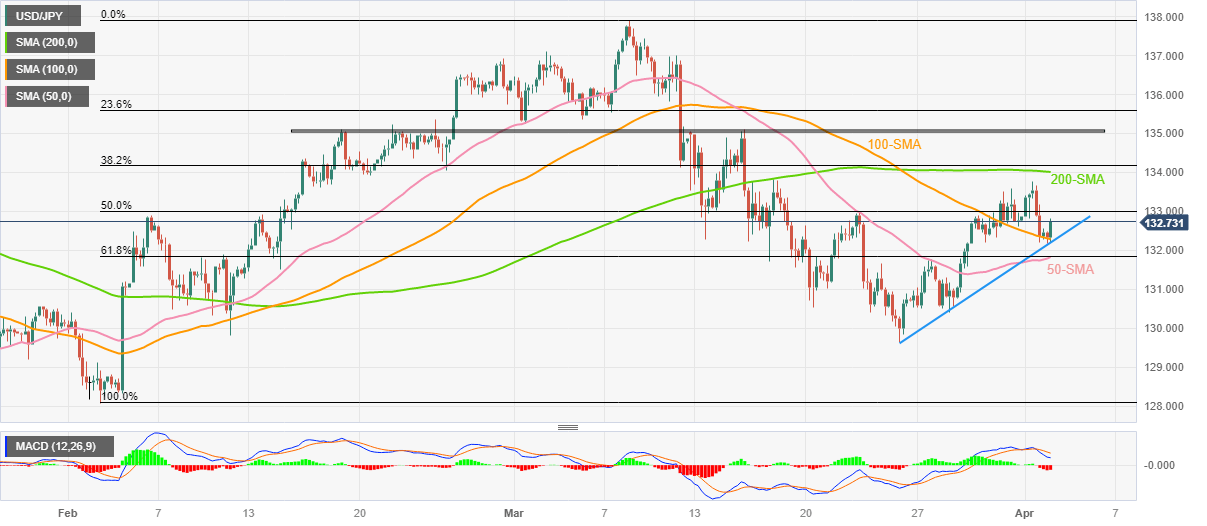

USD/JPY Price Analysis: Bounces off 132.30 support confluence but upside remains elusive

- USD/JPY rebounds from one-week-old ascending trend line, 100-SMA to reverse the week-start losses.

- Bearish MACD signals, previous failures to cross 200-SMA keep sellers hopeful.

- 50-SMA, 61.8% Fibonacci retracement acts as an extra filter to the south.

USD/JPY grinds near intraday high of around 132.80 during early Tuesday, following the downbeat start of the key week. In doing so, the Yen pair bounces from a convergence of the 100-bar Simple Moving Average (SMA) and one-week-old ascending trend line to reverse the previous day’s losses.

Although the Yen pair rebounds from the 132.30 support confluence, bearish MACD signals and the failure to cross the 200-SMA, around 134.00 by the press time, challenge the bulls.

Even if the USD/JPY crosses the 134.00 hurdle, a six-week-long horizontal resistance area near 135.10 can restrict the upside moves. It’s worth noting that 135.40 and 136.00 round figures are extra filters towards the north.

Should the quote remains firmer past 136.00, the odds of witnessing a fresh Year-To-Date high, currently around 137.90, can’t be ruled out.

On the flip side, a clear break of the 132.30 support confluence becomes necessary for the USD/JPY bear’s return.

Even so, the 61.8% Fibonacci retracement level of the USD/JPY pair’s February-March upside and 50-SMA, near 131.80, can act as the last defense of the buyers.

Following that, the 130.00 round figure and the previous monthly low near 129.65 may gain the USD/JPY seller’s attention.

Overall, USD/JPY is likely to extend the latest rebound but the recovery moves have limited upside room to cheer.

USD/JPY: Four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.