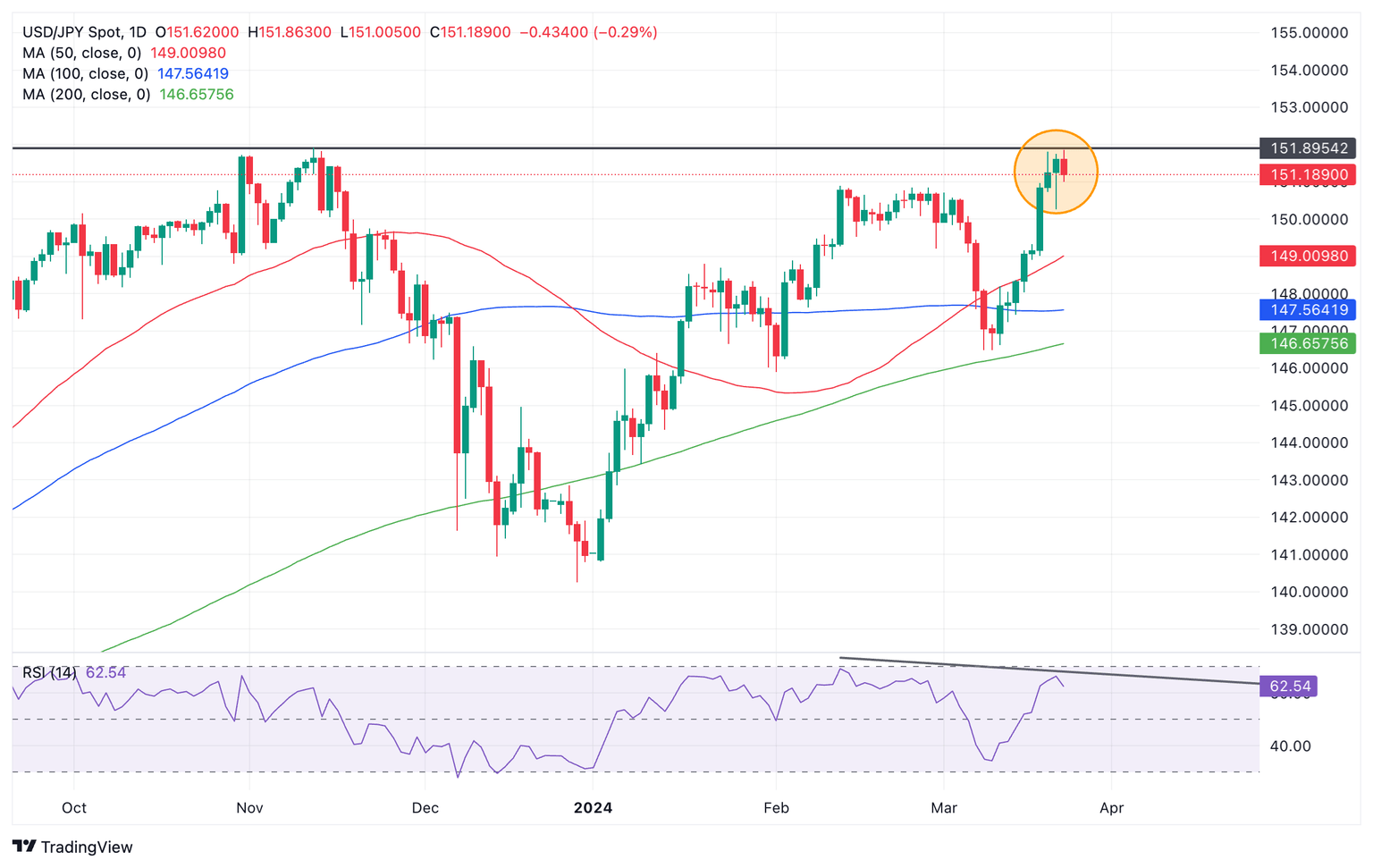

USD/JPY Price Analysis: Hanging Man at highs could be bearish omen

- USD/JPY forms a bearish candlestick pattern at the multi-year highs.

- A bearish close on Friday would enhance the possibilities of a pullback.

- The BoJ has historically intervened to strengthen JPY in the 151.000s, indicating more downside pressure likely.

USD/JPY has formed a bearish Hanging Man Japanese candlestick pattern (circled) at key chart highs in the 151.000s on Friday, suggesting a heightened risk of a short-term reversal and pullback.

US Dollar versus Japanese Yen: Daily chart

The combination of the fact that the pair has tested the level of the 2023 high and formed the bearish pattern increases the possibility of a decline following on.

If Friday ends as a bearish red candlestick this will add confirmation to the Hanging Man formed on Thursday, and further increase the odds of more downside.

Japanese candlesticks are only short-term reversal patterns, however, so the move lower may be short-lived.

The fact that the 151.000s represents a zone in which the Bank of Japan (BoJ) has been known to intervene to strengthen the Yen in the past, further increases the chances of imminent weakness for the pair.

A pullback might be expected to go as low as support at the 50-day Simple Moving Average (SMA) situated at 149.009.

Alternatively, a recovery and clear break above 152.000 would suggest bulls continue to have the upper hand and the BoJ is reluctant or unable to intervene sufficiently to move the exchange rate.

Such a move, however, would be unlikely to rise much higher given the forces pitched against it, with a possible target at the next whole number of 153.000.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.