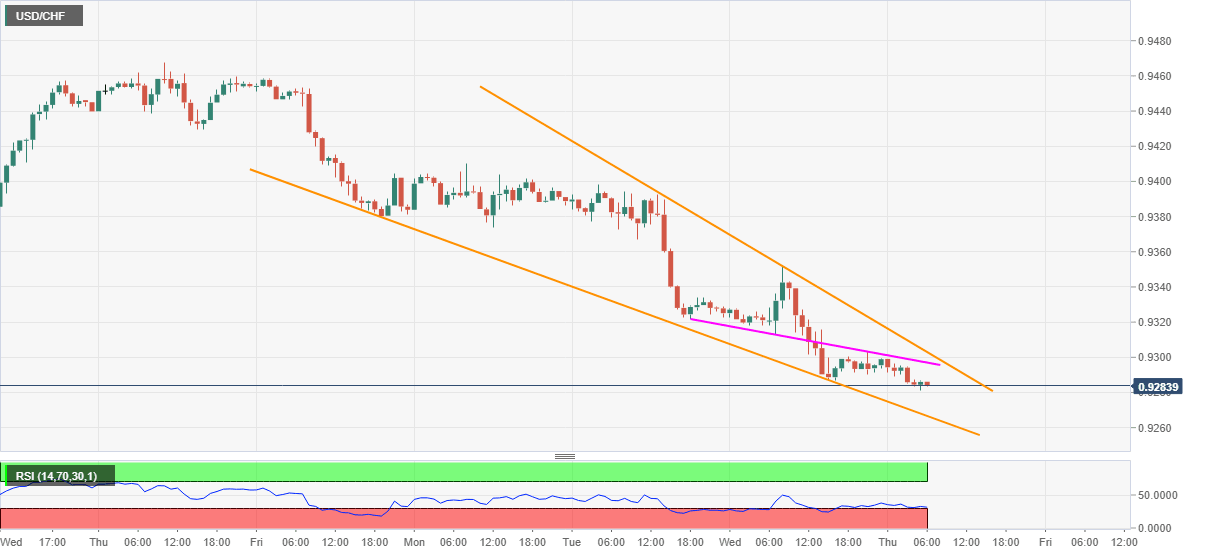

USD/CHF Price Analysis: Refreshes multi-day low under 0.9300 against all odds

- USD/CHF seesaws around the lowest since March 10.

- Oversold RSI conditions, falling wedge keeps the buyers hopeful.

- Bears will have to defy the weekly support line before attacking the year’s bottom flashed in March.

USD/CHF makes rounds to 0.9285, down 0.12% on a day, before the European markets open for Thursday. The quote recently dropped to the fresh low since early-March while testing 0.9281 figures. Even so, RSI conditions and a one-week-old bullish chart pattern, namely rising wedge, suggests a recovery in the quote.

However, the pair needs to cross the two-day-old support-turned-resistance, at 0.9298 now, before confirming the bullish pattern with a clear break above 0.9305.

Following that, buyers may aim to cross the 0.9400 mark and 0.9450 numbers to the north. However, 0.9350 could act as an intermediate resistance whereas 0.9467 and the month’s top close to 0.9500 may challenge the bulls afterward.

Alternatively, the weekly support line around 0.9265 could offer another bounce point past-0.9281, failing to avail the same highlights 0.9200 round-figures and the yearly bottom near 0.9180 for traders.

USD/CHF hourly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.