USD/JPY rebounds into new Friday high, aimed for 143.00

- USD/JPY sees late rally, jumps to 142.60.

- The US Dollar is paring back the day’s losses as the Yen declines.

- US inflation continues to erode faster than expected.

The USD/JPY is rallying into new highs on Friday as the US Dollar (USD) tries to pare back some of the day’s losses coupled with a broad-market weakening of the Japanese Yen (USD) as markets get set to wrap up the last day of trading before the holiday break and the last full trading week of 2023.

The Yen saw an early bump on Friday after Japanese National Consumer Price Index (CPI) Inflation printed more or less as-expected, with Core Japan CPI (headline CPI less fresh food prices) for the year through November meeting market forecasts of 2.5% versus the previous print of 2.9%.

Japanese inflation continues to fall back towards the Bank of Japan’s (BoJ) 2% target, but the BoJ continues to undercut market hopes for a hawkish pivot from the Japanese central bank. The BoJ remains unconvinced that Japanese inflation will continue to hold above 2% looking foward, and the BoJ remains firmly entrenched in hyper easy monetary policy with negative interest rates.

The BoJ currently expects inflation to decline below a 2% annual rate sometime in 2025.

The US Dollar declined once more on Friday after the US Personal Consumption Expenditures (PCE) Price Index declined faster than expected, seeing a resurgence in rate cut expectations from the markets. The Greenback is now paring back the day’s losses heading into the back half of the week’s final trading session.

The Core US PCE Price Index for the year through November softened to 3.2%, below the market forecast of 3.3% and easing back further from the previous print of 3.4% (revised down from 3.5%).

Read More: US PCE inflation softens to 2.6% from a year ago vs. 2.8% expected

Declining US inflation has weighed on the US Dollar this week, igniting a resurgence in investor expectations of an increased pace of rate cuts in 2024. Market rate cut expectations may have run far ahead of what the Fed considered feasible, however: the Fed’s dot plot of interest rate expectations show a median forecast of 75 basis points in rate cuts through the end of 2024, but markets are currently pricing in bets of 160 basis points in cumulative rate cuts, with some particularly over-eager market participants betting on a rate cut as soon as next March.

USD/JPY Technical Outlook

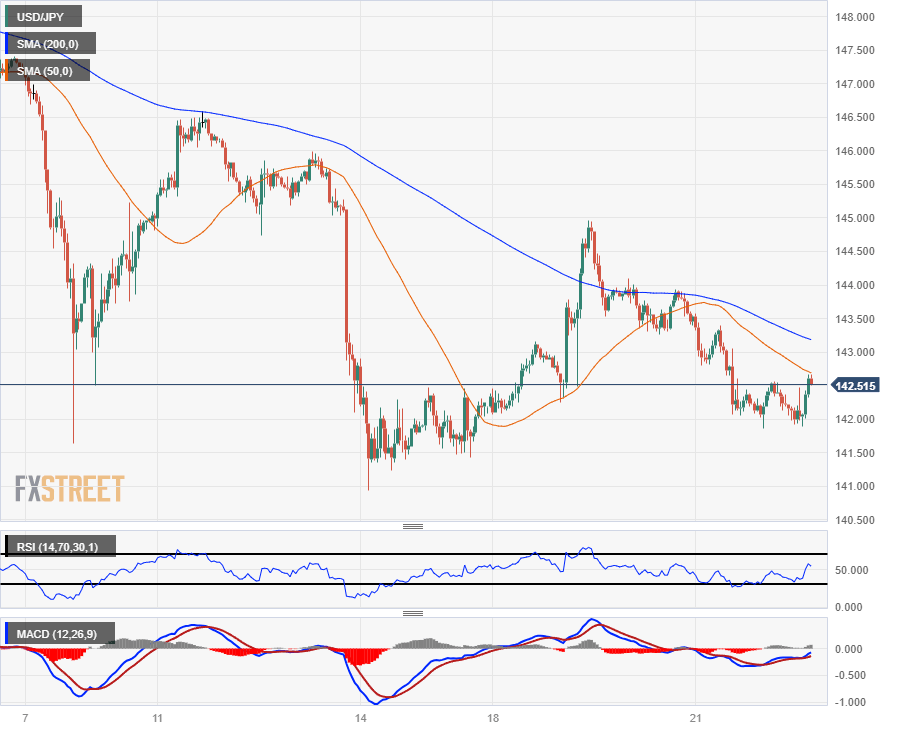

The USD/JPY set a new high for Friday at 142.66, stopping just short of the 50-hour Simple Moving Average (SMA) as the pair gets hung up on near-term resistance levels.

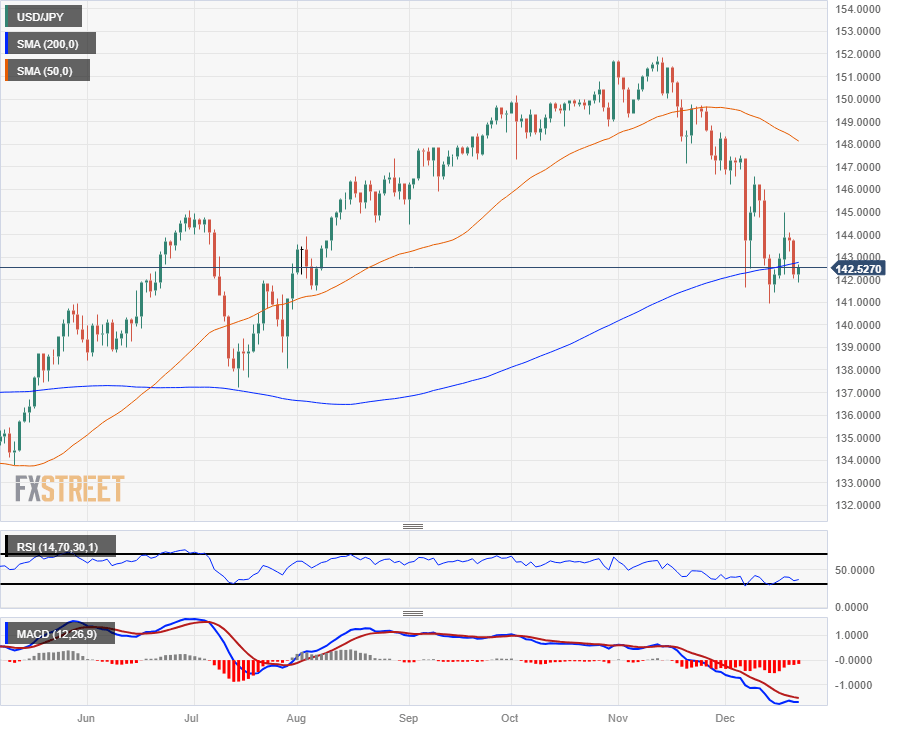

Despite USD/JPY’s Friday rebound, the pair remains firmly bearish, with an unavoidable lower-highs pattern baked into the charts.

The pair remains constrained at the 200-day SMA rising into the 143.00 handle, and the USD/JPY is down over six percent from November’s peak bids near 151.90.

USD/JPY Hourly Chart

USD/JPY Daily Chart

USD/JPY Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.