USD/INR Price Analysis: Scales above 82.00 ahead of US Inflation and FOMC minutes

- USD/INR has continued its auction above 82.00 ahead of US Inflation data.

- FIIs are turning buyers in the Indian market after months of correction.

- Oil prices are expected to extend their upside above $81.50 on expectations that the Fed will reach its terminal rate sooner.

The USD/INR pair has delivered a flat opening above 82.00 and is expected to remain volatile as investors are awaiting the release of the United States inflation data and Federal Open Market Committee (FOMC) minutes for fresh impetus.

The US Dollar Index (DXY) has attempted a recovery after a steep correction to near 102.04 as investors are taking caution ahead of inflation data. Meanwhile, S&P500 futures have eased the majority of gains generated in early Asia amid anxiety ahead of the quarterly result season, portraying a caution in an overall upbeat market mood.

The Indian Rupee is also expected to show volatility as the annual result season is at the doorstep. Meanwhile, Foreign Institutional Investors (FIIs) are turning buyers in the Indian market after months of correction.

On the oil front, oil prices are expected to extend their upside above $81.50 on expectations that the Federal Reserve (Fed) will reach its terminal rate sooner.

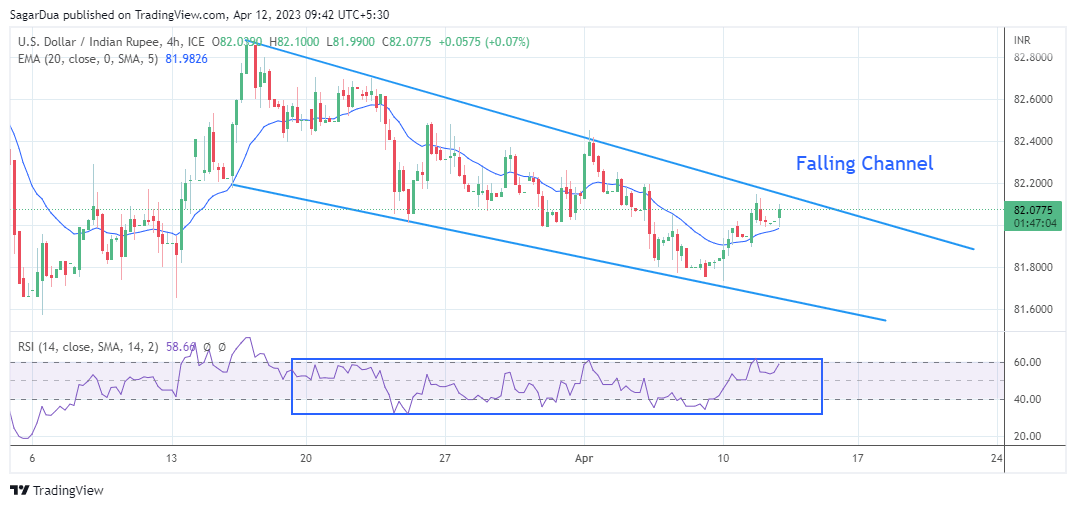

After a firm recovery, USD/INR has reached near the upper portion of the Falling Channel formed on a four-hour scale. Every pullback in the aforementioned chart pattern is considered as buying opportunity for market participants. The 20-period Exponential Moving Average (EMA) at around 82.00 is providing a cushion to the US Dollar bulls.

Also, the Relative Strength Index (RSI) (14) is making efforts in climbing above the 60.00 level. An occurrence of the same will trigger the upside momentum.

Should the asset break above April 05 high at 82.20, US Dollar bulls will push the major toward April 03 high at 82.45 and March 22 high at 82.70.

Alternatively, a downside below April 07 low at 81.75 will drag the asset to March 06 low at 81.57 followed by January 06 low at 81.30.

USD/INR four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.