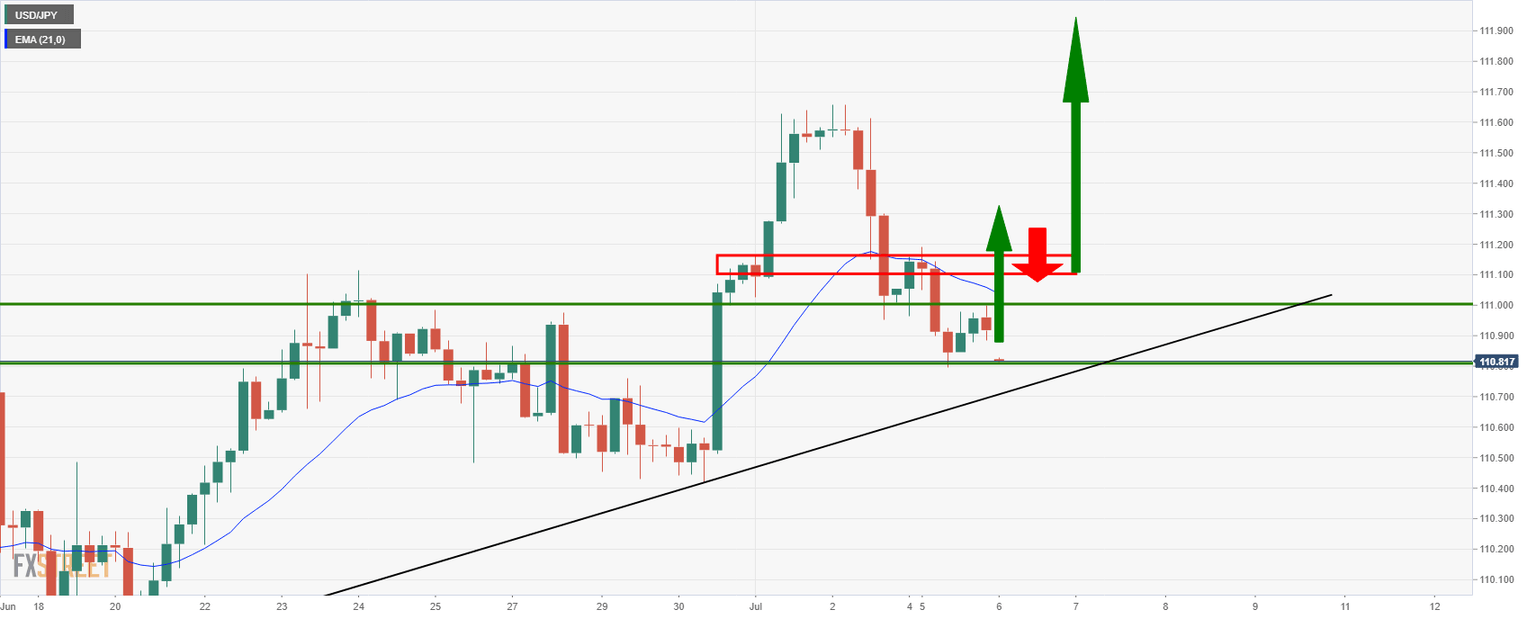

USD/JPY Price Analysis: 110.00/50 is a critical supply area

- USD/JPY bulls look for a restest of 110.00/50.

- Bears need to commit between 110 and 110.50.

As per the prior analysis, USD/JPY Price Analysis: One for the bravest of bulls targetting 111.90/20, the supply zone was always a higher risk for the bulls.

Prior analysis

''...If this support structure holds, there will be a case for the upside in USD/JPY.

However, buying at resistance should not really be a part of a trader's playbook.

The following illustrates the market structure of the yen from a top-down basis and concludes that a long position should only be taken with additional measures to limit downside exposure and risk of a losing trade.''

''... a trade can be taken from the next bullish structure at reduced risk in order to limit likely losses of failures beyond one's entry point.

For instance, a break of the 4-hour resistance at 111.20 would be bullish and potentially trigger enough renewed demand to the daily targets:''

However, the conditions were never met. Instead, the price melted from the resistance structure and now the focus is on the downside:

In the live market above, it is illustrated that the resistance was important and the price has melted below the 110 level.

This leaves the market in the hands of the bears that can expect a discount to short from in a daily correction as follows:

The price is stalling and a correction to at least the 38.2% Fibonacci could be on the cards to test 110 again. If it gives, then the next layer of resistance is 110.40/50.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.