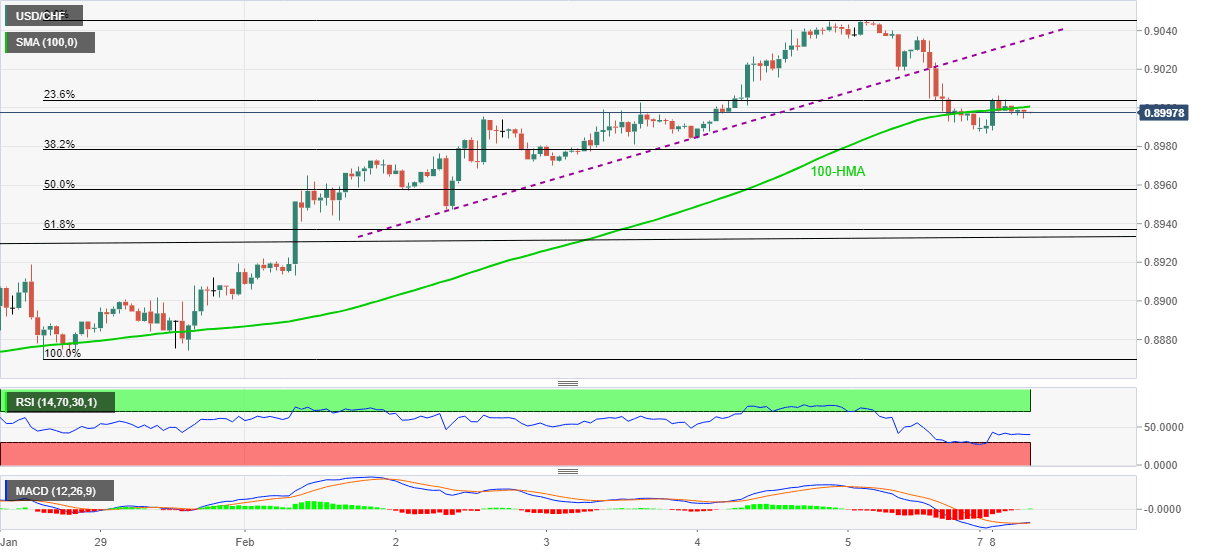

USD/CHF Price Analysis: 100-HMA tests sellers around 0.9000

- USD/CHF trims early Asian gains while keeping Friday’s pullback from December 01.

- Bulls need to regain above the previous support line, sellers can look towards key Fibonacci retracement supports.

USD/CHF eases to 0.8996 while trimming the early Asian gains during the pre-European session trading on Monday. In doing so, the quote wavers around 100-HMA but keeps Friday’s downside break of an ascending support line from January 02.

As a result, USD/CHF sellers remain hopeful to attack the 50% and 61.8% Fibonacci retracement of January 28 to February 05 upside, respectively at 0.8957 and 0.8937.

Though, any further weakness past-0.8937 will need a confirmatory drop below the 0.8900 threshold to keep the USD/CHF bears happy.

Alternatively, clear trading above 100-HMA level of 0.9000 needs to cross the previous support line, at 0.9035 now, to refresh the monthly peak surrounding 0.9045.

In a case where the USD/CHF bulls remain dominant past-0.9045, December’s peak surrounding 0.9095 and the 0.9100 round-figure will gain the market’s attention.

USD/CHF hourly chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.