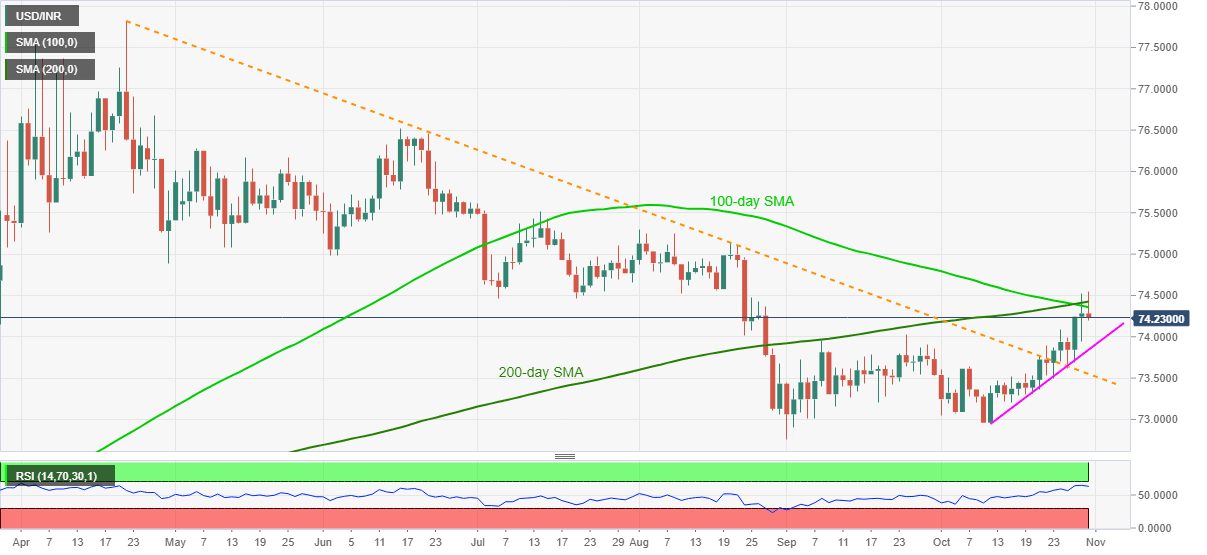

USD/INR Price News: Key SMAs trigger Indian ruppe pullback from 10-week low

- USD/INR defies two-day uptrend with mild losses above 74.00.

- 100-day, 200-day SMA takes clues from the RSI consolidation to favor short-term sellers.

- Bulls can stay hopeful unless keeping the break of six-month-long falling trend line.

USD/INR drops to 74.22, down 0.08% intraday, amid the initial hour of Friday’s Indian trading. The pair surged to the highest since August 24 earlier in the day but couldn’t hold the break above the important simple moving averages (SMAs). The latest retracement also takes clues from the RSI line that loses further upside momentum in the last two days.

As a result, the previous month’s high of 74.02 lures the day traders before highlighting a three-week-old rising support line, at 73.84 now.

While a downside break of 73.84 can push USD/INR bulls a bit far, the previous resistance line, at 73.55 now, can help to keep the hopes of fresh upside.

Alternatively, a daily closing beyond 74.45 will propel the quote to the 75.00 round-figures before directing the buyers to the August 20 top near 75.15.

During the pair’s upside past-75.15, the mid-July peak close to 75.50 and June month’s high of 76.51 should be watched carefully. Though, it all depends upon how long the RSI can avoid overbought conditions.

USD/INR daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.