USD/CHF hesitates at 0.9400 with the FOMC on focus

- The US dollar treads water above 0.9400.

- Hopes about peace talks and China's stimulus measures have lifted market sentiment.

- The USD/CHF is teetering above trendline support at 0.9390.|

The US dollar’s rally from early-March lows near 0.9150 seems to have lost steam on Wednesday. The pair has been trading sideways around the 0.9400 mark on Wednesday, lacking direction with investors' focusing on the conclusion of the Federal Reserve’s monetary policy meeting.

The greenback loses steam in a risk-on session

Financial markets are witnessing a certain risk revival on Wednesday, with Asian and European stock markets posting solid gains. Upbeat news from the Russia – Ukraine peace talks and the announcement of a new economic stimulus in China have buoyed stock markets, favoring the euro and pound and weighing on the USD, despite market expectations of a Fed rate hike later today.

Russian Foreign Minister, Sergey Lavrov said earlier on Wednesday that he is hopeful about a mutual compromise. On the other end of the table, Ukrainian Prime Minister, Volodymyr Zelenski, affirmed that talks sound more realistic, although more time is needed. These comments have boosted optimism for an agreement that might end the war.

In China, Vice-Premier Liu He announced that Beijing is set to roll out measures to support economic growth and keep capital markets stable. This has boosted confidence among Asian investors.

USD/CHF treads water above 0.9400, testing trendline support

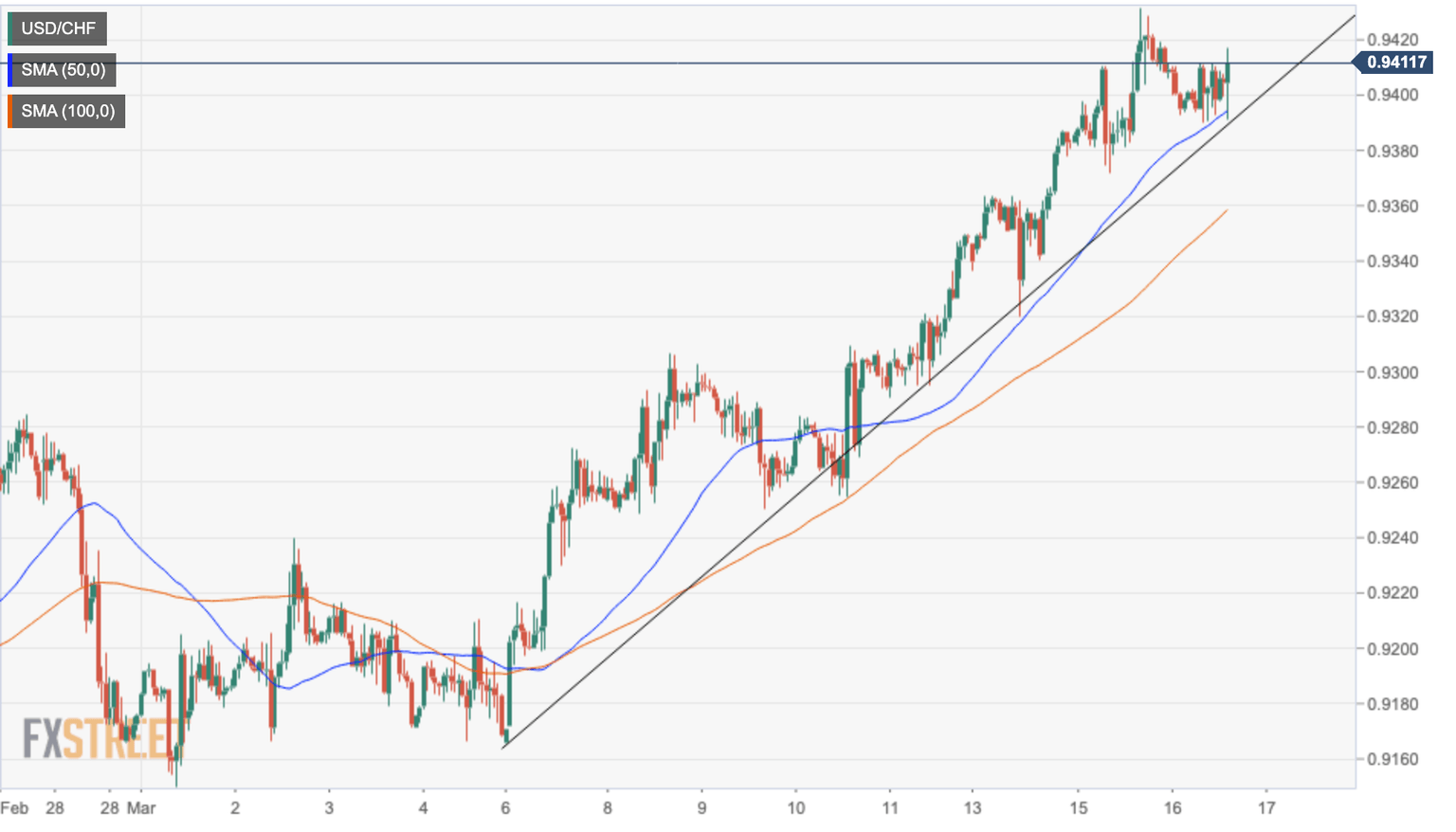

From a technical perspective, the pair is now teetering right above the support trendline from early March lows, now at 0.9390.

A confirmation below that line might cancel the near-term bullish momentum and, send the pair towards the 100-hour SMA at 0.9360, which has offered support previously, before aiming for March 14 low at 0.9320.

On the upside, immediate resistance lies at 0.9415, and above here, 0.9430 (March 15 high) before setting sail to attack April 2021 high at 0.9470.

USD/CHF hourly chart

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.