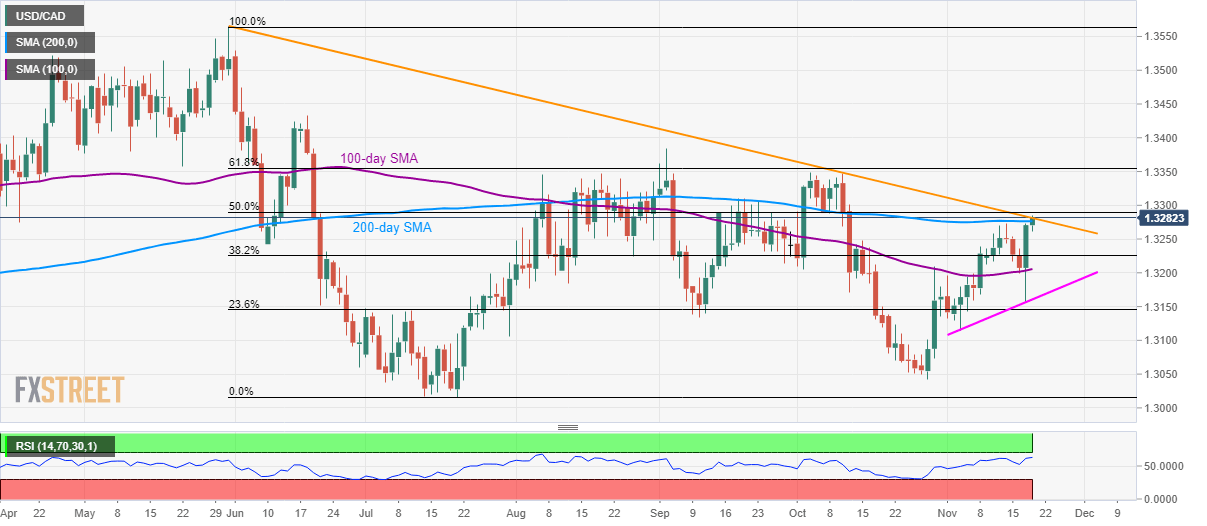

USD/CAD Technical Analysis: 1.3280/90 resistance confluence challenges 5-week high

- USD/CAD confronts 200-day SMA, a falling resistance line since late-May.

- 50% of Fibonacci retracement adds to the resistance.

- 100-day SMA acts as a near-term firm support.

The USD/CAD pair’s run-up to five-week high seems to witness a bumpy road ahead. The quote takes the bids to 1.3280 during the Asian session on Wednesday.

The downward sloping trend line since May 30, coupled with 200-day Simple Moving Average (SMA), near 1.3277/80 acts as immediate upside barriers for the pair’s latest rise. Also increasing hardships for buyers is 50% Fibonacci retracement level of May-July declines at 1.3290.

In case bulls manage to dominate past-1.3290, the 1.3350/55 area including the previous month high and 61.8% Fibonacci retracement will be in the spotlight.

On the downside, 38.2% Fibonacci retracement level of 1.3225 offers nearby rest during the pair’s pullback, a break of which could recall a 100-day SMA level of 1.3205.

It should be noted that the two-week-old rising support line around 1.3160 could question sellers below 1.3205.

USD/CAD daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.