD/JPY continues to churn chart paper near recent highs, however the pair is still down slightly from decades-long peaks set during 2024 when the Yen plummeted across the board. Unless the BoJ caves on its hyperdovish stance and begins to raise interest rates, there isn’t a policy speech or technical scenario that can be presented that will rock the Yen out of its bearish stance. Global markets continue to favor the Greenback, keeping the Dollar-Yen pairing bid into the high side.

USD/JPY daily chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.