USD/CAD Price Forecast: Moves away from multi-year peak, slips below 1.4400 mark

- USD/CAD retreats after touching a fresh multi-year peak earlier this Thursday.

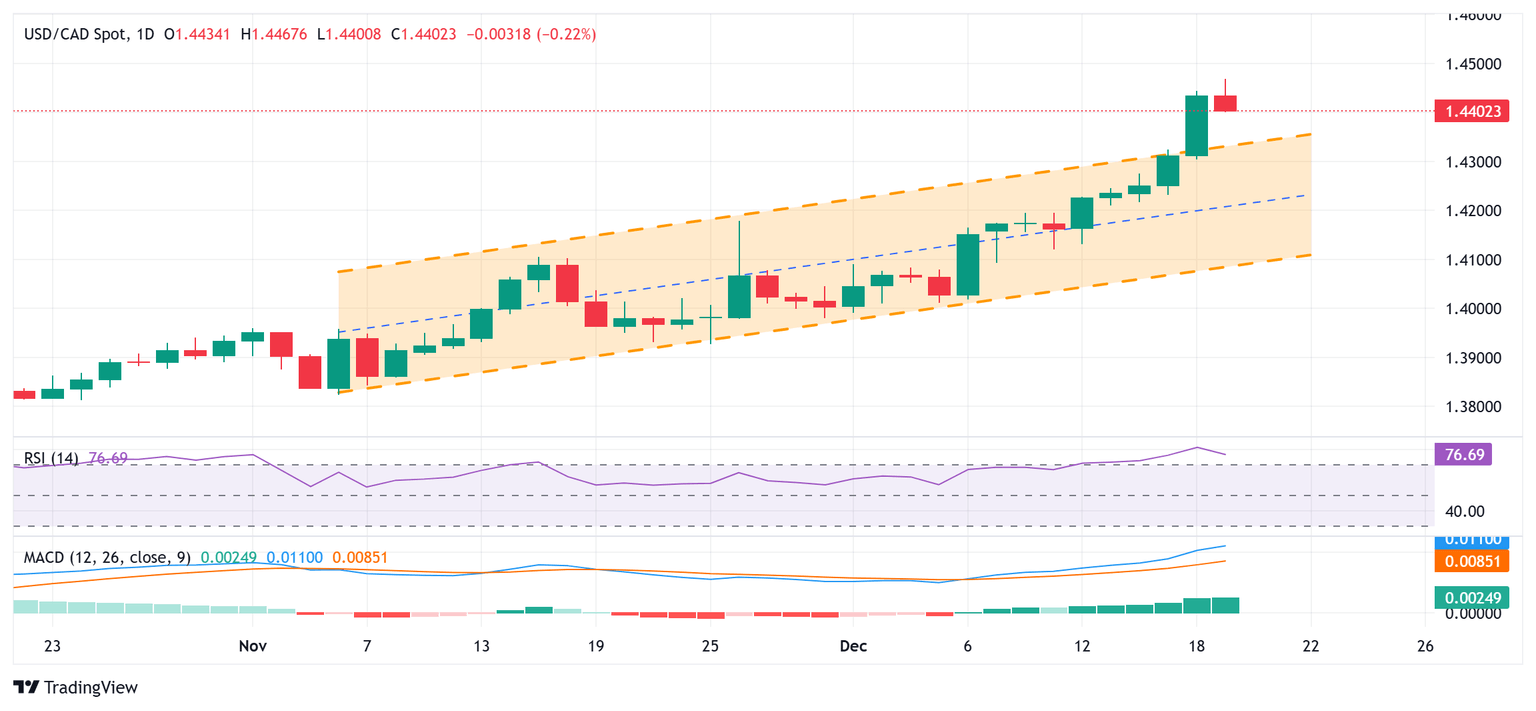

- The overbought RSI prompts some profit-taking amid subdued USD price action.

- The recent breakout through an ascending trend channel favors bullish traders.

The USD/CAD pair extends its steady intraday retracement slide from the highest level since March 2020 and drops back closer to the 1.4400 mark during the first half of the European session on Thursday. The uptick could be attributed to some profit-taking amid the overbought conditions on the daily chart, though the fundamental backdrop seems tilted firmly in favor of bulls.

The Federal Reserve (Fed) offered a more hawkish view and signaled a cautious path of policy easing next year, which remains supportive of a further rise in the US Treasury bond yields to a multi-month peak. Apart from this, geopolitical risks and trade war fears should continue to act as a tailwind for the US Dollar (USD). Apart from this, the political crisis in Canada, the Bank of Canada's (BoC) dovish stance and a downtick in Crude Oil prices could undermine the commodity-linked Loonie. This might contribute to limiting the downside for the USD/CAD pair.

From a technical perspective, the Relative Strength Index (RSI) remains above the 70 mark and prompts some long unwinding around the USD/CAD pair. That said, this week's breakout through a multi-week-old ascending channel was seen as a key trigger for bullish traders and supports prospects for the emergence of dip-buying at lower levels. Hence, any further corrective slide below the 1.4400 round figure is likely to find decent support and remain limited near the aforementioned ascending trend-channel breakout point, around the 1.4335-1.4330 region.

This is closely followed by the 1.4300 mark, which if broken decisively might prompt some technical selling and drag the USD/CAD pair to the next relevant support near the 1.4250 horizontal zone. The downward trajectory could extend further towards the 1.4220-1.4215 region en route to the 1.4200 round figure.

On the flip side, the 1.4450 zone now seems to act as an immediate hurdle. Some follow-through buying beyond the 1.4465 area, or the multi-year top, should allow the USD/CAD pair to reclaim the 1.4500 psychological mark. The subsequent move-up has the potential to lift spot prices to the 1.4560 intermediate hurdle en route to the 1.4600 round figure and March 2020 swing high, around the 1.4665-1.4670 region.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.