USD/CHF Price Analysis: 0.9030 guards immediate recovery

- USD/CHF extends bounce off 0.9001, refreshes intraday top.

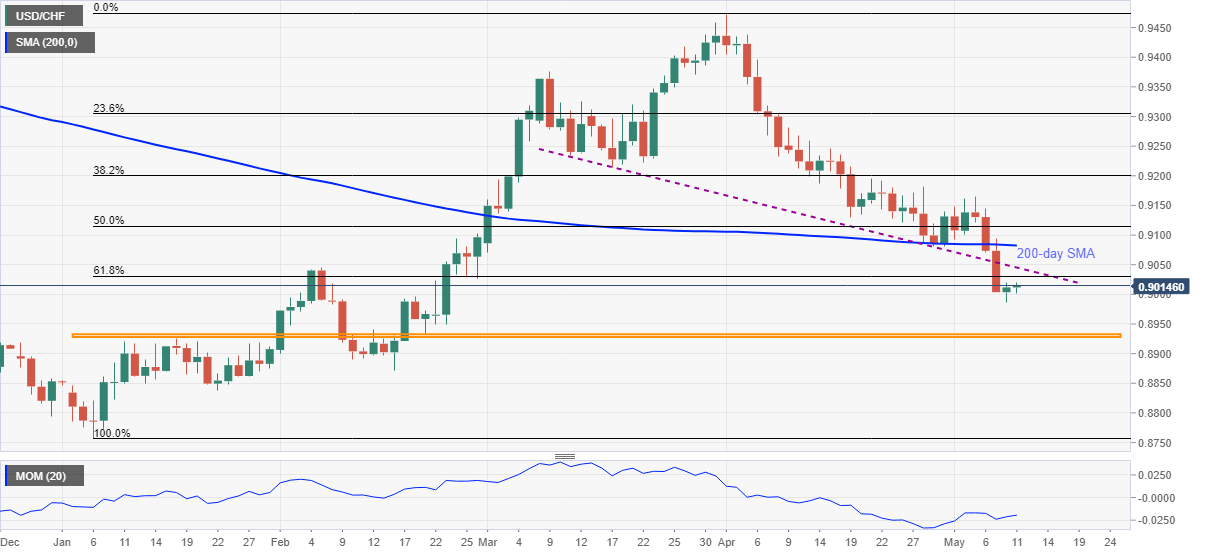

- Clear break of 200-day SMA, two-month-old support line and 61.8% Fibonacci retracement level back the bears.

- Multiple levels marked since January lure sellers, bulls have a bumpy road before regaining market attention.

USD/CHF picks up bids to 0.9020, up 0.10% on a day, ahead of Tuesday’s European session. In doing so, the Swiss currency pair stretches the previous day’s corrective pullback from late February lows.

However, the quote remains below multiple strong supports, now resistances, amid the sluggish Momentum, which in turn suggests the USD/CHF weakness going forward.

Among the key resistances, 61.8% Fibonacci retracement of January-April upside near 0.9030 becomes immediate to cross for the pair buyers ahead of a downward sloping trend line from March 11, around 0.9045.

Should USD/CHF bulls manage to cross 0.9045 support-turned-resistance line, 200-day SMA and 50% Fibonacci retracement level, respectively around 0.9085 and 0.9115 will be the key to watch.

Meanwhile, the pair’s fresh weakness will need to break the 0.9000 threshold before targeting the 0.8925-30 a four-month-old horizontal support zone.

USD/CHF daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.